Daily Comment (February 4, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning. U.S. equity futures are modestly higher this morning. We begin our coverage with a look at tomorrow’s non-farm payroll report and why it could be a rather deceptive blowout. The next stop is international news, including a discussion of Italy’s new PM. We follow with policy and economic news. Our coverage of the pandemic is next, and we close with China news. Being Thursday, we publish a new Weekly Energy Update. And the current Asset Allocation Weekly is also available.

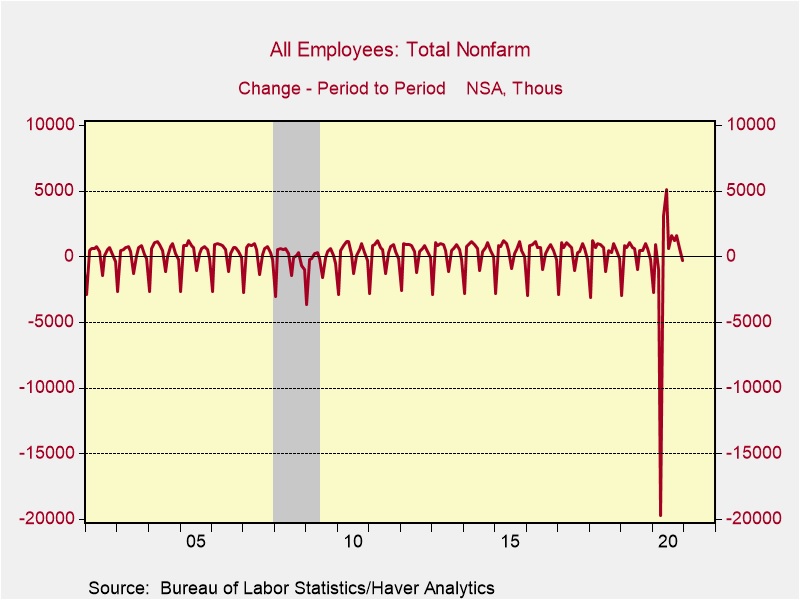

About tomorrow: Normally in January, retailers lay off large numbers of seasonal workers who were hired for the Christmas rush. Other industries, due to winter weather, also lay off workers. These layoffs are easy to see in the non-seasonally adjusted data.

The largest decline each year is in January; a smaller one occurs in July as schools lay off some teachers and automakers engage in model retooling. Since 2001, the average decline in non-farm payrolls for January is 2.874 million jobs; retailers account for about 22%, and goods-producing jobs represent about 16%. Since the layoffs are regular, the BLS uses seasonal adjustments to smooth out the data. The seasonally adjusted data is reported. The average January seasonally adjusted non-farm payroll data since 2001 is more than 91,000, so obviously, the seasonal adjustment factor is sizeable.

Retailers didn’t increase their November hiring as much as in the past. Compared to the average since 2001, hiring was about 73,000 less in 2020. In addition, it is possible that some of the seasonal hirings were in delivery and other forms of e-commerce, which may not have the same layoff patterns. The bottom line is that we could get a bullish surprise tomorrow; this was reflected in yesterday’s ADP data, which came in stronger than expected. Current expectations are calling for a greater than 100,000 non-farm payroll increase. We would take the “over” on that one. Although the stronger data will be welcome, it may not be as robust as it first appears.

International roundup: A new Italian prime minister?

- Although new governments in Italy are not at all unusual, we were surprised to see the former ECB head, Mario Draghi, tapped to form a new government. Draghi is credited for saving the Eurozone. His aggressive actions to bolster banks over the opposition from Germany likely prevented several countries from exiting the Eurozone. Thus, he has the credentials of a crisis manager. Italy is facing a myriad of problems. It was hit hard by the pandemic, and its economy has been moribund for years. Forming a government will be a challenge. Italy has seen a radical and technocratic government in recent years. The key will likely be finding a balance. We note that Italian financial markets greeted the announcement favorably.

- We are seeing the dollar rally from its lows last year. Although we remain dollar bears, the lift in the greenback appears to be coming from three sources:

- The stumbling Eurozone economy is putting downward pressure on the EUR. This bearish pressure will likely persist until vaccine distribution improves. In addition, the ECB has made it known it isn’t pleased with its currency’s appreciation, making traders less sure about holding bullish positions. Because the EUR is a “major” currency, its weakness is notable.

