Daily Comment (January 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s report begins with President Biden’s Fed picks and additional U.S. economic and policy news. Next, we discuss China’s trade surplus. We then focus on international news, and we conclude with a pandemic update.

Economics and policy:

- The White House announced President Biden’s nominations to the Federal Reserve Board on Thursday. As expected, former Fed Governor Sarah Bloom Raskin was selected to take over as Federal Reserve Vice chair for Supervision. Biden also chose economists Lisa Cook, a professor of economics at Michigan State University, and Philip Jefferson, a professor and administrator at Davidson College, to fill the other two vacant Fed board seats. The picks will need to be confirmed by the deeply divided Senate. We expect Raskin will have a fairly easy time getting nominated due to her previous nomination as a Federal Reserve Governor. However, the two additional candidates may face greater scrutiny, as Senators on both sides of the aisle will probably seek assurances from the nominees that they will be supportive of efforts to combat inflation.

- Current Fed Governor Christopher Waller signaled he could support as many as five rate hikes this year if inflation remains too hot.

- The amount of money investors have stashed at the Federal Reserve facility jumped by the most since the end of 2021. Seventy-nine counterparties stored $1.637 trillion at the Federal Reserve overnight reverse repurchase agreement facility (RRP). The increased usage of the facility appears to be driven by the investors’ need to store their short-term cash. One reason for the surge into RRP could be for regulatory purposes: another reason could be the lack of short-term treasuries. That being said, the problem will likely persist while the Fed maintains its asset purchase program, which is expected to end by March.

- Mortgage rates continue to surge based on expectations that the Federal Reserve will raise interest rates multiple times this year. The combination of higher rates and home prices will likely reduce demand for homes, as fewer buyers will be able to afford to make the purchase. According to the Federal Reserve Bank of Atlanta, Americans needed 33% of their income to cover mortgage payments in 2021. That is up from the 29% required in 2020. We expect housing prices could start to rise at a slower pace in 2022 and could possibly fall.

- The Earth’s temperature rose to its sixth-highest level on record in 2021, according to the National Aeronautics and Space Administration (NASA).

China:

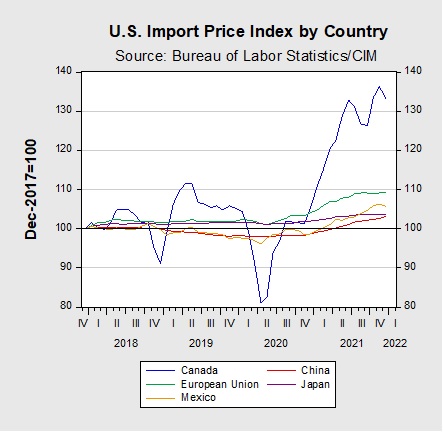

- Global demand continues to boost Chinese exports. In December, Chinese exports were $340.5 billion, pushing the annual total to $3.36 trillion. The strong growth in exports comes despite the supply chain issues due to the pandemic and a real-estate property meltdown that has slowed economic growth. In 2022, we expect that a weaker yuan relative to the dollar could be supportive of trade growth. According to China’s General Administration of Customs, the U.S. was the country’s largest export market in 2021. Despite an increase in Chinese exports, the prices for these goods were more favorable to the U.S. when compared to trade partners.

International news:

- Tensions over Ukraine continue to simmer as NATO leaders and Russian officials are struggling to come to terms over a security agreement that could prevent further escalation. Russian Foreign Minister Sergei Lavrov has warned NATO that Moscow will not wait “endlessly” to ensure a security deal. Meanwhile, the U.S. is pressuring its European allies to agree to potential sanctions if Russia invades Ukraine. Talks between the two sides have failed to come to an agreement, and Russia has only ramped up the pressure in recent days. On Thursday, several Ukrainian government agencies were hit with a cyberattack that warned Ukrainians to “be afraid and expect the worst.” In addition, the attack brought down a few government agency websites. The tense geopolitical situation has led to an increase in natural gas prices in Europe as the financial markets fear a potential conflict and are growing concerned that Russia could withhold more of its natural gas from the continent.

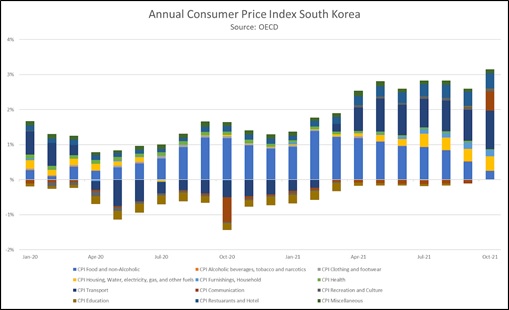

- The Bank of Korea (BOK) raised its key policy rate by 25 bps to 1.25% on Friday and signaled the central bank is prepared for additional rate hikes. This is the bank’s third-rate hike since the summer. The aggressive rate hikes suggest the BOK may be more concerned with an increase in inflation than with the risks posed by the spread of COVID-19. Over the last few months, inflation has been driven primarily by rising transportation costs.

- Bank of Japan policymakers are discussing a timeframe to begin telegraphing an eventual rate hike. The latest CPI report in Japan shows that annual inflation rose 0.6% from the prior year, its highest level since the start of the pandemic.

- North Korea appeared to have launched two ballistic missiles hours after threatening the U.S. On Friday, Pyongyang warned that it would take a “stronger and certain reaction” if the U.S. sanctioned individuals associated with its weapons program. Over the last few days, Washington has advocated that additional U.N. sanctions must be imposed on North Korea in response to its recent missile launches. Earlier this week, a North Korean missile launch forced some airports on the U.S. west coast to halt flights as a precaution.

COVID-19: The number of reported cases is 320,609,453, with 5,522,759 fatalities. In the U.S., there are 64,083,262 confirmed cases with 846,488 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 646,546,885 doses of the vaccine have been distributed, with 524,199,956 doses injected. The number receiving at least one dose is 247,987,225, the number of second doses is 208,564,894, and the number of the third dose, the highest level of immunity, is 78,139,161. The FT has a page on global vaccine distribution.

- The European Medicines Agency warned that frequent booster shots may cause more harm than good. The agency explained that frequent booster doses, described as every four months, could weaken the immune system, and tire out the body. It recommends that countries should leave more time between shots and schedule the boosters to align with the onset of cold season.

- The Supreme Court has blocked President Biden’s vaccine mandate for large businesses but allowed the mandate for healthcare workers. The court’s decision will likely make it harder for the Biden administration to increase vaccination rates.

- Hong Kong is expected to extend its COVID restrictions and flight ban until after the Lunar New Year. The region has struggled to contain the spread of the Omicron variant.