Daily Comment (January 12, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we open with a discussion of Federal Reserve Chair Powell’s testimony yesterday before the Senate Banking Committee, in which he doubled down on his recent hawkishness regarding inflation. We next turn to various international developments that have the potential to affect the financial markets today and in the near term. We wrap up with the latest news regarding the coronavirus pandemic.

U.S. Monetary Policy: In his Senate confirmation hearing for a second term yesterday, Fed Chair Powell stood by his recent pivot toward being an inflation hawk, calling high inflation a “severe threat” to a full economic recovery from the pandemic and vowing to tighten monetary policy as needed to vanquish it.

- Powell said he was optimistic that supply chain bottlenecks would ease this year and help bring down inflation as the Fed takes its foot off the gas pedal. However, he also insisted that if inflation stayed elevated, the Fed would be ready to step on the brakes. “If we have to raise interest rates more over time, we will,” he said.

- He said nothing against expectations, firming in interest-rate futures markets over the past week, that the central bank would begin hiking interest rates in March.

- Finally, beyond the Fed’s already-announced plan to taper its bond purchases down to zero by March, he also said the central bank could begin allowing outright reductions in its $8.8 trillion portfolio of bonds and other assets later this year. It would be another tool for tightening financial conditions.

- Overall, Powell (along with others on the policy committee) seems to have shifted from patience to panic regarding inflation, even though “base effects” alone are likely to pull down the year-over-year price changes in the next few months. If Powell and his fellow policymakers make good on their plans to hike interest rates and run down the Fed’s balance sheet, we continue to believe they would be running the risk of tightening monetary policy too much and producing a slowdown in the economy and more volatile financial markets.

United States-NATO-Russia: Following up on Monday’s U.S.-Russia talks, officials from all the NATO countries are meeting today with Russian Deputy Foreign Minister Ryabkov in an effort to de-escalate tensions in Eastern Europe and stave off a potential Russian invasion of Ukraine.

- Going into the meeting, it appears that the two sides will stand by their diametrically opposed positions, with Russia demanding security guarantees such as a prohibition against Ukraine joining NATO and the U.S. and its allies insisting that each country has the right to apply to the alliance if it wants to.

- In addition, reports suggest the NATO countries will also use the meeting to complain about Russian cyberattacks and electoral interference.

European Union: As national leaders begin negotiating to ease the EU’s strict fiscal deficit and debt limits, EU Budget Commissioner Johannes Hahn said he would oppose carving out climate spending and other strategic expenditures from the EU’s public debt calculations, insisting that member states must focus on reducing their indebtedness.

- In his own words, Hahn said, “I am not supporting any ideas [to] exclude certain kinds of debts, qualifying them as good ones, sustainable ones, green ones, etc. At the end of the day, debt is debt.”

- Hahn, an Austrian, is expressing a common view among a group of mostly northern European countries. In contrast, the governments of France, Italy, and other, mostly southern, European countries are arguing for easier borrowing to support “strategic” initiatives such as climate-stabilization investments.

- While looser deficit and debt rules could help spark investment and bolster economic growth in the EU, at least for a time, the trade-off could be even higher debt levels that would eventually weigh on economic activity, European debt, and the Euro.

Japan: As commodity and transportation costs soar due to the COVID-19 pandemic and a weakening yen makes fuel and imports costly, more Japanese companies are raising prices. The price hikes, usually by market leaders with specialty products, are still modest. However, the trend does offer a tantalizing hope that Japan could finally emerge from the deflation that has defined it for decades.

Kazakhstan: The riots and protests of the last week are calming down, and President Tokayev, for the first time, blamed former President Nazarbayev for the unrest. In a scathing speech to parliament, Tokayev detailed how Nazarbayev’s policies worsened income inequality for years until public anger boiled over.

- Tokayev vowed to launch economic reforms to reduce income inequality, but the more important aspect of his speech is simply his attack on the former president, who had built up an extreme cult of personality around himself during his tenure.

- Tokayev’s attack on Nazarbayev confirms our view that even if Tokayev didn’t instigate the unrest on purpose to discredit Nazarbayev, he certainly took advantage of the situation to push the former president out of his powerful position on the national security council, albeit with the help of Russian troops.

