Daily Comment (February 25, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

The fifth and final part in our recent Weekly Geopolitical Report series, “The U.S.-China Balance of Power,” is now published. We also have several other recent multimedia offerings. There is a new chart book recapping the recent changes we made to our Asset Allocation portfolios. Here is the latest Confluence of Ideas podcast. The most recent Asset Allocation Weekly, chart book, and podcast are also available. Being Thursday, the Weekly Energy Update is available. You can find all this research and more on our website.

Good morning on the day after the Fed’s financial plumbing had a clog! The market news this morning is that 10-year T-note yields are now above 1.4% (and, as we speak, above our fair value yield of 1.42%). Equity futures, which were higher most of the night, have turned negative. This decline is, of course, on the back of a significant rally yesterday, where the Dow Jones Industrials hit a new record. Our coverage begins with the financial, followed by economic and policy news. China coverage is next, with a pandemic update afterward. We close with our international news roundup.

Financial Markets: As the year started, there was one clear “known unknown,” using Rumsfeld’s taxonomy. We knew the economy and markets are awash in liquidity; the unknown was where it would go. If it went to goods and services, we were likely to see higher inflation. If it went to financial assets, we could see an epic runup in financial assets. At the same time, faced with this uncertainty, investors had to position themselves. Thus, we have seen what appear to be hedging activities. Bitcoin, gold, and residential real estate saw inflows. Over the past six months, though, we have seen a steady rise in interest rates. On August 4, the 10-year constant maturity T-note fell to 52 bps. It is over 140 bps this morning. Essentially, bond investors are indicating they need higher yields to compensate for inflation and growth.

This situation puts the FOMC in a difficult spot. If it allows the long end to continue to rise, real estate, the most important asset for the bottom 90% of households, will start to suffer. At some point, equity markets will come under strain as well. At the same time, the beleaguered financial sector, which had something of a lost decade from 2010-19, could benefit from the steepening yield curve. In addition, higher long-duration rates might take some of the froth out of equities. After all, the major indices have stalled recently, but that hasn’t hurt cyclical sectors or small caps. And, as Chair Powell stressed over the past two days, the economy, although clearly recovering, is still in a fragile state. He left no doubt—policy rates won’t change anytime soon, and the balance sheet will continue to expand. However, those policies may simply not be enough. We suspect the FOMC views yield curve control as a last-ditch policy tool. Fixing the yield curve’s rates could have adverse effects that are hard to predict and potentially difficult to fix. After all, monetary policy has traditionally allowed the financial markets to set longer-term interest rates. QE was an attempt to guide longer duration rates, but it’s hard to make the case that it worked very well.

So, where does this leave us? Our take is that, without intervention, the 10-year is on its way to 2.00%. The Fed probably lets it go there as long as financial stress doesn’t rise. In other words, help probably isn’t on the way until there is a crisis. That doesn’t necessarily mean we will get one, but we think the odds favor the idea that the FOMC won’t move preemptively to cap the long end. That doesn’t mean equities won’t continue to move higher. After all, earnings have recovered remarkably well. It does mean that the path higher will likely become more volatile.

Economics and policy: CEOs back fiscal support, anti-trust, the minimum wage, and semiconductors dominate the news.

- Major company CEOs have come out in support of fiscal stimulus.

- Since the mid-1980s, the “Bork standard” on antitrust has dominated. Essentially, this standard argues that as long as consumers are not harmed, the size of a business doesn’t matter. This was a reversal of the “Brandeis standard,” which argued that size alone was the standard for determining antitrust issues. The Bork standard has been good for consumers, but it has led to two concerns. First, although consumers have been taken care of, workers have not. There is evidence to suggest that large companies have tended to maintain margins through wage suppression. Second, large companies can have outsized political influence. There is a growing movement to return to the Brandeis standard. If the legal system does move that way, large tech companies would be vulnerable.

- As the Senate Parliamentarian decides whether the minimum wage hike can be part of the reconciliation bill, Hawley (R-MO) is considering introducing legislation that would be an alternative to the current idea of a national minimum wage of $15. Although the proposal is still evolving, Hawley hits on a key issue; if the goal is to boost incomes for the less affluent, who should bear the burden of the policy? A pure minimum wage hike puts the burden on businesses. That incidence might be justifiable. The problem is that a wage of that level may push some businesses into closing and may raise geographic inequities. An alternative is to have taxpayers bear part of the burden, which is what Hawley’s bill would do. For large companies, getting taxpayer aid to pay workers more doesn’t seem reasonable, but for smaller companies, it may. That is what Hawley’s bill attempts to accomplish.

