Daily Comment (January 14, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of the president’s pressure campaign on Iran, highlighting its significance for US foreign policy. We then examine key domestic initiatives, including the White House’s push to cap credit card interest rates and improve home affordability, as well as the notable geopolitical effort to acquire Greenland. We also address the global implications of China’s record trade surplus. Lastly, the report includes a roundup of essential domestic and international data.

Trouble for Iran? As protests in Iran continue, the United States appears to be positioning itself as a potential enforcer should the government’s crackdown become extreme. On Tuesday, the White House encouraged protesters to maintain pressure on the current regime and to occupy key institutions. Additionally, it offered assurances of US backing, suggesting possible intervention if Ayatollah Khamenei does not curb the violence. These comments signal another step in the president’s pivot toward a more assertive foreign policy.

- By challenging the internal stability of Tehran, President Trump is accelerating the erosion of China and Russia’s strategic reach. The recent capture of Nicolás Maduro served as the catalyst, throwing the stability of anti-US regimes into doubt. As Iran struggles to contain a brutal wave of domestic protests, Cuba stands as the next likely domino to fall, leaving the Sino-Russian alliance with fewer reliable footholds in the Western Hemisphere and the Middle East.

- Washington’s effort to flip key regional allies of China and Russia is gaining momentum. Following the ouster of Maduro, the president is balancing relations with the interim Venezuelan leadership and the Machado-led opposition to ensure a pro-US transition. These diplomatic inroads are mirrored in the Caucasus, where a new 49-year security corridor has been established, and in the Middle East, where the administration is directly engaging with the exiled former crown prince of Iran amid nationwide unrest.

- While the US has achieved recent strategic successes, these gains are not without risks. Russia, for example, has intensified its campaign in Ukraine in response to these advances and may feel emboldened to challenge NATO more directly after the conflict concludes. Meanwhile, China appears to be leveraging its influence by pressuring countries, such as Australia and Brazil, into aligning more closely with its geopolitical orbit.

- Recent US foreign policy moves, including its pointed comments on Iran, highlight a broader strategy of countering Russian and Chinese influence through expanded power projection. In our view, such actions risk provoking retaliatory measures from Moscow and Beijing, both of which are intent on solidifying their international standing. While we do not consider direct war likely, we recognize a clear pathway for miscalculation that could escalate into conflict.

Wall Street Responds: On Tuesday, the White House escalated its pressure on banks, using social media to demand they impose a one-year, 10% cap on credit card interest rates. He warned that institutions failing to comply by January 20 could face punishment, without citing a legal basis for the threat. This aggressive directive represents the latest in a series of populist economic interventions, including recent moves in housing policy, designed to deliver immediate consumer relief and improve the party’s electoral prospects ahead of the 2026 midterms.

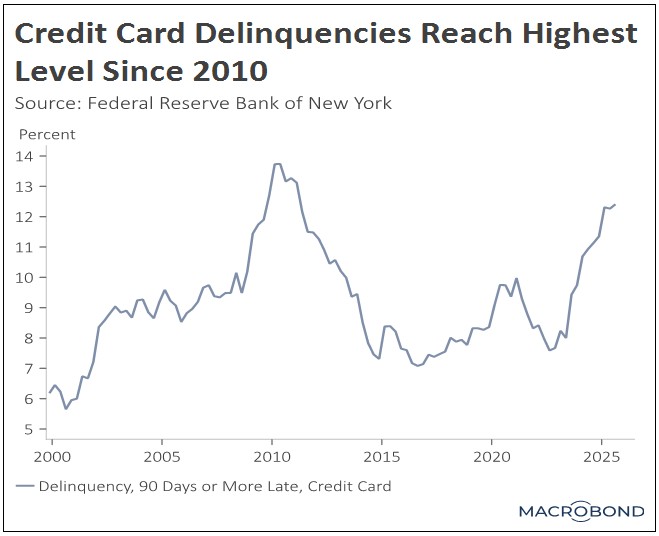

- The president’s timing targets major banks just as they prepare to release their earnings reports. Revenue from credit card swipe fees has become a cornerstone of bank profits, driven by the widespread extension of household credit. While these fees have boosted profit margins, they have also fueled rising consumer debt and a surge in delinquencies — a trend that has now sparked calls for government intervention.

- While industry leaders have signaled their intent to contest the cap through aggressive lobbying and judicial challenges, emerging reports suggest the sector is already exploring strategic concessions. Potential compromises include a voluntary expansion of the 36% Military Lending Act (MLA) cap to all consumers and the introduction of a temporary one-year promotional rates to satisfy the White House.

- To further pressure the banks, the president has signaled his support for the Credit Card Competition Act. This legislation would require banks, specifically those with assets over $100 billion, to ensure that every credit card offers a payment network option beyond just Visa and Mastercard. This would grant merchants a choice of competing networks for processing transactions.

- Though the president’s formal power to act against financial institutions is limited, his public intimidation campaign is effectively testing the limits of unilateral executive action. If successful, it would likely embolden the White House to issue further directives, fueling an interventionist populist agenda that bypasses institutional norms and permanently expands the scope of presidential authority.

- The White House’s growing assertiveness is creating significant uncertainty for firms. This environment may compel companies to reconsider future plans as they work to ensure compliance and avoid regulatory entanglements. Consequently, equity market risks are becoming more elevated, underscoring the value of maintaining a well-diversified portfolio with exposure to both value and quality factors.

Homebuilders Under Fire: The White House has publicly criticized homebuilders for failing to sufficiently lower housing costs. The Federal Housing Finance Agency has specifically accused these companies of intentionally keeping prices elevated at the expense of potential buyers, citing their use of stock buybacks as evidence of their capacity to reduce home prices. This coordinated criticism signals to the industry that they are expected to prioritize affordability over excessive profits.

Greenland Talks: The United States continues to advocate within NATO for its ambition to annex Greenland. While the territory is already part of the alliance through Denmark, the White House has suggested that control by the US would enhance its strategic protection. These comments follow statements from Greenland’s leaders reaffirming their preference to remain under Danish sovereignty and are likely to raise questions about Washington’s commitment to NATO’s foundational principles.

China Surplus Rises: China’s trade surplus shattered records in 2025, punching through the $1 trillion ceiling for the first time to reach $1.19 trillion. This milestone confirms that manufacturers have successfully bypassed the 20% slump in US trade by pivoting toward the EU and ASEAN regions. While this shift highlights China’s increasing independence from US consumer demand, the massive global imbalance is fueling international concerns over industrial overcapacity, likely leading to a new wave of reciprocal tariffs from non-US nations in 2026.