Daily Comment (February 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities have simmered down since Thursday’s rally. Meanwhile, prospective college football players will not have to wait long to join their teams, as official signings will occur before title games. In today’s Comment, we delve into the reasons behind the markets’ resilience amidst Europe’s technical recession, explore the complexities surrounding commercial real estate issues, and offer insights into what US allies stand to gain from the ongoing chip war between the United States and China. As usual, we end our report with a summary of international and domestic releases.

What Recession? The Euro Stoxx 50 set a new record on Thursday as data showed that the regional economy is already starting to recover.

- While European economic data suggests a bumpy recovery is taking hold, the path varies across the continent. The eurozone’s composite purchasing manager index (PMI) rose from 47.9 to 48.9 in February, exceeding expectations of 48.5, according to S&P Global. However, the picture is more nuanced. France’s PMI saw a significant jump to 47.7 from 44.6, indicating expansion. Conversely, Germany’s PMI unexpectedly dipped to 46.1 from 47.1, falling below the expected 47.5 and suggesting contraction. This divergence highlights how the impact of the recent economic slowdown varies significantly across countries, with some weathering the storm better than others.

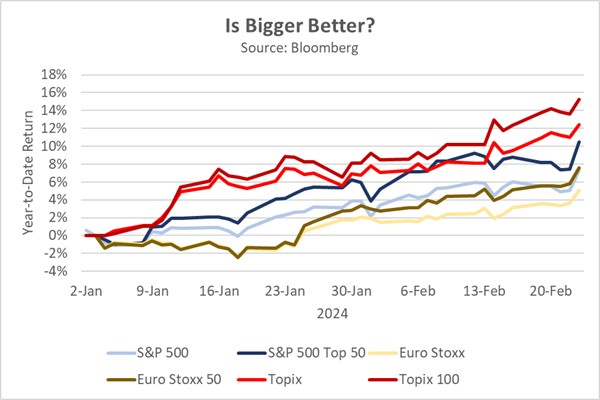

- Intriguingly, markets seem to be overlooking the recent weak economic data. Even though several European nations, including Germany, entered technical recessions earlier this year, stock markets have enjoyed a strong start. The Euro Stoxx 50 Index boasts an impressive gain of almost 8% so far this year, closely trailing the S&P 500 Top 50 Index’s rise of 9.5%. The apparent disconnect between economic data and European market performance is not unique to the region. Despite facing similar economic challenges, Japan’s Topix 100 Index has also seen a remarkable surge of over 15% in the first quarter of this year.

- Several global stock markets are experiencing a “top-heavy” trend, with large companies driving overall gains disproportionately. This investor preference for large-cap stocks stems from their perceived stability during economic uncertainty, further fueled by mixed signals from central banks on future interest rate cuts. The persistence of this trend depends on the severity of the anticipated downturn. If the expected shallow recession in Japan and Europe materializes, the current trend might continue. However, a deeper downturn could force investors to seek “safer havens” in government bonds, potentially leading to a shift away from large-cap stocks.

CRE Problem Persists: Banks are racing against time to find solutions as hundreds of billions of dollars in office space loans approach maturity.

- January saw a dramatic surge in commercial real estate foreclosures, fueled by the brutal combination of high-interest rates and low occupancy rates. This “double whammy” squeezed borrowers, making it nearly impossible for many to keep up with payments, resulting in 635 foreclosures across the US. This spike highlights the significant challenges that lenders face in helping borrowers adapt to the harsh reality of higher interest rates, where the “extend and pretend” strategy is no longer viable. The increasing number of troubled CRE loans has raised concerns among regulators, with figures like Treasury Secretary Yellen and Fed Vice Chair Brainard closely monitoring the situation, fearing the potential spillover effects on the broader economy.

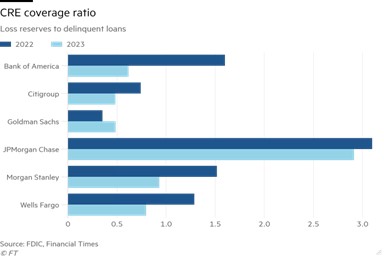

- A recent Barclays study revealed a significant link between bond spreads for regional banks and their risk profile. It found that 85% of the difference in bond spreads between regional banks can be explained by two factors — the weighted average rating factor (WARF), and their exposure to CRE as a percentage of their total capital. Despite their perceived stronger financial position compared to smaller banks, a recent report revealed that the bad property debts of larger banks now exceed their reserves for potential loan losses. This raises concerns about their ability to withstand potential shocks in the commercial real estate market.

- The Federal Reserve’s response to this financial challenge hinges on its assessment: Is it a liquidity squeeze or a broader refinancing issue? If the Fed perceives a liquidity shortage, it might use previous measures like temporary support to prevent bank runs. Alternatively, if it sees a wider refinancing challenge, lowering interest rates could improve the negotiating power of borrowers. However, both approaches present potential drawbacks. The most recent FOMC meeting minutes showed that policymakers believe that there are ample reserves in the financial system, suggesting a potential openness to rate cuts. However, Fed officials’ recent comments indicate that the committee does not plan to do so anytime soon.

Chip Wars: The US is showing that it would like to involve its allies as it battles China for AI supremacy.

- Following months of anticipation, the US government has begun allocating funds from the 2022 CHIPS and Science Act. On Thursday, South Korean semiconductor manufacturer SK Siltron secured a $544 million loan to expand its Michigan plant, marking a significant step in bolstering domestic chip production. The report comes several days after it was announced that GlobalFoundries received a $1.5 billion grant as it looks to help expand its facility in Malta, New York. It is widely expected that Taiwan Semiconductor Manufacturing Company and South Korea’s Samsung will also want to take part in the program.

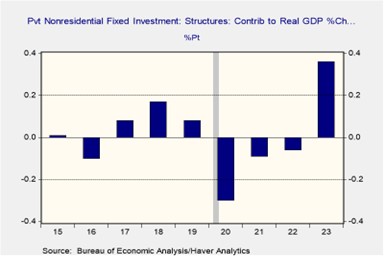

- Increased government funding for critical industries, like advanced manufacturing, points to a potential shift toward prioritizing domestic production. This trend is bolstered by a significant surge in investments for building and upgrading manufacturing infrastructure in 2023, marking the highest contribution to economic growth in over a decade. This push isn’t limited to semiconductors; initiatives like the Inflation Reduction Act have fueled investments in electric vehicle manufacturing, further emphasizing the government’s preference for producing goods that are more forward-looking as it readies to take on China.

- Despite challenges in developing its domestic electric vehicle industry, the US holds a potential advantage in semiconductors due to its long history of designing advanced chips. Recent government initiatives leverage this strength to help the US maintain its global leadership and strengthen partnerships with allied nations. This could, in turn, benefit US-aligned technology firms through increased collaboration and trade opportunities. Notably, Japan is strategically positioning itself to capitalize on this trend, as evidenced by its recent partnerships with American companies like Rapidus and Micron, aiming to revitalize its own chipmaking capabilities.

Other News: The first commercial flight to the moon landed on Thursday. This mission not only signifies the United States’ triumphant return to the lunar surface after half a century, but also hints at the potential resurgence of another era of space exploration akin to a modern-day space race. The US and China are collaborating on addressing debt concerns in developing nations, showcasing a continued effort to manage tensions despite ongoing disagreements. Meanwhile, the South Carolina primary on Saturday could solidify former President Donald Trump’s lead in the Republican nomination race.