Daily Comment (February 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a mysterious warning from Congress about a new, destabilizing military capability in Russia. We next review a range of other international and US developments with the potential to affect the financial markets today, including multiple economic reports related to key economies in Asia and Europe and notes on US fiscal policy and the economic impact of immigration.

United States-Russia: Republican Representative Mike Turner, chair of the House Intelligence Committee, issued a cryptic call for all lawmakers to visit a secure facility in the Capitol so they could review new classified intelligence regarding what he called “a destabilizing foreign military capability.” Administration officials speaking on condition of anonymity said the intelligence relates to a new Russian nuclear capability that could be used against US satellites in space. The officials said the weapon is still in development and has not yet been deployed.

- Reports say Turner’s committee has had the referenced intelligence for about a week, and National Security Advisor Jake Sullivan was already scheduled to brief Congressional leaders on the intelligence on Thursday. It is therefore not clear why Turner issued his unusual call yesterday.

- It’s possible that Turner is simply trying to whip up anti-Russian sentiment as Congress battles over military aid to Ukraine to help it fight off Russia’s invasion.

- Nevertheless, Russia is far ahead of the US in modernizing its nuclear force, and it has made progress in developing exotic new technologies, such as hypersonic missiles. As we discussed in our recent Bi-Weekly Geopolitical Report, space has also become a high-priority warfighting domain for today’s top militaries. It would not be surprising if Russia really has leapfrogged the US in some new, destabilizing capability.

- In any case, such a development would be more evidence that the world is becoming more chaotic and risky, as we have long expected. However, while the evolving world will create headwinds for many investments, it will also likely create some investment opportunities. Here at Confluence, we continue to focus heavily on managing investments with a keen eye on both the risks and the opportunities.

Israel-Hamas Conflict: After Iran-backed Hezbollah militants apparently fired missiles from southern Lebanon into Israel yesterday, killing one Israeli soldier and wounding several others, Israel unleashed artillery and air strikes against southern Lebanon, killing and wounding both Hezbollah members and civilians. The attacks are a reminder that Israel’s retaliatory war against the Hamas government in Gaza could still spread into a regional conflict, which would threaten energy and commercial supply chains critical to the global economy.

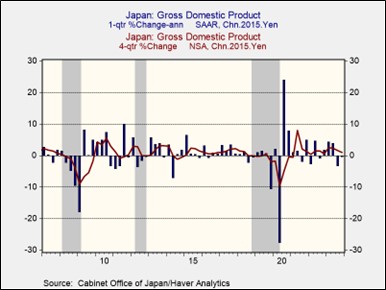

Japan: New data shows gross domestic product unexpectedly fell for a second straight quarter at the end of 2023, putting the Japanese economy in a technical recession. After stripping out price changes and seasonal effects, fourth-quarter GDP fell at an annualized rate of 0.4%, after dropping at a rate of 3.3% in the third quarter. Nevertheless, good growth earlier in 2023 meant that Japanese GDP in the full year was up 1.9%, accelerating from its growth of 1.0% in 2022 and helping confirm positive trends that have recently boosted Japan’s stock market.

South Korea: The Financial Services Commission has launched a public-private partnership to provide the equivalent of $57 billion in low-cost loans to boost investment in targeted sectors, such as advanced semiconductors, batteries, and smaller companies. Including two state-owned lenders and five major commercial banks, the program is part of a global trend in which governments are embracing subsidies, trade barriers, and other forms of industrial policy to promote favored sectors.

- These modern industrial policies largely aim to improve economic resilience, shield the country from external supply shocks, and promote better-paid jobs at home.

- The downside is that this could further fracture and balkanize global supply chains over time, making the global economy less efficient and leaving inflation and interest rates higher than they otherwise would be.

European Union: The European Commission today cut its economic growth forecasts for the overall EU and the eurozone. The Commission now expects gross domestic product in the EU to grow a modest 0.9% in 2024, while it expects eurozone growth to come in at just 0.8%. Previously, the Commission had forecast growth of 1.3% and 1.2%, respectively. Despite recent data suggesting Europe’s industrial recession could be bottoming out, the region continues to struggle with high energy prices, elevated interest rates, and weak domestic and foreign demand.

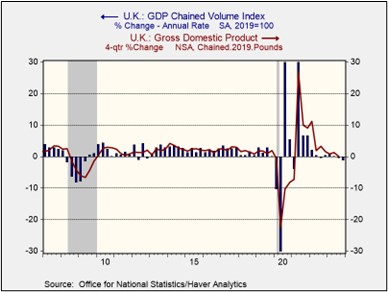

United Kingdom: Similar to the Japanese experience, British gross domestic product fell for a second straight quarter at the end of 2023, putting the country in a technical recession. After stripping out price changes and seasonal effects, fourth-quarter GDP fell at an annualized rate of 1.4%, worse than expected and far more than the 0.5% rate of decline in the third quarter. The British economy continues to struggle against a range of headwinds, including high prices, elevated interest rates, and weak demand.

United States-China: Volkswagen is reportedly holding thousands of imported Porsche, Bentley, and Audi autos on US docks after the company was informed by one of its downstream suppliers that the cars were equipped with a small electronic component from western China that might have been made with banned forced labor. Volkswagen is replacing the components at dockside, which is likely to delay US delivery of many of the autos for months.

US Fiscal Policy: In an interview yesterday, Lael Brainard, director of the White House National Economic Council, argued that the ability of the US economy to keep growing despite the Federal Reserve’s high interest rates and slowing inflation can be largely ascribed to the administration’s stimulative fiscal policies, including its big infrastructure rebuilding law and subsidies for investments in advanced technologies.

- Those programs probably have started to pump cash into the economy, but we don’t think that’s necessarily the main fiscal stimulus that’s boosting economic growth.

- Our recent work suggests much of the stimulus comes from expanding Social Security and Medicare outlays now that so many baby boomers retired during the COVID-19 pandemic, along with a drop in personal income tax revenues because of big, inflation-generated adjustments to tax brackets last year.

US Labor Market: Congressional researchers have estimated that the huge influx of migrants coming across the southern border in recent years will expand the labor force beyond what they previously predicted, thereby boosting future economic growth and government revenues. However, the researchers also believe the new immigrants are less educated than previous waves, meaning they could be less productive and therefore hold down wages for less-skilled job categories.