Daily Comment (December 7, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] Today is the 75th anniversary of the bombing of Pearl Harbor, a monumental event that led to U.S. involvement in WWII and eventually acceptance of the superpower role at Bretton Woods in 1945.

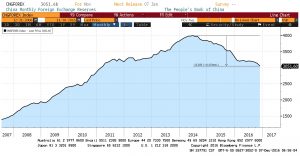

It was another quiet market overnight. Perhaps the most important overnight news came out of China, which continues to see a drain of foreign reserves.

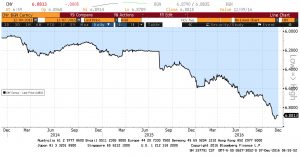

For the month of November, foreign reserves fell $69.1 bn, putting them at levels last seen in 2011. We believe much of the drain is due to capital flight. Reports of Chinese buyers of West Coast real estate have been increasing.[1] Today’s FT reports that European companies are facing restrictions on repatriating earnings from China. President-elect Trump has been pressing to declare China a currency manipulator, a status that would trigger an official investigation and consultations with the manipulating nation. If anything, China is trying to prop up the value of the CNY. If the currency were allowed to float, given the degree of capital flight, the CNY would likely plummet. So, there is no doubt that China manipulates its currency; it isn’t alone in this regard. But, the way China is manipulating the currency is by raising its value, which would discourage its exports. Trump isn’t incorrect that China has used its currency to increase exports in the past, but that isn’t the case now.

In fact, the CNY has lifted a bit recently, probably on fears that the likelihood of a reaction from Trump would increase if the CNY/USD level breaches 7.0. However, it appears the primary fear of Chinese officials is that the CNY will weaken further due to money desperately seeking a home outside of China.

As a side note, the primary reserve currency nation needs to have a deep, liquid and open financial system. China’s financial markets have none of these characteristics. For those worried about the CNY becoming a reserve currency and replacing the dollar, China’s recent behavior of manipulating its currency and trying to prevent money from leaving the country are simply inconsistent with being the primary reserve currency nation.

Tomorrow, Mario Draghi will hold his regularly scheduled ECB policy meeting along with his press conference. It is expected that the ECB will extend its QE program beyond March 2017, when it is scheduled to end, but there is the potential he will signal a reduction in the pace of buying during that extension period. We are seeing some short-covering in the EUR in front of the meeting.

Finally, we want to take note of a recent comment by Stephen Schwarzman at a Goldman Sachs (GS, 231.38) conference yesterday. Schwarzman, the head of Blackstone (BX, 26.55), says the Trump administration will usher in the most profound regulatory/tax changes he’s seen in his 45 years in finance.

“The changes as a result [of the election] are going to be very substantial in many areas, but particularly in the business community and the financial area. You’re going to have a very substantial reversal in regulations of all types…if you look at the architecture of the financial world, it’s going to change very substantially…this is as big a change happening all at once – I’ve been in finance for, I don’t know, 45 years? This will be the biggest…When you have changes like this that are so profound, it’s going to drive higher GDP. It’s going to make the U.S. a more friendly place for foreign capital. And it’s going to have significantly accelerated growth not just for financial institutions but for the country as a whole…So, this is, like, very important. It’s very important. And it’s not just about some stocks for financial companies, although that would be a nice thing. It’s much bigger and more impactful over a much longer period of time.”

Is Schwarzman right? We are not sure. There have been some pretty substantial changes over the past 45 years. These changes include the end of restrictions on interstate banking, the end of Glass-Steagall, massive industry concentration, Dodd-Frank and a series of massive tax reforms, two under Reagan, one each under Clinton and G.H.W. Bush, etc. So, Schwarzman is guilty of a bit of hyperbole here. We think he is saying that, under President Obama and in the wake of the Great Financial Crisis, the financial services industry has been facing a myriad of new regulations that have hurt the profitability of the industry. Is it reasonable to assume some degree of regulatory relief? Yes; the cabinet appointments alone would lead to that outcome. But, will President Trump deliver regulatory changes on the scale of interstate banking or the removal of Glass-Steagall? It seems hard to believe that anything of that magnitude is on the horizon.

And, it’s important to remember that bringing back Glass-Steagall was part of the GOP platform. One of the key unknowns for next year and thereafter is who will best represent Trump’s policies—Speaker Paul Ryan or Senior White House Counselor Steve Bannon? If it’s Ryan, and Trump turns out to be a typical GOP establishment supply-sider, then Schwarzman will be more correct than not (still guilty of hyperbole but not wrong about regulatory relief). This outcome probably also means that a left-wing populist will win the White House in 2020. If Trump is a Bannon-style populist, banks will face continued regulatory pressure. At this point, we don’t know who Trump will actually be; at present, both Ryan and Bannon supporters are projecting their hopes and dreams on the upcoming presidency. That’s why right-wing populists and supply siders are finding common cause.[2] However, their policy goals are not consistent. Bannon’s Trump punishes firms for offshoring and puts up trade barriers. He badgers firms into increasing employment and wages. Ryan’s Trump cuts taxes on the upper income brackets and embraces globalization and deregulation. The visions are not in unison. If Trump is successful, he will convince the two sides that he is their supporter and weave a policy mix that gives enough to each side to placate both. That will take a bit of political mastery.

What’s important here is that the financial market, especially the financial sector, is discounting lots of good news. It remains to be seen how much good news will actually be forthcoming. Schwarzman’s quote demonstrates that hopes are high.

_______________________________

[1] https://www.bloomberg.com/news/articles/2016-12-04/vancouver-housing-tax-pushes-chinese-to-1-million-seattle-homes;

[2] In the spirit of Advent, it’s a bit like Isaiah 65:25. The wolf and the lamb shall feed together, and the lion shall eat straw like the bullock: and dust shall be the serpent’s meat. They shall not hurt nor destroy in all my holy mountain, saith the LORD.