Daily Comment (December 17, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning on a busy Thursday (and a snowy one for our friends in the Northeast). Equity futures are up this morning, while the dollar is down sharply and gold and bitcoin are higher. In fact, bitcoin broke $20k, supported by comments that it is deeply undervalued. Our coverage starts with the Fed, including an analysis of the interaction of the Fed, the Treasury, and the yield curve. Up next is the forex market and the Treasury announcement that Vietnam and Switzerland are currency manipulators. The EU passed its budget and is thinking about a “bad bank” to absorb nonperforming loans; Brexit appears close. China news is next, followed by pandemic coverage. We close with a roundup of policy and economic news. Being Thursday, our Weekly Energy Update is available. A note to readers—the Daily Comment will go on holiday hiatus starting Dec. 23 and return on Jan. 4. Here are the details:

The Fed: To some extent, the meeting was modestly hawkish. The dots plot suggested a greater openness to rate hikes in 2023.

The sole rate hike forecast for 2022 did come down 50 bps but we added another member to hikes in 2023. The majority are still holding to no rate hikes for 2021-23. The FOMC also increased its expectations of this year’s GDP growth, from -3.7% in September to -2.4% at this meeting, and there were modest upward revisions to future years. Unemployment is expected to decline more quickly as well. But inflation won’t hit its 2% target over the forecast period. There was no change to the allocation of purchases but the Fed did suggest it would continue QE for a long time. Financial markets seemed to express some disappointment. The dollar rallied a bit and equities were mixed, with non-cyclicals doing better than cyclical sectors. Although the Fed dashed hopes of additional support (there was speculation the Fed would boost purchases at the long end), overall, this was mostly a steady policy outcome. We expect Governor-appointee Waller to be sworn in for the next meeting, meaning we will have another dot on the plot.

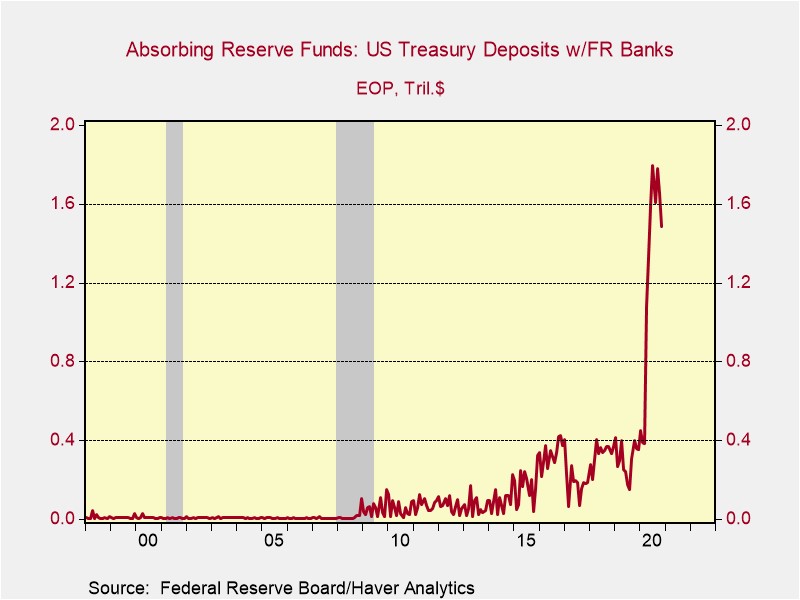

A bit of “inside baseball”—the yield curve has steepened lately, leading to comments that the market is expecting a stronger economy going forward. Although that may be the case, the steepening may have more mundane origins. It starts with the Treasury. It has been building its account at the Fed by issuing lots of T-bills. Most likely, Mnuchin was worried about a government shutdown and was prefunding stimulus. In any case, we have seen a sharp rise in the Treasury’s account at the Fed.

