Daily Comment (February 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a range of news items related to continued economic and security tensions between China and the West. We next review a range of other international and US developments with the potential to affect the financial markets today, including an important Russian military victory in Ukraine and an important new effort to regulate one aspect of artificial intelligence in the US.

United States-China: Senior US Treasury officials have told the Financial Times that they warned Chinese Vice Premier He Lifeng that Washington and its allies will retaliate if Beijing tries to deal with its excess industrial capacity and high debt load by dumping products on the global market. The US officials said they are most concerned about possible Chinese dumping of high-technology products such as electric vehicles, lithium-ion batteries, and semiconductors.

- Like many countries that sought to develop their economies via high investment and strong exports, China held on to the strategy too long, leaving it saddled with high debt and a production base that far exceeds domestic demand.

- For countries that find themselves in that predicament, many strategies are available to bring supply back into balance with demand. For example, the US allowed a sharp depression and a dramatic write-down in asset values during the 1930s. Japan opted for a long, slow correction marked by weak asset pricing and plodding economic growth from the 1990s until very recently.

- Other countries have turned to warfare or colonialism. What Western leaders fear is massive Chinese dumping as a kind of quasi-colonialism, which would further decimate Western industries and throw legions of workers into unemployment. Increasing hints of Chinese dumping are therefore likely to further exacerbate Chinese-Western geopolitical and economic tensions, keeping alive a range of risks for investors.

European Union-China: Following on the US warning to China, the EU has opened an anti-dumping probe into Chinese state-owned locomotive and railcar maker CRRC, in what Competition Commissioner Margrethe Vestager says is a signal to domestic and foreign firms that the EU won’t hesitate to use its legal tools to fight off unfair foreign competition.

- The investigation follows on a similar probe into Chinese electric vehicles launched in September.

- The new probe shows that the EU is slowly coming around to the tough US policies against Chinese subsidies and other unfair trade practices. The move raises the risk that China will retaliate against EU firms active in China or that try to export to China.

China: On Sunday, The People’s Bank of China left its benchmark interest rates unchanged for a sixth straight month, disappointing investors who have been hoping for stronger economic stimulus measures from the government. The rate on the key medium-term lending facility was left at 2.5%, apparently to support the sagging renminbi (CNY).

- Despite the freeze on official central bank rates, major banks today implemented a surprisingly aggressive cut in their five-year prime lending rate from 4.20% to 3.95%. That was the biggest cut in the prime rate since it was introduced five years ago.

- The five-year prime rate is China’s standard for residential mortgages, so it is likely that the government guided the banks to cut the rate as a way to provide some support for the beleaguered real estate developers.

- Since many investors had been looking for stronger measures to support the economy, Hong Kong stock prices fell to start the week, but mainland stocks gained as investors caught up from the week-long Lunar New Year holiday.

Australia: Responding to China’s aggressive military buildup, the Australian government today unveiled a plan to more than double the size of the country’s navy. The government now plans to spend an additional $7.2 billion on its navy, expanding the fleet to 26 warships, including 11 new frigates and six new large vessels with long-range missile capability. The Australian navy will then be at its largest size since World War II.

- The plan is consistent with our belief that rising geopolitical tensions will boost defense budgets around the world in the coming years.

- Since rising tensions will also keep fracturing the world into relatively separate geopolitical and economic blocs, we think the result will be increased investment opportunities in areas such as defense, broad industrials, basic materials, energy, and even technology firms with strong or potential defense business.

Singapore: In a potential sign that right-wing populist ideologies may be spreading to Asia, the Internal Security Department has recently detained two youths who espoused extremist views and were reportedly planning attacks on racial minorities, lesbian and gay activists, and “woke” progressives. One of the youths, an ethnic Chinese, bizarrely espoused white supremacy. If the ideology continues to spread in Asia, perhaps driven by social media, it could risk destabilizing countries throughout the region, just as it has in Europe.

Russia-Ukraine War: Kyiv’s forces on Saturday withdrew from the eastern Ukrainian city of Avdiivka, ceding it to the Russians after an intense, weeks-long siege. Reports indicate that the Ukrainians defending the city were not only overmatched by Russia’s vast firepower and available personnel, but were also increasingly hampered by their shortage of ammunition and other supplies. Separately, a Russian military pilot who defected to Ukraine last year has been found murdered in Spain, illustrating the brutal vengeance of the Russian intelligence services.

- Avdiivka is Ukraine’s most significant loss of territory since its unsuccessful counteroffensive last summer and the following loss of Western military aid.

- Now that the Kremlin has successfully shifted the Russian economy to a war footing, it is enjoying an increasing advantage in available equipment, ammunition, and personnel. The key question is to what extent the Russians can capitalize on their capture of Avdiivka to build momentum and start taking more Ukrainian territory.

