Daily Comment (February 18, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

We have several recent multimedia offerings. First, we have a new chart book recapping the recent changes we made to our Asset Allocation portfolios. As we noted last week, we’ve also posted a new Confluence of Ideas podcast. We also have a new Asset Allocation Weekly, chart book, and podcast. You can find all this research and more on our website.

Good morning from St. Louis, where it is a balmy 14o! The midsection of the U.S. all the way to Texas continues to deal with a vicious cold snap, which has affected the energy industry and chip makers, too. Mercifully, it looks like the Arctic blast will dissipate by the weekend, with much warmer temperatures forecast for next week. U.S equity futures are lower this morning as markets grapple with the steady rise in interest rates. We discuss the Fed minutes and look at recent equity market activity and breakeven rates. From there, we discuss policy and economics, highlighting the continued tussle between Australia and the tech industry. Pandemic news follows. We close with a roundup of international news.

Fed minutes and markets: In general, the comments from the recent FOMC meeting were rather upbeat, with the FOMC members arguing that fiscal stimulus measures, coupled with expected improvement in virus control, would lift economic growth over time. Still, given the gap between current and full employment, monetary policy was projected to remain accommodative for the foreseeable future.

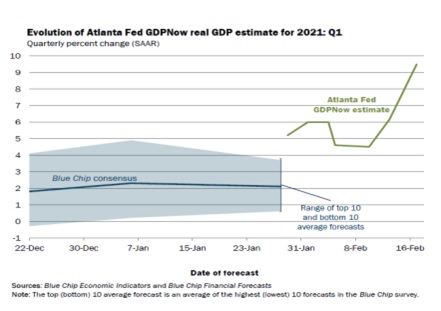

In equity market action, we are seeing a “good news is bad news” trade, usually confined to bonds. Yesterday, for example, we saw equity futures reverse, moving from green to red in the wake of the strong retail sales numbers. Below are a couple of charts highlight what we are seeing. First, the Atlanta FRB’s GDPNow forecast shows Q1 GDP coming in at a blowout 9.5% growth rate.

(Source: Atlanta FRB)

Although we expect this estimate to decline (some of the retail sales yesterday were likely imported goods, for example), GDP is coming in much stronger than we expected.

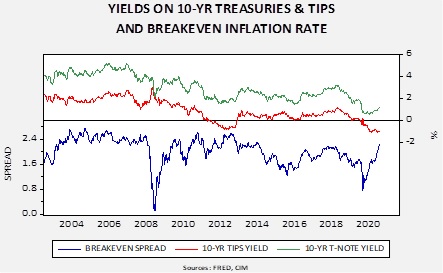

Second, the TIPS/T-note spread, the measure of inflation expectations, is now up to 2.2%

We have been looking at the relationship between equities and Treasury yields. Although it wasn’t mentioned in the Fed minutes, we do expect the FOMC to eventually “sit” on Treasury yields, engaging in some form of yield curve control to prevent higher rates from adversely affecting the economy. There are a lot of unknowns surrounding this decision. The most immediate is whether the Fed will take this step outside of a crisis. Another is what level of rates would trigger a reaction; our best estimate is around 2% on the 10-year Treasury. It is important to note that rising yields are, in part, a function of economic recovery. The fact that equities are, at least so far, reacting adversely to better economic data suggests that accommodative monetary policy is the prime driver of equity values. That may change in the coming weeks, but in the short run, it does suggest at least some degree of churn in equities.

Policy and Economics: Here are some of the highlights.

- News Corp (NSWA, USD, 23.12) has reached an agreement with Google (GOOGL, USD, 2116.72) where the tech giant will begin paying the content provider for the news it publishes on its website. So far, this agreement only affects Australia. Google has been trying to get ahead of new regulations being considered in Australia, which would require platform aggregators to pay for the news they provide. If this movement gains traction, it will be interesting to see if the aggregators begin selling subscriptions for readers to access content.

- Meanwhile, in stark contrast, Facebook (FB, USD, 273.57) decided to strike back at Australia by blocking users in that country from sharing news. Today, this decision prevented government health and emergency services from being accessed by the public. The blocked information was for vaccine distribution. We will continue to watch this situation unfold, but this action by the company could turn into a public relations nightmare and lend credence to the company’s critics.

- One policy proposal that has been circulating since the 1970s is universal basic income (UBI). The idea is that citizens receive a regular stipend from the government. It has received support from both the right and left. The former likes it because it would end the government’s welfare infrastructure and more efficiently distribute aid, while the latter supports UBI because the left likes the idea of a permanent safety net. However, it has its detractors. The lack of targeting means those who don’t need the money get it anyway. Those in the government’s welfare apparatus usually oppose it. There are concerns about the policy adversely affecting work effort; studies of limited UBI programs mostly indicate that work effort isn’t dramatically affected, although that may not be the case on a large scale. Andrew Yang ran for the Democratic Party presidential nomination on the policy. For the most part, UBI remains a sort of policy curiosity for now.

