Daily Comment (February 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an interesting development pointing to the long-term potential of hydrogen as a global fuel source. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a new Chinese threat to the developed countries’ auto industries and a surge in US retirements that has driven much of the recent expansion in the country’s budget deficit.

Global Energy Market: At the American Association for the Advancement of Science’s annual meeting last weekend, the US Geological Survey presented unpublished data indicating as much as 5 trillion tons of hydrogen exist in underground reservoirs worldwide, potentially setting the stage for it to be a key carbon-free energy source in the future. According to the data, most of the deposits are likely inaccessible. However, if even just a few percent are recoverable, it would be enough to supply the projected demand of 500 million tons per year for centuries.

- Currently, economists and analysts are focused on nuclear, solar, and wind energy to replace fossil fuels and reduce carbon emissions in the future. There has been some focus on hydrogen, but it has been modest to date.

- The new data could potentially help shift interest toward developing hydrogen as an energy source. If technologically and economically feasible, widespread adoption of hydrogen energy would likely create new investment opportunities in the future.

Global Auto Market: Chinese electric vehicle giant BYD has announced a new version of its plug-in hybrid model, the Qin Plus DM-i, priced at the equivalent of just $11,086. The firm says its strategy with the new vehicle is to accelerate the global transition from internal-combustion vehicles to EVs. With the vehicle priced below many of today’s top-selling gasoline cars, such as Toyota’s Corolla, the new BYD offering highlights the threat that low-priced Chinese cars could decimate auto industries throughout developed countries.

China-United States: At the annual Munich Security Conference over the weekend, FBI Director Wray warned that the Chinese are not only still hacking the computer systems of critical infrastructure such as electricity grids to pre-position malware for use in time of conflict, but they have increased it to a “fever pitch.” According to Wray, Chinese spies and hackers are increasingly inserting “offensive weapons within our critical infrastructure poised to attack whenever Beijing decides the time is right.”

- Wray’s comments are only the latest in a long series of FBI warnings about massive Chinese spying and hacking in the US. According to Wray, those warnings were long dismissed by corporate leaders, but they are increasingly being taken to heart as more evidence of the activity is unearthed.

- Government officials even fear that the Chinese-made cargo cranes at US ports are compromised by sensors and software that could allow Beijing to monitor or disrupt US trade. Therefore, the Biden administration will launch a maritime cybersecurity program today that will provide $20 billion from the Jobs and Infrastructure Act of 2021 to improve port security, including replacing all Chinese-made port cranes with new, US-made cranes.

- The pre-positioning of Chinese malware across US computer systems is a reminder that World War II, the last Great Power conflict, is probably not a valid template for how a potential US-China conflict would unfold. In World War II, almost all of the conflict consisted of visible, kinetic attacks: bombs being dropped, artillery being fired, etc. Much of a future US-China conflict might be invisible and non-kinetic, including electromagnetic attacks on satellites in space, malware in cyberspace, and the like.

China-Taiwan: Tensions between China and Taiwan have worsened in recent days after an incident in which two Chinese fishermen drowned while being chased out of Taiwanese waters by the island’s coast guard. In response, Beijing says it will step up law enforcement around the Kinmen archipelago, a group of Taiwanese islands that sit as close as three miles from the Chinese mainland and 100 miles from Taiwan’s main island. The stepped-up Chinese patrols have even included the boarding of a Taiwanese sightseeing boat this week.

- A potential Chinese effort to take control of Taiwan has long been a key geopolitical risk, as it would probably draw in the US, Japan, and other countries friendly to the island.

- In recent months, Chinese-Philippine tensions have increased sharply, to the point where we have thought they were the greater near-term risk. This week’s tensions between China and Taiwan are a reminder that the Taiwan Strait remains a high source of risk for investors going forward.

India: Government officials and farmer groups in recent days have failed to reach an agreement on the farmers’ demands for fixed prices on dozens of crops and debt relief, keeping alive the farmers’ threats to stage mass protests in New Delhi. Even though the popular Prime Minister Modi remains in the driver’s seat ahead of this spring’s parliamentary elections, the impasse and the tough choice between a budget-busting subsidy deal and mass protests is a political risk. In turn, that risk could potentially be a headwind for Indian stocks in the coming weeks.

France: After the government cut its forecast of 2024 economic growth to just 1.0% from 1.4% previously, Finance Minister Le Maire said national budget spending will be reduced by a further 10 billion EUR on top of the earlier cut of 16 billion EUR to keep the deficit at the targeted 4.4% of gross domestic product. According to Le Maire, the new cuts will come from reduced hiring and other operational expenses at government ministries, less foreign aid, and reductions in various subsidies. The spending cuts will likely be a further headwind for French GDP growth this year.

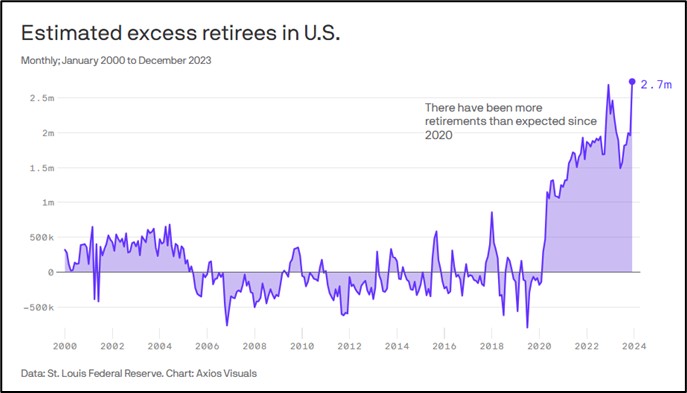

US Fiscal Policy: New analysis shows the US has about 2.7 million more retirees than predicted by a St. Louis FRB model, versus just 1.5 million excess retirees six months ago. There has also been a fiscal deficit frequently, beginning in 2008 until the onset of the COVID-19 pandemic in 2020. While the pandemic prompted millions of older workers to finally retire, this second wave of retirements was likely prompted by surging stock values. In any case, the sudden wave of new retirees is one reason why the US fiscal deficit has suddenly widened dramatically.

- The new wave of retirements has led to a sudden rise in Social Security retirement benefits and Medicare spending.

- Comparing the year ended in January 2024 to the previous year, the excess of Social Security and Medicare outlays over Social Security and Medicare gross tax receipts expanded by $672.6 billion, accounting for fully 70% of the expansion in the federal budget deficit in the period (after adjusting for the accruals related to the administration’s proposed student loan forgiveness program and its subsequent reversal).

- Although politicians often claim the expanding federal budget deficit stems from profligate spending by the government, the deficit expansion primarily stems from the aging US population and individual baby boomers finally deciding to retire and start drawing Social Security and Medicare benefits.

US Stock Market: S&P Dow Jones Indexes announced that on-line retailing giant Amazon.com will replace Walgreens Boots Alliance in the Dow Jones Industrial Average starting on Monday. While the reshuffling was prompted by Walmart’s upcoming three-for-one stock split, which will reduce its weighting in the index, the move will help make the index more reflective of the broader, technology-dominated US equity market.