- If the Russians successfully build on their momentum and begin to roll across Ukraine, Western politicians could potentially be galvanized to re-start their assistance to Kyiv. However, it could be too little, too late. If so, the incentive for peace talks would rise.

- In US political terms, the closer Russian forces end up from the North Atlantic Treaty Organization’s southern frontier, the more those politicians who opposed aid to Ukraine may be open to criticism for allowing an increased Russian threat to NATO. That could lead to foreign policy being a bigger part of the US electoral campaign, making it more volatile going into the autumn.

NATO-Sweden: Hungarian Prime Minister Viktor Orbán’s ruling Fidesz Party said it has scheduled a parliamentary vote next Monday on Sweden’s accession to NATO, and it plans to vote in favor. If so, Sweden will finally have the unanimous approval of all NATO members, allowing it to join the alliance. With the inclusion of Sweden and its capable military, NATO’s northern flank will be strengthened, and the Baltic Sea will become virtually a NATO lake, potentially helping to deter future Russian aggression in the north.

United Kingdom: Addressing a parliamentary committee today, Bank of England Governor Andrew Bailey said the central bank may begin to cut its benchmark interest rate even before consumer price inflation falls all the way to its target of 2%, citing encouraging signs that price pressures are falling rapidly. Despite the prospect for lower bond yields in the UK, investors appear to be encouraged by the prospect for reduced impediments on economic growth. The British pound has therefore risen 0.4% to a multi-week high of $1.2641 as of this writing.

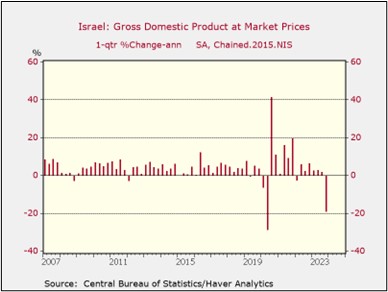

Israel-Hamas Conflict: The Israeli government yesterday said gross domestic product in the fourth quarter fell at an annualized rate of 19.4% from the same period one year earlier, far worse than expected and almost matching the rate of decline in the midst of the COVID-19 pandemic in 2020. Israel’s defense expenditure has surged since its war with the Hamas government in the Gaza Strip began on October 7, but that spending has been offset by a huge drop in personal consumption spending and private fixed investment.

US Artificial Intelligence Regulation: Late last week, the Federal Trade Commission proposed modifying a rule that already prevents the impersonation of government and business entities to also outlaw the impersonation of individuals. The proposal follows a move earlier this month by the Federal Communications Commission to ban the use of AI-generated voices in robocalls.

- These proposals show how government agencies are trying to address the risk of AI-driven scams and frauds via rulemaking, rather than waiting for a deeply polarized Congress to act.

- The rapid development of AI raises the risk that political operators or fraudsters could use deepfake video and voice for scams. For example, officials fear that people could be manipulated or defrauded using AI-generated deepfakes of their family members, friends, work colleagues, or celebrities.

US Semiconductor Industry: The Commerce Department said it will provide $1.5 billion in grants to contract semiconductor maker GlobalFoundries to expand the company’s production facilities in New York and Vermont. The award is the first under the CHIPS and Science Act of 2022, which set aside $52 billion in incentives for firms to expand their US chipmaking factories and shore up secure domestic supplies of semiconductors. The Commerce Department is expected to announce billions of dollars of additional awards in the coming weeks.

US Banking Industry: Based on recent regulatory filings, overdue commercial real estate loans at the six largest banks have now grown to 160% of the amounts the banks have set aside to cover losses on those loans, versus 90% one year earlier. As commercial property owners continue to struggle with high interest rates and increased vacancies, more loans are likely to go sour in the coming months. In turn, that will likely force banks to boost their loss reserves further, impinging on bank profits and weighing on bank stock prices.

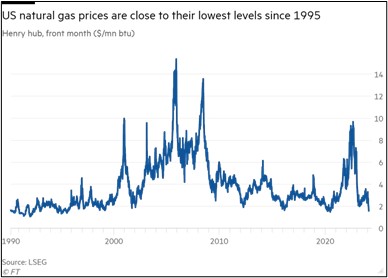

US Energy Market: US natural gas prices in recent days have fallen close to their lowest levels since 1995, reflecting weak heating demand amid the country’s warmest winter on record, surging US production, and possibly from the administration’s recent pause on liquified natural gas exports. Near futures prices for gas this morning are down 1.5% at approximately $1.59. The decline in gas prices will likely help reduce consumer price inflation in the near term, potentially helping to convince the Federal Reserve that it can start cutting interest rates.