Daily Comment (February 12, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our take on the latest jobs report, then turns to US trade policy and why we believe further tariff restrictions are unlikely. We next discuss the CBO’s updated fiscal deficit estimate, upcoming talks aimed at ending the conflict in Ukraine, and the first projects launched under the new Japan–US investment fund. We also include a summary of key economic data from the US and global markets.

Labor Market Story: US employment data is sending mixed signals on the labor market. The BLS reported 130,000 jobs were added in January, a sharp rebound from December’s revised 48,000 gain. However, benchmark revisions revealed a far weaker labor market in 2025 as total job growth was slashed by 69% to just 181,000, while 2024 was revised down by 24%. The disconnect between the strong monthly print and the dramatic downgrades shows that while the labor market may be stabilizing, it remains on shakier ground than previously thought.

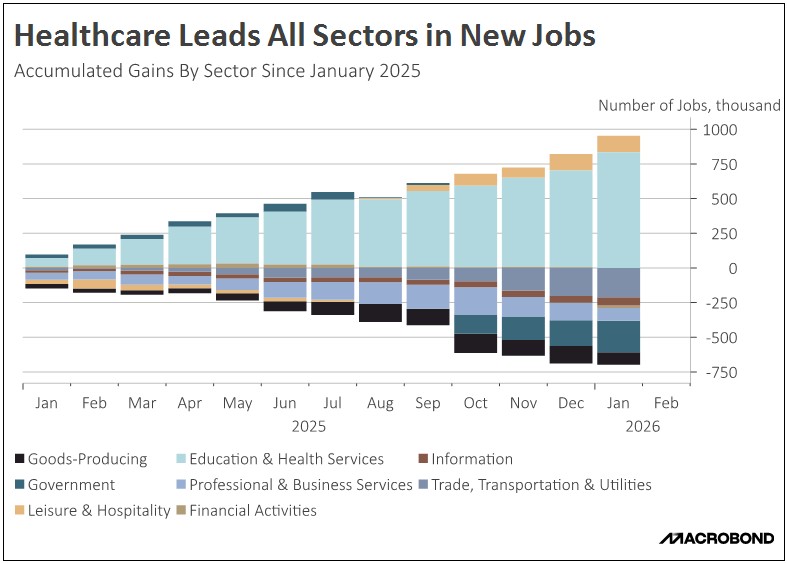

- The January report shows that job gains remain heavily concentrated in health‑related fields, with construction also beginning to rebound. Total private payrolls increased by 172,000, driven by a combined 124,000 new positions in health care and social assistance, while construction added 33,000 jobs, accounting for the bulk of new goods‑producing employment. By contrast, most other major sectors were little changed for the month, with notable job losses in the federal government and financial services.

- While most of the recent commentary has focused on the Tech sector’s role in the economy, far less attention has gone to the steady support coming from Health Care. In 2025, Health Care and social assistance accounted for the vast majority of net job gains. This reflects the sector’s relatively noncyclical demand profile, with resilient consumption and pockets of pricing power pointing to an industry that continues to expand even as more cyclical parts of the economy softened.

- A sharper pickup in construction hiring also points to firmer investment in the broader economy, supported by a mix of reshoring efforts and generous tax and industrial-policy incentives that are driving factory, infrastructure, and data center projects. These gains could signal the early stages of more broad‑based job growth in the months ahead, even if the evidence is still tentative.

- Looking ahead, we believe the sluggish job growth of last year is giving way to a more resilient 2026. Confidence is returning, and businesses are moving forward with investment plans that were previously on hold. We are also seeing the early stages of a major “sector rotation.” As the AI hype stabilizes, investors are seeking value in overlooked areas of the market. This shift suggests that 2026 will be the year the market rally finally broadens from the tech giants to the overall economy.

Trade Tensions: The White House is facing increasing pressure at home and abroad to soften its trade policy approach. In the US, lawmakers are pushing back against the president’s efforts to impose tariffs without congressional approval. At the same time, foreign leaders are expressing growing concern that a trade agreement is becoming politically risky in their own countries. Although these challenges have introduced some uncertainty, we remain confident that trade policy is unlikely to turn materially more restrictive in the coming months.

- The White House suffered two significant legislative setbacks this week regarding its trade strategy. On Wednesday, the House passed a bipartisan resolution to terminate the national emergency that was used to justify a 25% tariff on Canadian goods. This followed a Tuesday night defeat for GOP leadership, where three Republicans joined Democrats to block a procedural rule that would have prevented Congress from calling “snap votes” to repeal the president’s tariff powers until August.

- Additionally, questions are mounting over the implementation of recently announced trade deals. The White House has already eased its India fact sheet under pressure from New Delhi, shifting “commits” to “intends” on planned US purchases and removing references to agricultural pulses and digital tax changes. Meanwhile, the Indonesia framework appears to be back on track after coming under strain when Jakarta pushed for wording changes to make the deal more politically palatable.

- While these setbacks could still lead to marginal adjustments, we do not believe they signal a reversal of the broader shift toward a less restrictive trade stance. In our view, the White House appears to be moving away from escalating tariffs as its primary policy tool and is instead gravitating toward stabilizing rates at more moderate levels to ease pressure on consumers and businesses. As a result, although some countries may see their relative standing shift, we do not expect a return to the scale of disruption seen last year.

- As noted in our previous reports, an easing trade environment is likely to support a broader sector rotation. Last year, markets flocked to areas best positioned to navigate trade-related challenges; this year, we expect the focus to shift toward firms poised to benefit from the relaxation of those policies. Accordingly, we continue to see merit in adding exposure to non-AI-related sectors, which may finally receive a boost given their relatively attractive valuations.

Deficit Expectations: The Congressional Budget Office (CBO) has raised its fiscal deficit projections, underscoring the growing urgency for policymakers to address the long-term debt trajectory. The nonpartisan agency now expects cumulative deficits from 2026 to 2035 to be roughly $1.4 trillion higher than forecast in January 2025, a revision driven largely by last year’s One Big Beautiful Bill Act and tighter immigration policies. Over time, larger deficits could potentially put upward pressure on longer-dated US government bond yields.

Ukraine Update: Ukraine is preparing for another round of discussions on a possible settlement to its conflict with Russia. Ukrainian President Volodymyr Zelensky has indicated that negotiations have moved to the sensitive question of territory, including proposals related to a special economic zone in the eastern Donbas region, though both sides remain far apart and reluctant to make binding concessions. At this time, we continue to remain confident that the conflict between the sides appears to be coming to an end.

Japan and US Fund: Washington and Tokyo are working to operationalize a joint investment fund aimed at developing strategic sectors in the US. Current discussions reportedly include three flagship projects: large‑scale data center infrastructure, a deep‑sea energy terminal in the US Southwest, and synthetic diamond production for semiconductor applications. The initiative illustrates how tariff and industrial policies are being used to attract foreign direct investment into strategically important industries and could provide an additional tailwind for markets.