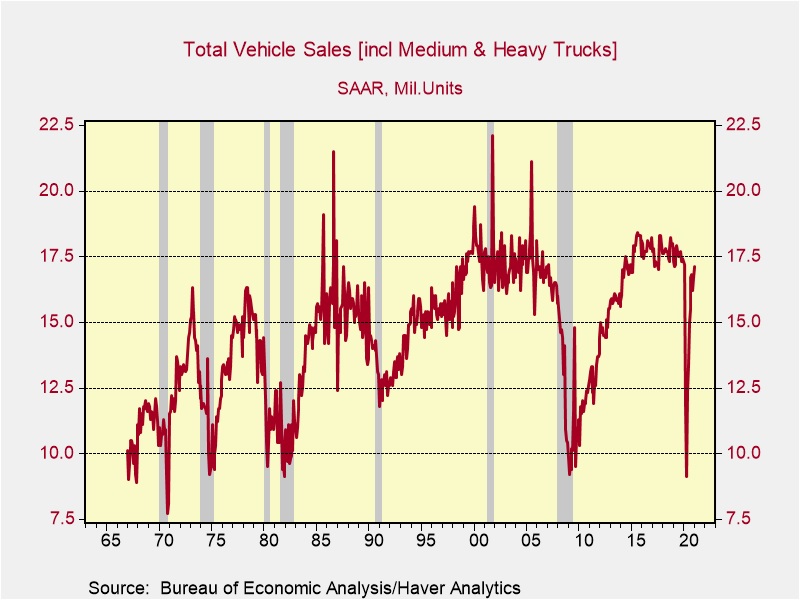

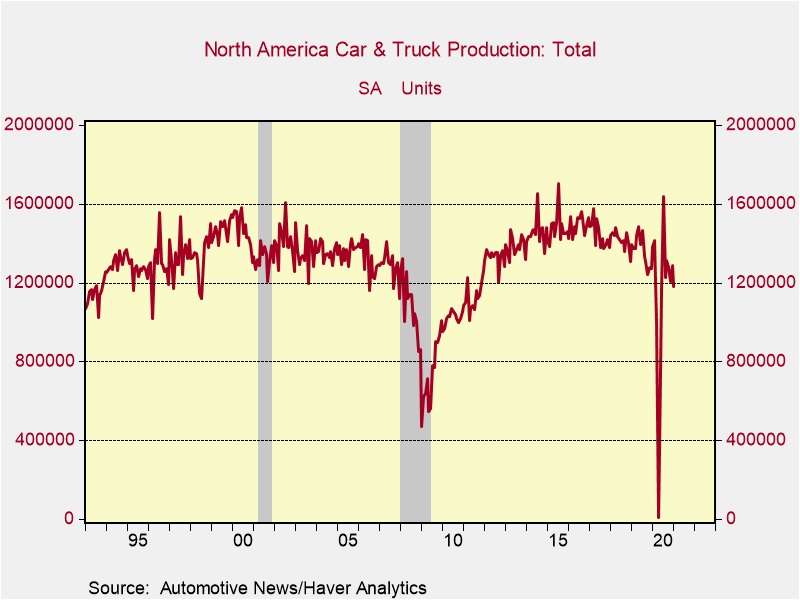

- The pandemic and the recent cold snap have put the downsides of efficiency and just-in-time inventory methods in focus. Automakers are dealing with a severe shortage of semiconductor chips, one that, in part, was their own fault. When the economy collapsed last year due to the pandemic, automakers feared that car sales were about to collapse. In response, they canceled their orders for semiconductors. This sort of action is standard under conditions of efficiency and just in time inventories. At the same time, their actions made sense given the history of car sales and the business cycle. As the chart below shows, sales tend to recover slowly after recessions, but the pandemic recession was clearly unique. So, much to the surprise of automakers, car sales recovered quickly, meaning that car production needed to resume.

Production is slowing as critical material shortages bite.

President Biden signed an executive order calling for a review of supply chains not just for semiconductors but other critical supplies as well. A study is one thing, but making changes to supply chains, especially from on high, is another. We have been expecting that as the U.S. withdraws from its superpower role, supply chains would shorten. That process will reduce the chances of shortages but increase costs, possibly significantly.

- Perhaps highlighting the problem, Taiwan, home of Taiwan Semiconductor (TMSC, USD, 132.30), is dealing with a drought of such proportions that the company is trucking in water to maintain production.

- Supply constraints are starting to lift European prices as manufacturers are passing costs onto clients.

China: China is taking an aggressive stance on redefining human rights.

- China continues to use the pandemic to further its geopolitical goals.

- The WHO continues to investigate the potential for COVID-19 traveling on frozen food. However, the possibility that the virus emerged from a biolab has been deeply discounted. No other nation seems to have seen virus transmission from food imports; although the odds of a lab leak leading to the virus emerging on the world is small, it isn’t zero. So far, China has been able to steer the WHO in the direction of its policy goals.

- China is using vaccine distribution to the developing world to build its soft power.

- Former SoS Pompeo has penned an op-ed in the WSJ returning to the idea that COIVD-19 escaped from a Chinese biolab due to lax safety standards. Chinese media has reacted angrily.