- However, there is a growing movement to create a type of UBI for kids, something of a mirror of Social Security. President Biden has a plan to boost the child tax credit to $3,600 for children under six years of age and $3,000 for children 7-17. Support would begin to phase out for couples earning $150,000 per year. Senator Romney (R-UT) has a plan to raise the credit even more, to $4,200 per child six and under, and match the president’s plan for older children. The phaseout is higher under Romney’s plan. However, there is a twist in both plans. Instead of the credit coming once a year when taxes are filed, the Social Security Administration would distribute the credit monthly, making the plan less of a tax credit and more of a child allowance. In other words, this credit begins to look a lot like Social Security for kids (and their parents).

- In general, Americans tend to prefer universal benefits. Means-testing benefits are targeted and thus more efficient, but they can also project a stigma on recipients. It also requires a bureaucracy to distribute and monitor recipients. This “kids UBI” program could have political legs. The right will probably support it because it should help stabilize families, and the left will like the chance to reduce child poverty.

- In the meantime, the establishment continues to press against populist policies:

- Last year, California voters refused to pass Proposition 22, which would have given contract workers the rights of employees. With that win, other firms are exploring the “gig” model to reduce their labor costs.

- The Chamber of Commerce says that decoupling from China could cost thousands of jobs and billions of dollars of sales. We tend to agree, but if the policy goal is to isolate China, this sort of outcome is probably unavoidable.

- The U.S. will extend the mortgage foreclosure moratorium through the end of June. The majority of those in forbearance are in the FHA loan guarantee program.

- The CFTC has approved a binary event market platform from Kalshi, Inc., a privately held firm. Decision markets have become more popular recently, and this could become a source of information about expectations surrounding various events.

- The pandemic has accelerated trends that were already in place. Work-from-home and streamlining procedures are part of these changes. Economists worry that millions of jobs, most likely for less affluent households, will be adversely affected.

- There has been an uptick in illegal immigrant crossings in what looks like expectations of a less harsh immigration policy from the new administration.

COVID-19: The number of reported cases is 110,002,089 with 2,432,607 fatalities. In the U.S., there are 27,827,801 confirmed cases with 490,717 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 72,423,125 doses of the vaccine have been distributed with 56,281,827 doses injected. The number receiving a first dose is 40,268,009, while the number of second doses, which would grant the highest level of immunity, is 15,471,536. The Axios map shows marked declines in infection rates.

Virology

- One concern regarding the push for vaccines is that antiviral treatments have received less attention and funding. Israel has been working on a treatment designed to tame the antibody response which can, in some cases, go into overdrive and make a COVID-19 infection worse. The drug, Allocetra, made by Enlivex Therapeutics (ENLV, USD, 20.33) has shown promise in improving the recovery of severely ill patients. If COVID-19 becomes endemic, as we expect, having drugs to treat patients who contract the disease, even if inoculated, will be critical.

- We are seeing the U.S. slowly extend the time frame for dealing with the pandemic. Earlier this week, President Biden suggested that enough vaccines will be available to all Americans by the end of July. Although this is favorable news, having available vaccines is a far cry from having them in arms. Production problems have plagued vaccine producers; the latest bottleneck to emerge is a shortage of plastic bags used in bioreactors that produce the vaccines.

- During the 1918 influenza pandemic, there was a notable decline in life expectancy. We saw something similar last year due to COVID-19.

- As vaccines are distributed, the potential for “vaccine passports” is rising. Increasingly, industries that require face-to-face contact are beginning to consider proof of vaccination.

- South Korea is accusing North Korea of using hacking to acquire information about vaccine formulation and production.

- We continue to monitor cases of reinfection, especially related to mutations. In South Africa and Brazil, there are reports of variants causing new infections in areas where infections were previously widespread. Current vaccines appear to offer less effective protection. Overall, this pattern fits our expectations that COVID-19 will move from pandemic to endemic over time, meaning that the disease is now part of our lives, similar to influenza.

- Slow vaccine distribution in the emerging world will tend to foster new variants and prolong the pandemic.

- South Africa has started to distribute the Johnson & Johnson (JNJ, USD, 165.66) vaccine to healthcare workers, even though the vaccine hasn’t been approved.

- Cuba has developed its own vaccine and is preparing to produce it in quantity. It may force tourists to take the vaccine.

- Taiwan is accusing Beijing of blocking access to vaccines.

- Evaluations of some patients who died of COVID-19 show very large cells, usually seen elsewhere in the body, in brain capillaries. It is possible that reports of the virus causing “brain fog” may be caused by blockages.

- The CDC is funding a new effort to track variants of the virus in the U.S.

International news: North Korea, Italy, Germany, and China were all in the news. The latter, which usually has its own report, had a dearth of news due to the Lunar New Year.

- The U.S. has accused North Korean hackers of conspiracy to steal more than $1.3 billion of cash and cryptocurrency.

- Italy’s new PM, Mario Draghi, easily won a confidence vote, cementing his control of the new government.

- Germany is hopeful that the new administration will reduce tensions over the Nord Stream 2 pipeline, the natural gas pipeline that will connect Germany with Russia.

- As reported earlier this week, China is threatening to close off rare earth exports to the U.S. Here are some background reports on rare earth elements.

- One of the trends that developed during the Cold War was that each new administration, regardless of party, found itself with little room to maneuver regarding Soviet/U.S. relations. The GOP, which tended to be more hardline, felt it couldn’t deviate or it would lose its identity, and the Democrats didn’t want to look “soft on the Soviets.” We are beginning to see similar restrictions emerge on U.S./China relations.