Daily Comment (February 17, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Once again, we open the Comment with the latest developments in the Russia-Ukraine crisis. As we warned earlier in the week, it increasingly looks like Russia was lying when it said it was starting to pull back its troops. Just as important, there has been a spike in artillery fire from the Russia-backed separatists in eastern Ukraine, which has the potential to spark an invasion. Following that discussion, we examine the minutes of last month’s Federal Reserve meeting on monetary policy. We then review some other U.S. and international news that could potentially move the markets today. We end with the latest on the coronavirus pandemic.

Russia-Ukraine: Despite the Russian government’s statements this week that it has withdrawn some of its troops from their menacing positions near the Ukrainian border, U.S. and NATO officials say those assertions were false. In fact, they say the latest intelligence actually shows a continuing net buildup of forces. That assessment is also being echoed by private satellite imagery firms and experts. Meanwhile, the Ukrainian army this morning said Russian forces controlling the breakaway far eastern regions of Ukraine shelled a kindergarten in a Kyiv-controlled area, injuring two civilians. It later said the shelling was happening in more than 20 separate locations in what may be an effort to provoke a Ukrainian response that could justify a full-scale invasion. Finally, press reports say senior Chinese leaders, including President Xi, are struggling to decide how and how much to support Russia in the crisis without damaging their own interests.

- Even though President Xi has expressed support for President Putin’s demand that NATO pull back from Russian borders, deeper support or helping Russia evade any resulting sanctions would fly in the face of China’s traditional insistence that one country can’t invade or interfere with another country’s internal affairs.

- Chinese leaders also fear that closely aligning China with Russia on European security issues would risk alienating Europe more and pushing countries on the continent further into the orbit of the U.S.

- At the most basic level, the Chinese want to protect their own economic and security interests in regions that could be under threat from the Kremlin. Notably, Ukraine is a member of Xi’s signature Belt and Road Initiative, the vast infrastructure lending and construction program designed to put China at the heart of trade from Southeast Asia to Europe.

- Out of deference to Xi and the Chinese, Putin may now hold off on attacking Ukraine until the Beijing Winter Olympics conclude this weekend, which was the original assumption of many observers, including ourselves. In the meantime, the lack of evidence that Russia is de-escalating and incidents like the shelling in eastern Ukraine mean the financial markets are likely to get dicey again. We’re already seeing some evidence of that today, with equity futures pulling back modestly, safe-haven Treasury obligations and gold being bid up, and the Russian ruble trading down.

U.S. Monetary Policy: In the minutes from last month’s FOMC meeting, released yesterday, Fed officials gave no indication that they would hike their benchmark fed funds interest rate by 50 basis points next month, as some investors have started to fear and as St. Louis FRB President Bullard suggested on Monday. The omission helped salvage what had been a decidedly down day for the financial markets, allowing equities to close essentially flat. All the same, we caught numerous hawkish elements to the minutes that investors may start to focus on in the coming days.

- When it comes to the size of the Fed’s balance sheet, investors have focused much more on the pace at which the policymakers will slow and end their asset purchases. Less attention has been paid to the prospects that the Fed will actively sell off assets. The minutes indicate that at least some FOMC members felt that the Fed’s balance sheet has become so large that “a significant reduction in the size of the balance sheet would likely be appropriate.”

- Although the Fed’s main monetary policy tool is the fed funds rate, a rapid selloff of the Fed’s bond portfolio could be disruptive to the financial markets.

- Even if the Fed reduced its overall portfolio gradually, the minutes add to market speculation that it may run down or sell off its mortgage-backed securities more rapidly, potentially disrupting residential mortgage markets.

- When it comes to the FOMC members’ assessments of the economy and thoughts on the fed funds rate, the minutes provided an updated view of the current balance between hawks and doves. In general, the participants noted the strong momentum in U.S. economic growth and the recent surge in inflation, which “many” appeared to tag on the tightening labor market. In contrast, the minutes say only “a couple” of members still felt there was slack in the labor market. Similarly, only “a few” members thought longstanding structural factors like demographics and technological innovation would eventually bring inflation back down to the low levels seen before the pandemic.

- Overall, the minutes point to an FOMC that might have an itchy trigger finger. Although the minutes don’t specifically point to any discussion about a 50-basis point hike in the fed funds rate, it is probably on some members’ minds. The minutes certainly point to a period in which the policymakers hike interest rates at each and every meeting, essentially every six weeks. As that possibility hits home with investors, there will be a continuing risk of market volatility going forward, even if the Russia-Ukraine crisis is resolved peacefully.

U.S. Inflation and Growth: While it’s a bit technical, this Financial Times opinion piece argues that corporate capital investment in the U.S. has recently been much higher than official figures suggest. If true, the increased productive capacity would promise to help bring down inflation, boost economic growth, and increase corporate profits in the coming years.