- Katherine Tai is the nominee for USTR. She has been making the rounds, talking to senators and business leaders. If China had any hopes that tariffs would be lifted soon, Tai is making it clear that is unlikely. Her stance reflects an often-underestimated fact that presidents face; although they usually win office by promising to be different from their predecessors, they also inherit conditions and constraints that force them into following similar policies. The framing and commentary might change, but direction tends to be hard-wired. Simply put, China is a strategic threat regardless of who is in office.

- Western nations have generally agreed on human rights. Genocide is wrong. Systemic oppression isn’t good either. That isn’t to say that Western nations always live up to these standards. But, for the most part, the content of human rights is mostly standard. China is taking a different posture, arguing that economic prosperity and overall happiness are more important than religious freedom or racial or gender equality. Security and stability are also high on China’s “list” of human rights. Such a change in definitions certainly suits authoritarian regimes. After all, if humans don’t have certain rights merely for being human, the state is the grantor, and thus the definer, of the content of human rights. However, there is probably a deeper-seated issue operating as well. A history professor we knew argued that nations invaded by Genghis Khan tended to place a lower value on human life; it also seems they put a higher value on stability. Both Russia and China have had historical experience with invasions and periods of uncertain governance. Putting a higher value on stability after those experiences may be part of this condition.

- Canada has approved a non-binding resolution recognizing China’s treatment of the Uighurs as genocide.

- Global Times, considered a “mouthpiece” of the CPC, called the “five-eyes” alliance racist.

- China has attempted to cultivate Eastern European nations with investment and trade. If Beijing can acquire allies in the EU, it can likely sway overall EU policy towards China. It’s a classic “divide and conquer” strategy. It appears some Eastern European nations have become jaded with China and are starting to build roadblocks against further relations with China.

- China’s crackdown on fintech continues. Essentially, fintech firms are going to face higher capital requirements on the loans they make. China has been trying to bring lending under control to maintain systemic stability. Increasing reserves on loans is a step in that direction, but it will also reduce tech firm profitability.

- Industrial metals prices, including copper, have been very strong recently. Factors behind the rise include expectations of higher demand due to the electrification of automobiles, homebuilding, supply constraints, and economic recovery. It is not uncommon during periods of rising commodity prices to see a single, or a few, major buyers. Apparently, a Chinese broker, Shanghai Dalu, has been an aggressive buyer recently.

- Chinese financial regulators are pushing home prices lower in Shanghai. Over the past two years, prices in the city are up over 48%. History shows that these measures don’t last because efforts to cool the froth lead to debt defaults and financial stress.

COVID-19: The number of reported cases is 112,660,503 with 2,499,552 fatalities. In the U.S., there are 28,336,780 confirmed cases with 505,944 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 88,204,035 doses of the vaccine have been distributed with 66,464,947 doses injected. The number receiving a first dose is 45,237,143, while the number of second doses, which would grant the highest level of immunity, is 20,607,261. The FT has a page on global vaccine distribution. And the Axios map shows a dramatic decline in infections.

Virology

- Nursing homes in the West have been an area of high fatalities. COVID-19 is especially deadly with the elderly, and the concentration of old people in nursing homes makes them particularly vulnerable. At the same time, nursing homes become a good signal to the efficacy of vaccines. U.S. data confirms that the vaccines work.

- There have been some interesting positive effects from measures deployed to contain the spread of COVID-19. Deaths in Japan, for example, have fallen for the first time in over a decade. And, for the most part, this has been a winter without the flu in the U.S.

- Although children tend to be mostly spared from the worst of the virus, it is notable that hospitalizations of children from COVID-19 remain steady while adult hospitalizations are falling rapidly. A study in Israel shows that the Pfizer (PFE, USD, 33.75) vaccine is effective for both the young and old.

- Ghana is the first African nation to receive COVID-19 vaccines from the COVAX system.

International news: The KSA, Georgia, Syria, and Europe are all in our roundup.

- The U.S. will release a declassified report on the slaying of Jamal Khashoggi It will indicate that Crown Prince Salman likely ordered the assassination.

- The KSA sold EUR bonds at a negative interest rate.

- Protests in Georgia have erupted after the government arrested an opposition leader. There are fears that the Georgian government is bowing to pressure from Moscow to curtail its democracy. About 20% of the country is occupied by Russian-aligned military forces, a residual from the 2008 invasion.

- Although President Assad of Syria did remain in power and has essentially won the civil war, in the aftermath, he controls a state with a ruptured economy. He doesn’t appear to have any ideas on how to foster a recovery.

- Andrew Bailey, the Governor of the BoE, warned the EU of “serious escalation” if Brussels continues to encourage banks to move their operations to the continent to maintain operations. Despite the threats, we don’t see how the U.K. has much leverage to prevent the loss of business. At the same time, we also doubt the operations in the EU will be as efficient, which could mean New York gains market share.

- Border controls within the EU, put in place to slow the spread of COVID-19, are creating logistical snarls.