Daily Comment (February 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with several notes related to China, including changes to a key index of Chinese stocks. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a hotter-than-expected reading on British wage growth and a discussion of how artificial intelligence is affecting the US labor market.

China-Hong Kong: With the Hong Kong municipal government preparing a new national security law that would hew closer to mainland China’s tough rules, US law firm Latham & Watkins said its attorneys in the city will no longer have automatic access to the firm’s international databases. The lawyers will still be able to access mainland Chinese documents, but they will need special permission to see foreign information.

- The Latham & Watkins announcement helps confirm that cross-border information flows between China and the US geopolitical bloc will be a new arena of decoupling.

- The restrictions on Chinese-Western information flows follow years of increased barriers to trade, capital, technology, and even travel and tourism flows in each direction.

- As we have long argued, this fracturing of global markets is likely to reduce global economic efficiency and lead to higher costs, increased inflation, and elevated interest rates going forward, with particularly negative impacts on fixed-income assets.

Chinese Stock Market: Stock index compiler MSCI announced today that it will add five new names to its benchmark MSCI China Index, but it will delete 66 names that now fail to meet its standards because of China’s long stock slump. The 66 deletions, which stem from MSCI’s regular quarterly review, are more than in its last four quarterly adjustments combined. With the deletions, the index will now have slightly more than 700 names in total.

- Since many investors seeking to match the MSCI China Index will now have to sell out of the deleted names, those stocks are now likely to come under increased selling pressure. The deleted stocks include the likes of Weibo and China Southern Airlines.

- Currently, the MSCI China Index is down more than 7% for the year-to-date and about 27% over the last year.

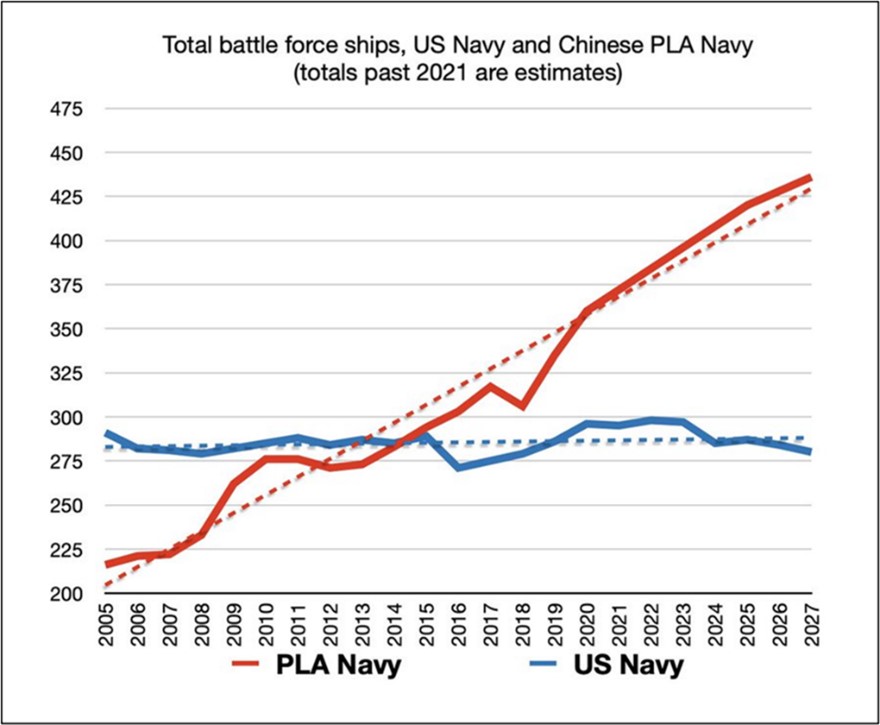

Chinese Shipbuilding Industry: Based on our expectation of ever more intense Great Power competition between China and the US, we pay a lot of attention to each side’s military power and defense industrial capacity. The Wall Street Journal today carries a good article showing how China’s shipbuilding industry has surged to become the world’s largest and richest, with many times more capacity to build commercial and naval ships than the US and the West.

- As we often note, China now has the world’s largest navy, with more than 350 combat ships. Moreover, the Chinese navy continues to grow rapidly, while the US is basically stagnant at about 295 combat ships.

- While we continue to believe that the US and the West will keep ramping up their defense budgets in the face of increased aggressiveness by the China/Russia geopolitical bloc, the lack of shipyard capacity (including a big shortage of workers) is holding back the US military’s rebuilding so far.

(Source: TheSoundingLine.com)

(Source: TheSoundingLine.com)

Russia-Estonia: The Russian government has put Estonian Prime Minister Kaja Kallas on its wanted list, along with dozens of other Baltic politicians critical of the Kremlin and its war against Ukraine. Although the move could be mere grandstanding by the Kremlin, it comes amid a surge of extraterritorial law enforcement and intelligence operations by authoritarian or authoritarian-leaning states ranging from China to India. The risks for Baltic politicians on Russia’s wanted list are therefore elevated.

- Separately, the Estonian foreign intelligence service has issued a warning that the Kremlin plans to double the number of troops it has along its border with Finland and the Baltic states in preparation for a possible war in the coming years. According to the report, Russian leaders are reluctant to attack any NATO territory right now, but they calculate that they could be in a position to do so within a decade.

- Despite Russia’s poor military performance early in its invasion of Ukraine, it has now ramped up its defense industrial capacity and improved its troop mobilization, leaving it in a stronger military position than many expected. With Russian President Putin intent on re-establishing the Soviet/Russian empire, further weakening of the US commitment to defending European territory would risk inviting a Russian invasion.

United Kingdom: Today, just as data indicated that US consumer price inflation slowed less than expected in January, a report showed UK wage growth slowed less than anticipated in October through December. The British data revealed that average weekly earnings in the period were up 5.8% from one year earlier, moderating from the annual increase of 8.5% during the summer, but the sticky wage growth will still likely discourage the Bank of England from aggressive rate cuts in the near future.

US Labor Market: New data suggests that generative artificial intelligence (AI) has already resulted in thousands of layoffs across the US economy, while more than half of all white collar “knowledge workers” report they are using the technology at least on a weekly basis. The report will likely boost concerns that generative AI will render the jobs of many affluent, college-educated knowledge workers obsolete, although we suspect it will also create many new jobs for those with skills in the technology.

US Weather: A strong nor’easter storm is lashing the Mid-Atlantic and Northeastern states today, leading to many cancelled airline flights in New York City and other major metropolitan areas. The storm won’t necessarily have a noticeable impact on national economic or financial market performance, but it could certainly be disruptive for travelers today.