- Several central banks are quietly extending their policy stimulus in the face of currency strength. The BOE today signaled that banks should prepare for the possibility of a negative policy rate. The Reserve Bank of Australia extended its QE program, which has included yield curve control. Several other emerging economy central banks, including Chile, Poland, India, and Israel, have signaled they intend to buy dollars this year. Some of this buying is to bolster foreign reserves, but we suspect it is also designed to prevent the dollar from weakening, undermining their export competitiveness.

- The Biden administration returned to the Rubin “strong dollar” policy.

- We don’t expect these trends to dominate over time. However, it does highlight a clear “race to the bottom” on exchange rates. No nation appears to be happy about a stronger currency, which is usually favorable to currency debasement positions, e.g., gold, bitcoin.

- The U.S. has approved a five-year extension to the New Start ballistic missile treaty. SoS Blinken criticized China and Russia and is considering new sanctions against North Korea.

- Indian farmer unrest continues unabated. The Modi government is extending its crackdown by blocking the internet and attacking journalists.

Policy and Economics: Here are some of the highlights.

- The Democratic Party leadership and the president are moving towards using budget reconciliation to push its $1.9 trillion of fiscal stimulus. This would allow the measure to pass with a party-line vote. However, they must tread carefully because the reconciliation law has automatic debt triggers that could lead to unintended Medicare cuts. Avoiding these cuts would require GOP support. Thus, the path to “going it alone” is fraught with risk. At the same time, there are discussions about restricting the $1,400 stimulus checks to lower-income households, which may expand support. Meanwhile, the $15 minimum wage looks like it will have a hard time making it through Congress.

- We are watching Europe’s views on the Biden administration’s trade policy. So far, Brussels looks unimpressed, with a Dutch paper calling Biden “a Trump with manners” regarding trade. Why the disappointment? The ‘buy American’ policy has Europeans worried about their ability to sell to the U.S. government. The new government rescinded the Trump administration’s decision to remove a 10% tariff on aluminum imports from the UAE. Biden hasn’t moved on approving a new WTO leader; the previous administration was the only government in the WTO to reject Ngozi Okonjo-Iweala for the post. There were expectations that Biden would quickly reverse course, but, so far, her acceptance is only “under consideration.” What is happening here is simply that the media tends to focus on personalities rather than trends. Personalities are far more interesting and meet the needs of the media, which is readership. In reality, all leaders work under constraints and can usually only make changes within those constraints. Thus, radical changes in policy are fairly infrequent. The trend in U.S. trade policy is to regionalize consistencies with the evolving equality cycle we are moving toward. Thus, the differences in trade policy won’t be all that significant.

- Klobuchar (D-MN) has introduced an antitrust bill focused on “…materially lessening competition.” What is new is that since the mid-1980s, harm to consumers has been the standard for antitrust. This bill appears to change the standard to size. Firms, especially in technology, have studiously avoided giving the appearance of harming consumers; mostly, they have gained margin through labor suppression. Stopping mergers on size alone would be a return to pre-1985 policy. Will this get through? The establishment of both parties will oppose it, but it will be interesting to watch if the GOP Senate populists, Rubio/Cruz/Cotton/Hawley (RCCP), support it.

- Last year, Congress passed the Corporate Transparency Act, a bill designed to make it harder to launder funds in the U.S. financial system. One part of the bill requires “shell” corporations to let law enforcement know who is purchasing real estate. The bill doesn’t go into effect until next January, but already, the real estate industry is scrambling to adjust.

- A Fed study of small businesses shows they are still operating below pre-pandemic levels.

- Semiconductor chip shortages are causing automobile production cuts.

COVID-19: The number of reported cases is 104,499,482 with 2,270,990 fatalities. In the U.S., there are 26,558,715 confirmed cases with 450,826 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 55,943,800 doses of the vaccine have been distributed with 33,878,254 injected. The number receiving a first dose is 27,154,956, while the number of second doses, which would grant the highest level of immunity, is 6,436,931. The Axios map shows declining infections across the country.

Virology

- The WHO is investigating the Wuhan virology lab, which has been the subject of claims that a leak from this lab let COVID-19 loose on the world. The fact China is letting the team in would suggest that Beijing feels comfortable that nothing will be found. Frontline has done a show on China’s behavior surrounding the virus; we haven’t looked at it, but it is available here.

