Daily Comment (February 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Markets are buoyant after a stellar earnings report from Nvidia, while Messi returns to action as the reigning Ballon d’Or winner. In today’s Comment, we discuss our reservations about the Magnificent Seven, give our reaction to the latest Fed minutes, and explain why Japan continues to capture the attention of investors. As usual, our report concludes with a summary of domestic and international data releases.

Magnificent Seven: Despite past solid performances, Big Tech valuations may face pressure as investors worry about their ability to sustain growth and meet audacious earnings targets.

- Chipmaker Nvidia reported stronger-than-expected earnings, indicating that AI hype still has momentum. The company announced that it made $22.1 billion revenue in the three month period ending in January. This surpassed estimates by $1.7 billion and sparked optimism for a $24-billion current quarter, driven by resurgent chip demand. The news comes after a stellar year with Nvidia’s stock surging 240% in 2023 and 40% year-to-date and is likely to buoy the broader tech sector as investors seek to avoid missing out on further gains made in the AI space.

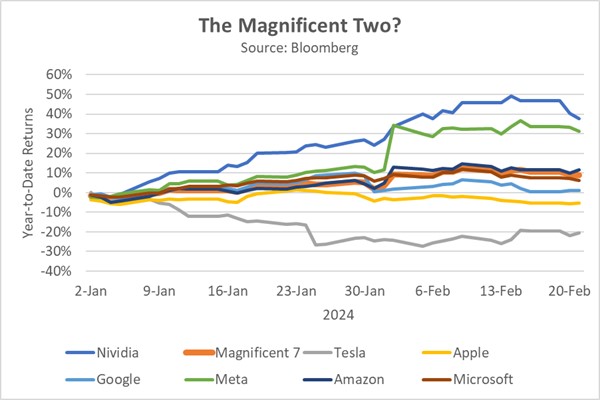

- While the Magnificent Seven experienced strong overall growth to start the year, it wasn’t evenly distributed, potentially fueling investor concerns. Meta and Facebook surged the most, exceeding 30% growth in the first two months, while Apple and Tesla’s stock prices dipped during the same period. This disparity highlights investor skepticism towards stocks lacking robust earnings to justify their valuations. Currently, these Magnificent Seven stocks trade at a hefty 40.1 times earnings, nearly double the S&P 500 average. The high valuation suggests that these firms may not be able to sustain their current pace for the rest of the year.

- Investors may be drawn to companies with strong market positions and future growth potential, but these companies are possibly running out of steam. In the AI chip market, Nvidia holds a significant share with its H100 GPUs, and has even caused supply chain challenges for major players like Tesla, as reported by the company. However, concerns are rising about the ability of Big Tech, including Nvidia, to consistently deliver blockbuster earnings growth in the future especially given their rich valuations. This may explain why META has decided to pay out its first dividend. Nevertheless, we recommend keeping a close eye on the technology sector as broader economic factors and company-specific news could impact their valuations in the coming months.

Fed Speaks, Market Reacts: Markets have digested the Fed’s reluctance for aggressive rate cuts in 2024, but uncertainty lingers due to policymakers’ conflicting views on future monetary policy.

- Federal Reserve officials expressed hesitancy to cut interest rates soon unless they see more progress, according to the January 30-31 meeting minutes. While officials acknowledge inflation’s move toward the 2% target, concerns about persistent economic momentum and the risk of overly restrictive policy have divided the board. Additionally, there was a broad consensus that there are enough reserves to meet bank needs. On Wednesday, Richmond Fed President Thomas Barkin and Governor Michelle Bowman reiterated their concerns, urging patience as recent economic data showed that a lot of upside inflation risk remains.

