Daily Comment (December 5, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] Italians rejected former PM Renzi’s plans for government restructuring. This outcome was actually expected by pollsters, although the level of the rejection, at 60%, was at the highest end of expectations. As he promised, Renzi resigned. The president of Italy will now give time for the parties in parliament to form a government. If one cannot be formed, new elections will be held. The new elections are the wild card in this situation.

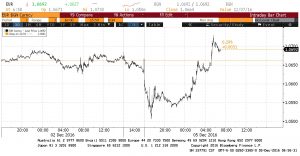

Market reaction was swift but short-lived. The EUR fell initially, but has since recovered.

This is a three day, three-minute chart of the EUR/USD exchange rate. The currency plunged when the results were announced, but has recovered all of its losses. The pattern that has been emerging is that markets react negatively to political news then recover. What has changed is that the recovery is occurring at a faster pace. Markets recovered fairly quickly to Brexit, with equities returning to previous values within a few weeks. With the Trump election, recovery came in about a day. With Renzi, it was a few hours. The underlying themes of equity bullishness and bond bearishness remain.

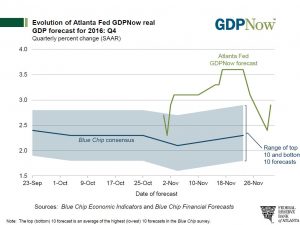

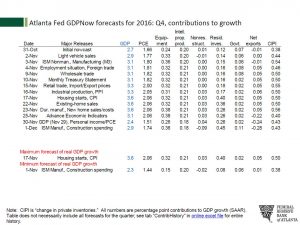

Economic growth is improving. Q3 GDP was strong; Q4 is running near 3%.

The Atlanta FRB’s GDPNow forecast has fallen a bit but is still running above consensus. In looking at the components, we are seeing some easing of consumption and a worsening trade situation bringing the forecast down from its recent peak of 3.6%. On the other hand, equipment investment and homebuilding are adding to growth. The bottom line is that the economy looks like it is putting in two solid quarters of growth. The FOMC will likely take a more hawkish view toward policy given the improving economic situation.

The other big weekend news was President-elect Trump’s call with the leader of Taiwan, Tsai Ing-wen. Trump tore up a delicate balance with this call. Here is a quick historical background. In the early 1970s, the U.S. was losing the war in Vietnam. The U.S.S.R. was threatening both Europe and China. American intelligence concluded that the Soviets could not fight a two-front war, one in Europe and another against China. If the U.S. wanted to cheaply keep the Soviets from acting in Europe, it needed to force the U.S.S.R. to keep defending the Sino-Russian border. To do this, Nixon went to China and “sold off” Taiwan. Up until that point, the official policy of the U.S. was that the Nationalist government on the island of Taiwan was the official government of China, including the mainland. This was obviously fiction. Nixon decided trading that fiction to keep the Soviets occupied was a good policy. In fact, it probably was.

Many policies and procedures can become hardened into practice even though the initial reason for the change wasn’t necessarily thought to be long-term in nature.[1] For China, getting recognition as the legitimate government of China in return for keeping up hostilities against the U.S.S.R. was a good deal. It meant a lot to China, which didn’t have the military power to take the island (it probably still doesn’t). Not only did Nixon end the threat to Europe, but the U.S. got listening posts in China to help spy on the Soviet Union.

However, the relationship between China and the U.S. has changed. China has been freeriding the U.S. hegemonic role for decades (China isn’t alone in this practice, either). Trump’s decision to take the call, which was apparently calculated,[2] is sending a signal to China that the outlines of the China/U.S. relationship are going to be renegotiated. China won’t be happy about that. That’s too bad. The point here is don’t focus on Taiwan; it’s not all that important. The key point is that the relationship between China and the U.S. is going to be reworked. We don’t know exactly how, but a nation dependent on foreign trade and facing a crisis of capital flight isn’t in a real strong bargaining position.[3]

That doesn’t mean we won’t have more volatility in our future. It’s important to remember that Trump ran on a campaign to change the way the economy and political and geopolitical systems work. The warning to China, along with the warning to U.S. firms on outsourcing, should be seen in the same framework. The most obvious outcome to all of this is probably higher inflation.

_________________________________

[1] The Guru and the Cat story is a famous allegorical example. See: https://seekingtheessence.wordpress.com/2006/09/09/the-guru-the-cat/.

[2] See: https://www.washingtonpost.com/politics/trumps-taiwan-phone-call-was-weeks-in-the-planning-say-people-who-were-involved/2016/12/04/f8be4b0c-ba4e-11e6-94ac-3d324840106c_story.html?hpid=hp_hp-top-table-main_trump-taiwan-835pm:homepage/story&utm_term=.a42045bde6cb.

[3] And, those Treasuries that China holds? Couldn’t it “dump” them? Yes, into a falling market and the Fed could simply return to QE temporarily to absorb the shock. Also, where does China put that $1.19 trillion of liquidity after it sells the Treasuries? There is no other market in the world that could absorb that cash. It’s important to remember that China bought those bonds as a form of vendor financing to maintain employment in China. Thus, dumping them isn’t really a threat. In fact, the rise of capital flight represents a much bigger risk to China.