U.S. Energy Industry: Amid weak deliveries of natural gas from Russia to Europe and a resulting spike in prices that drew in U.S. shipments, the U.S. has surpassed Qatar as the biggest LNG exporter in the world for the first time. In the following month, the U.S. supplied almost half of the record 11.7 million metric tons of LNG delivered into Europe. The data underline the current strong operating environment for many energy firms, despite dimmer future prospects as world energy policies discourage fossil fuels.

China: Dozens of bidding and procurement documents seen by the Financial Times indicate China has spent almost double its budget for the Beijing Winter Olympics. The Chinese government has been secretive about the true cost of the games, but the documents show it has already spent about $8.8 billion on them in an effort to project China’s power and success.

France-Mali: France and its European and West African allies have announced they will shift the focus of their anti-terrorism campaign in Africa eastward to Niger and south to the Gulf of Guinea after being pushed out of Mali by an uncooperative military junta. The move marks a setback in the effort to keep al-Qaeda and ISIS on the run. Over time, it means the terrorists may be able to regroup enough to launch socially and economically disruptive attacks on developed Western countries.

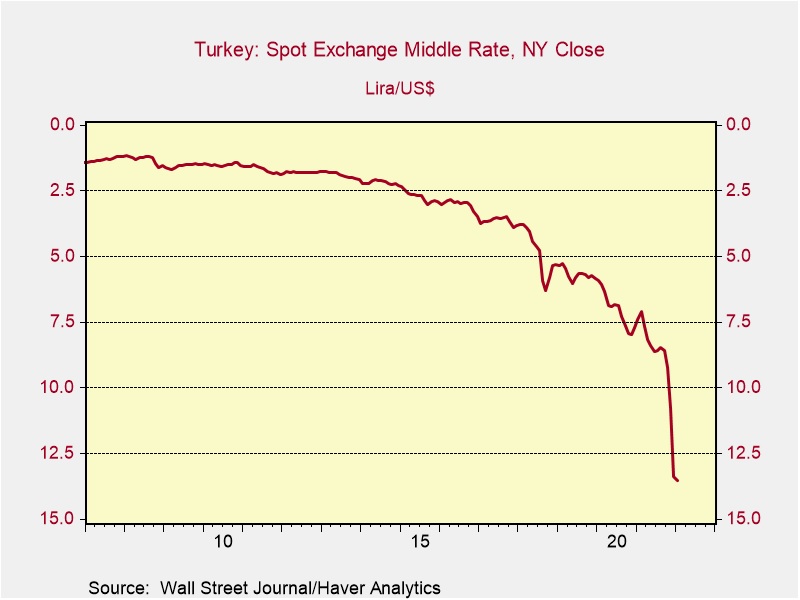

Turkey: As expected, the central bank held its benchmark short-term interest rate unchanged at 14.0% for a second consecutive month, citing increased geopolitical risks (likely a reference to the Russia-Ukraine crisis). The central bank’s unorthodox rate cutting in the face of high inflation triggered a chaotic slide in the lira’s value last year, but the recent stability in rates has helped slow the depreciation. So far today, the lira is trading only slightly lower.

COVID-19: Official data show confirmed cases have risen to 418,235,287 worldwide, with 5,853,246 deaths. In the U.S., confirmed cases rose to 78,173,320, with 928,519 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 214,218,580, equal to 64.5% of the total population.

Virology

- In the U.S., data continues to suggest the highly transmissible Omicron mutation is in retreat. The seven-day average of people hospitalized with a confirmed or suspected COVID-19 infection fell to 81,822 yesterday, down about 49% from an all-time high seven-day average above 159,000 reached on January 20. Importantly, new deaths related to the coronavirus have also started to drop.

- New Census Bureau data released yesterday show the number of people who were out of work because they were sick or caring for someone who was sick fell sharply to 7.8 million in late January and early February from almost 8.8 million in early January.

The figures contribute to the evidence that the Omicron wave of the mutation is now in full retreat.

- In Japan, the government today said it would reopen its border to a limited number of overseas students, workers, and business travelers after a three-month ban. The ban has been popular among voters and helped Prime Minister Kishida maintain healthy poll ratings during the Omicron infection wave, but it has been unpopular with foreigners and international businesses.

Economic and Financial Market Impacts

- Japan is also facing increased living costs, just like other countries facing higher inflation. But is that prompting Japanese firms to boost salaries? No. A recent poll shows over two-thirds of Japanese firms don’t plan to raise base salaries at this year’s labor talks. They do plan to boost pay in the form of one-time bonuses that may not kick-start household spending.