Daily Comment (February 7, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Today’s comment begins with an update on the Russia-Ukraine situation. We then cover a range of U.S. and international developments that have the potential to affect the financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: National Security Advisor Sullivan and other officials have revealed that the latest U.S. intelligence assessments show Russia has now boosted its forces on the Ukrainian border to the point where it could launch an attack at any moment. The assessments show Russia currently has 83 battalion tactical groups arrayed close to Ukraine’s borders, a substantial increase from the 53 groups it had in December and 60 last month. Separately, Russian media said some parliament members may try to bring up a bill recognizing the independence of Ukraine’s Donbas region, dominated by ethnic Russians, and has been waging a separatist war against Kyiv since 2014. U.S. officials worry such a move could offer the Kremlin political cover for an attack. All this comes as Ukraine faces a severe energy crunch that has forced it to operate all 15 of its nuclear electricity plants simultaneously for the first time since the end of the Soviet Union. Meanwhile, French President Macron today is visiting Russian President Putin in Moscow in an effort to de-escalate the situation, while President Biden is hosting German Chancellor Scholz at the White House to persuade him to take a tougher line against Russia.

- The intelligence assessments suggest that between 3,000 and 10,000 Russian troops and between 5,000 and 25,000 Ukrainian troops could be killed or wounded if Russia launches a full-scale invasion of the country. The assessments also warn that a full invasion could produce 25,000 to 50,000 civilian casualties, depending on the extent of fighting in urban areas.

- As we’ve seen before, the Ukrainian government tried to put on a brave face and played down the latest Russian maneuvering. Foreign Minister Kuleba issued a statement saying, “Don’t believe in apocalyptic scenarios… Ukraine possesses a powerful army, unprecedented international support, and the faith of Ukrainians in their state. The enemy is the one who has to fear us, not the other way around.”

- The latest intelligence assessments provide a hint at the potential humanitarian cost of a Russia-Ukraine conflict. With an attack likely leading to massive economic sanctions against Russia, a potential disruption to Russian energy exports, and the possibility of a wider conflict and more extensive economic damage, investors would also face falling values for risk assets. We would, however, expect a conflict to boost prices for U.S. Treasury obligations, gold, crude oil, and natural gas.

United States-China: The Biden administration is reportedly close to finalizing its strategy to boost trade in the Asia-Pacific region to counter China’s growing influence there. The new Indo-Pacific Economic Framework would focus on rebuilding ties with friendly nations in areas such as digital commerce, supply chain development, and green technology. It would not involve a full-fledged, tariff-cutting free-trade agreement like the Trans-Pacific Partnership, which the U.S. abandoned in 2017.

U.S. Healthcare Industry: At least a dozen states, led by both Republicans and Democrats, have recently enacted or are considering enacting laws aimed at reining in aggressive financial tactics by healthcare providers and collection agencies. For example, some of the laws include requirements for hospitals to provide financial assistance to people with low incomes or limit aggressive debt-collection practices.

- Medical bills are the biggest source of debt in collections, larger than all other types of debt combined, including credit cards and utilities, according to an analysis of a sampling of credit reports published in the Journal of the American Medical Association last July. Before the housing crisis in 2007-2008, medical bills were the most prevalent source of household financial stress and bankruptcy.

- If the clampdown on hospital billing and collections continues to grow, it could have ripple effects on pricing for a wide range of healthcare firms. Since healthcare is one of the largest sectors of the stock market, such price pressures could hurt returns for many investors.

United Kingdom: Prime Minister Johnson has revamped his staff after several top officials resigned late last week amid the scandal over his pandemic rule-breaking social gatherings.

- London’s police continue to investigate whether the parties broke any laws. Johnson’s grip on power remains tenuous, with an increasing chance he will be forced out of power.

- Political instability is rarely good for an economy or its stock market. If Johnson is forced out of office, British equities would likely face downward pressure.

France: New polling shows right-wing candidates are in an extremely close race for the run-off spot in the April presidential election. The latest surveys show President Macron still has the highest support, but upstart far-right firebrand Éric Zemmour has now almost pulled even with long-term right-wing leader Marine Le Pen, who is only about one percentage point behind traditional center-right conservative Valérie Pécresse. The election bears watching because the potential election of a far-right populist in a country as important as France would likely rattle financial markets in Europe.

Global Monetary Policy: In a Financial Times opinion piece yesterday, former PIMCO chief investment officer Mohamed El-Erian warned that even though the Fed and the ECB are now in a “hawkish pivot,” the switch to tighter policy is still partial at best, too slow, and likely to lead to an over-compensation later this year.

- If El-Erian is correct, it would imply a long series of benchmark rate hikes and a quicker reduction in Fed and ECB balance sheets, which would likely keep boosting bond yields and undermining equities throughout the year.

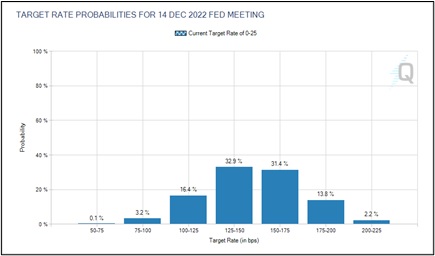

- We still think it’s more likely that tighter policy will quickly spark disruption in some corners of the financial market or start to slow the economy, forcing policymakers to end their tightening cycle earlier than many investors expect. As shown in the chart below, investors are still expecting about 1% of total tightening in the Fed’s benchmark fed funds interest rate by the end of the year, equivalent to about four 0.25% hikes.

Source: Cmegroup.com

Global Financial System: With the world awash in capital seeking higher returns, and with banks wanting to offload risk to reduce capital buffers, Credit Suisse (CS, $9.64) has securitized an $80 million portfolio of loans backed by its ultra-high net worth clients’ yachts, private jets, and other assets. And what is the interest rate on the portfolio? It is over 11%.

COVID-19: Official data show confirmed cases have risen to 395,540,912 worldwide, with 5,741,726 deaths. In the U.S., confirmed cases rose to 76,506,842, with 902,639 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 212,806,521, equal to 64.1% of the total population.

- Major companies in a wide range of industries have reported their operations and growth were held back in the latest quarter because of workers on sick leave with the Omicron mutation.

- In South Korea, the government is abandoning its vaunted test-and-trace system in the face of a surge of Omicron cases that threatens to overwhelm the country’s health system.