- One of the developing features of COVID-19 is that it is causing health irregularities in some patients, even those with asymptomatic cases. Given how new the disease is, it is not clear whether these symptoms persist or weaken over time.

- For the first time, the number of vaccines distributed exceeded the total number of confirmed cases, indicating that the distribution is starting to ramp up.

- The government is beginning to ship vaccine supplies directly to pharmacies, which should aid in distribution.

- The Russian vaccine was found to be almost 92% effective; it does require two doses but can be stored at refrigeration temperatures.

- One unknown about the vaccines is if they induce sterilizing immunity, which means that a vaccinated person can no longer contract the disease. If it doesn’t, the immunity it gives means that one doesn’t get sick but can be an asymptomatic carrier. A study of the AstraZeneca (AZN, USD, 50.00) suggests it may give sterilizing immunity.

- High levels of hesitancy remain among Americans regarding getting the vaccine, which will slow progress in managing the virus.

- Denmark is issuing a coronavirus passport; we will be watching to see if this becomes a trend. If it does, it should help open up travel.

- Vaccine makers are starting to work on changes to address the new strains emerging. In addition, research on using different vaccines for boosters is beginning.

- Britain is reporting new variations of the B.1.1.7 mutation. There is some speculation that a person may have been infected with both the British and South African or Brazilian variants, and the virus is recombining. The fear is that this new “supercharged” variant may undermine the current vaccines. This variant carries the E484K mutation.

- Despite these fears, data from Israel suggest that the Pfizer (PFE, USD, 34.84) vaccine is working well to protect recipients. It is not clear whether this immunity is being tested by new variants.

- Meanwhile, the EU has had a very difficult time with its vaccine program.

- Low reimbursement rates are leading some doctors to stop testing for COVID-19.

China: Relations between Washington and Beijing remain strained.

- Yang Jiechi gave a policy address to the National Committee on U.S./China Relations. There is no evidence in the talk that China intends to change its behavior. The blame for tensions, according to Yang, is solely due to American behavior. Yang is a high-ranking diplomat, and his speech would be a signal of China’s policy stance. Meanwhile, the Biden administration appears to be taking its time to engage the Chinese leadership.

- When the USS Theodore Roosevelt entered the South China Sea near Taiwan last week, the PLA Air Force simulated an air attack on the carrier group. Both sides are engaging in the threatening activity. Some of this could be China testing the new U.S. administration.

- A recent survey conducted by the Chicago Council on Global Affairs and the University of Texas at Austin showed two interesting trends. First, the GOP members and its leadership favor a much more aggressive policy against China compared to Democrats, both leadership and members. Second, the leadership of both parties tends to favor defending Taiwan, but the American public universally opposes that policy.

- As China prepares for a loss of access to U.S. semiconductors and equipment, Chinese firms are said to be stockpiling chips and chip-making equipment.

- Turkey has welcomed Chinese Uighurs in the past; the Uighurs are ethnic Turkmen. However, the Erdogan government is working to improve relations with China, and as part of this goal, Turkey is starting to arrest Uighurs in Turkey on allegations of terrorist acts in China and extraditing them.

- The Intercept has a new report on the degree of surveillance Beijing deploys in Xinjiang.

- As horrific reports about the treatment of Uighurs continue to circulate, we are seeing a movement is starting to boycott the 2022 Winter Olympics, which are to be held in China.

- Although Western governments are clearly displeased with the coup on Myanmar, their leverage is limited due to the regime’s close ties to China. One key project is a large oil and gas pipeline project that will terminate at Kyaukpyu. When completed, the project would allow Beijing to avoid the Straits of Malacca to import oil and natural gas.

- Chinese hackers also used the SolarWinds (SWI, USD, 16.33) bug to spy on the U.S. government’s payroll agency.

- China has been dealing with a serious air pollution problem for some time, a side effect of rapid and mass industrialization. Although there are government agencies tasked with addressing the problem, they have been sidelined historically due to a higher goal of development. However, we are beginning to see signs that the Xi government is getting more serious about tackling environmental issues.

- The U.K. will still accept the British National Overseas passport, despite Beijing’s decision to no longer recognize the document.

- Ant Financial appears to be acquiescing to the Xi government’s demand that it be regulated as a financial institution, something that its founder, Jack Ma, tried to avoid. The regulator that took on Ma, Guo Shuqing, is seeing his status rise.

- Japan is increasing government incentives for Japanese firms to move production out of China.