- The result is that Tokayev has solidified his position at the head of the government and forced Nazarbayev into full retirement, but the price he paid by inviting in Russian troops is that he now will be under much stronger influence from the Kremlin.

Ethiopia-Tigray: After a string of victories against rebel Tigrayan forces over the last several weeks, the Ethiopian government has offered an olive branch by releasing several opposition leaders from prison and expressing its willingness to launch talks toward reconciliation. The development offers some hope that the country’s civil war might end, but a dialogue and a peace process are not guaranteed.

COVID-19: Official data show confirmed cases have risen to 313,959,367 worldwide, with 5,507,140 deaths. In the U.S., confirmed cases rose to 62,313,787, with 842,322 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 247,321,023. The data show that 74.5% of the U.S. population has now received at least one dose of a vaccine, and 62.6% of the population is fully vaccinated.

Virology

- With the more easily transmissible but less dangerous Omicron mutation spreading fast, the number of COVID-19 hospitalizations is rapidly becoming the most important metric for the pandemic. Unfortunately, the U.S. seven-day average of people hospitalized with confirmed or suspected COVID-19 reached 140,576 yesterday, surpassing the previous high recorded during the surge last winter. The latest data from the Department of Health and Human Resources show that 79.2% of U.S. hospital beds are currently occupied, with COVID-19 cases alone occupying 21.3% of the available beds.

- The tally suggests that a new onslaught of patients is arriving at many hospitals and putting added stress on the healthcare system.

- We still think U.S. leaders will shy away from the costly and highly unpopular mass lockdowns imposed earlier in the pandemic. However, as hospitals come under increasing stress, there is a chance that officials will impose some less intrusive measures that could nonetheless be a headwind for the economy.

- To help keep classrooms open during the Omicron surge, the Biden administration plans to distribute five million free rapid COVID-19 tests each month to schools around the country. The tests for schools are in addition to the 500 million tests the administration plans to begin distributing to the public for free in the coming weeks.

- In Europe, the Omicron mutation is spreading so fast that WHO Regional Director Hans Kluge has warned that more than half of the Continent’s population could be infected within the next two months.

- In the U.K., Prime Minister Johnson is facing public outrage over reports that he attended a “bring your own booze” garden party at Downing Street in May 2020, against his own government’s social distancing rules at the time. Parliament members say the outrage is strong enough that Johnson could soon face a vote of no confidence.

- In China, the government continues to adhere to its zero-tolerance policy regarding COVID-19, leading to a growing list of big cities being locked down and forcing the closure of many major manufacturing and shipping facilities. If the shutdowns last long enough, they could spark a new round of supply disruptions that would dent economic growth worldwide and potentially keep inflation pressures high.

- In one extreme example of the government’s zero-tolerance strategy, a Chinese court has sentenced three port workers to between 39 and 57 months for violating COVID-19 containment measures in 2020.

- The charges against the three workers ranged from not wearing masks to foregoing protective clothing when handling cargo.

Economic and Financial Market Impacts

- In its latest economic forecasts, the World Bank said global economic growth would fall from 5.5% in 2021 to 4.1% in 2022. According to the forecasts, the slowdown would mostly reflect the effects of the Omicron variant, supply chain disruptions, labor shortages, and the winding down of government economic support around the world.

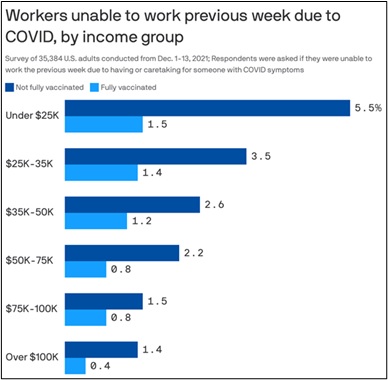

- New data from the Census Bureau shows that unvaccinated workers, particularly low-wage earners, were much more likely to miss a full week of work because they had COVID-19 symptoms or were caring for someone with symptoms — even before Omicron. Missing work for these folks typically means missing substantial pay, since only 33% of low-income workers get paid sick leave. The chart below is from labor economist Aaron Sojourner of the University of Minnesota, and Julia Raifman, a health policy researcher at Boston University.