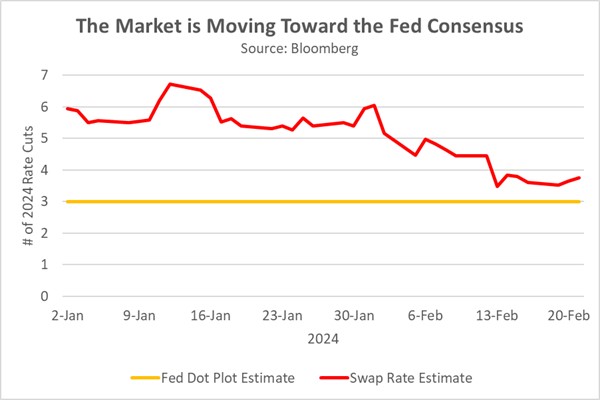

- The Fed’s latest remarks significantly diminished the market’s expectation of a rate cut at the upcoming March meeting. At the start of the year, investors anticipated that policymakers could slash rates up to seven times, expecting the central bank to pivot to protect the economy from slowing down. However, sentiment began to change following the Federal Reserve’s January 30-31 meeting, during which Powell suggested that a rate cut in the upcoming meeting was unlikely. The latest swap rates suggest that investors believe that the Fed may cut three or four times this year, which is in line with the Fed’s median projection.

- Maintaining current interest rates for an extended period could complicate the Fed’s pursuit of a soft landing, as recent meeting minutes reveal. While policymakers expressed confidence in the overall economy, concerns emerged regarding the sustainability of recent growth, primarily driven by volatile factors like net exports and inventory investment. The minutes explicitly labeled these factors as “offering little signal for future growth,” highlighting their limitations as economic indicators. Further, rising bank loan-loss provisions suggest potential credit deterioration later in the year. Although we do not expect a recession this year, we believe that the risk is elevated.

Japan is Back! The Nikkei 225 index hit a new high for the first time in over 34 years as investors begin to embrace the new normal.

- The recent resurgence of the Japanese stock market, once a global powerhouse in the 1980s, is fueled by a confluence of factors, including improvements in corporate governance, a shift from deflationary to moderate inflation, and a complex geopolitical landscape. The bounce began after the Tokyo Stock Exchange started its campaign to raise corporate valuations and was supported by the Bank of Japan, which has been reluctant to raise rates as a way of encouraging firms to test its pricing power. Furthermore, the lackluster performance of China’s stock market has led investors seeking regional alternatives to turn to Japan.

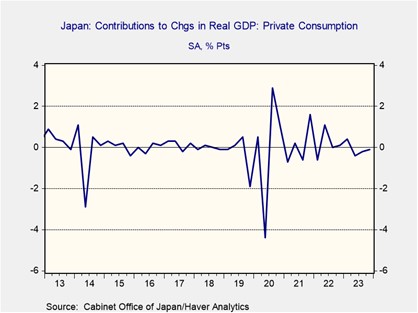

- Echoing 2023’s performance, Japan’s stock market has again outpaced many of its global counterparts in the first few months of 2024. However, uncertainty remains regarding the sustainability of this trend. The Nikkei 225 index currently boasts a 16% year-to-date gain, significantly exceeding the S&P 500’s 5.0% rise and even surpassing the broader MSCI World Index’s 3.6% increase. While foreign investors divesting from China may have fueled some of the initial gains, their return is uncertain and contingent on China’s rebound. Additionally, tepid results from upcoming union wage negotiations could challenge the narrative of Japan’s shift away from deflation, especially as the country flirts with recession.

- The stock market’s strong performance despite Japan’s economic downturn creates a puzzling disconnect, fueling concerns about market sustainability. Weakening consumer spending, a key factor in the slump, could complicate ongoing union negotiations. Companies might resist wage increases, challenging the optimistic narrative that Japan has finally escaped its multi-decade deflationary period. This could prompt investors to re-evaluate their bullish stance. However, a relatively cheap currency presents an opportunity for Japanese exporters. If leveraged effectively, it could boost earnings and support the export-driven growth strategy, potentially mitigating concerns about sustainability in the long run.

Other News: President Trump’s unveiling of his VP shortlist — comprising Tim Scott, Ron DeSantis, and Vivek Ramaswamy — underscores his mounting confidence as the frontrunner for the Republican nomination, signaling a potential rematch with President Biden. In a display of bipartisan unity, lawmakers engaged in discussions with Taiwan’s President-elect to reaffirm Washington’s steadfast support for the sovereign island. Meanwhile, the US government has committed billions of dollars to replace cargo cranes, previously manufactured by China, at ports — a significant indication of its strategic divergence from its Indo-Pacific rival.