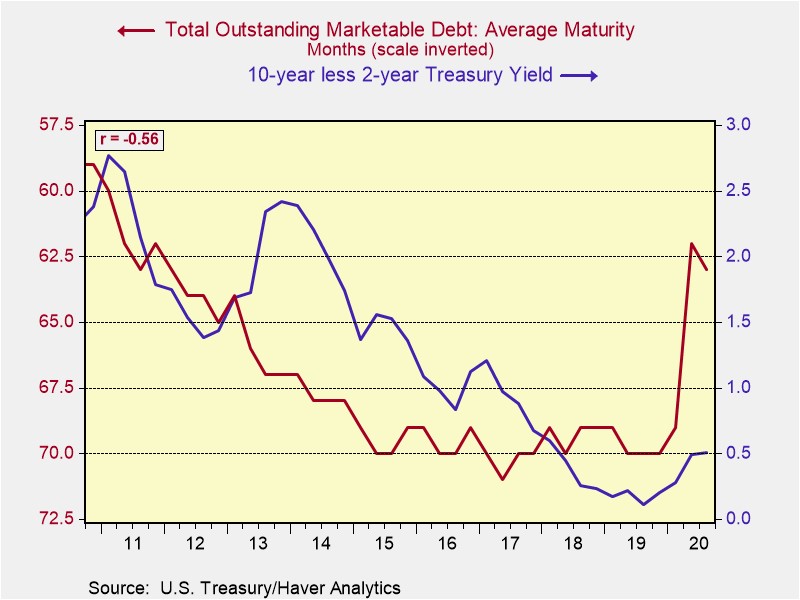

As the Treasury issued T-bills to fund this hoard, it has led to a drop in the average maturity of Fed holdings; last year, it was 70 months. It has fallen to 62.5 months. And, over the past decade, rising maturity coincided with the two-year/10-year yield curve.

As the Treasury draws down this account to fund stimulus (and assuming a funding bill passes this week), there will be pressure for the yield curve to flatten. Stay tuned.

Forex: The Treasury has a formal process to establish if a country is manipulating its currency. The process seeks to determine if a country is preventing the appreciation of its currency to run a larger trade surplus with the U.S. than it would otherwise. The U.S. announced yesterday that Vietnam and Switzerland are being named “manipulators.” The designation will trigger a process where the U.S. engages with the countries in question to address America’s concerns. If the negotiations don’t yield a satisfactory outcome, the U.S. can apply trade restrictions. The case for Switzerland is straightforward—it intervenes regularly to prevent the appreciation of the CHF, but it has nothing to do with the U.S. Without intervention, the CHF would appreciate against the EUR, making Switzerland less competitive within Europe. So, there is no doubt Switzerland intervenes, but it isn’t to improve its position with the U.S.

The case of Vietnam is more complicated. It has become a destination for productive capacity that is leaving China to land. And so, almost by design, it has seen its current account expand. We would expect some appreciation of the Vietnamese dong, but most likely it will be modest. The action by the Treasury, though, may be signaling a greater openness to a weaker dollar, which is the goal of this policy.

The EU: The EU budget has passed the European Parliament, meaning the Eurobond will be issued in the coming months. This is a remarkable achievement and will support further integration of Europe. We never thought Germany would accept this idea; a Eurobond will allow Italy to borrow in EU credit, something that has always terrified Berlin. But, here we are!

- The EU is going to have a nonperforming debt problem. It’s a fact of life that some loans will go bad. How to deal with bad loans is always a challenge. If the creditor insists on full repayment, it can lead to bankruptcy which might have been unnecessary. If the debtor is favored, moral hazard creeps in. Consequently, societies try to balance off the interests of both parties. In the meantime, banks holding nonperforming loans lose the capacity to make new loans, which can restrict future growth. One tactic to address this problem is the bad bank. A bank is created to buy the nonperforming loans to get those loans off the bank balance sheets, freeing up capacity for new lending. The bad bank buys these loans at a discount and then works out arrangements with borrowers in default. The trick is setting the value of the bad debt—make it too generous and it becomes a subsidy for the banks that made the bad loans in the first place. Make it too low and banks can suffer unnecessary losses. The EU is planning to set up a series of bad banks in member states to deal with loans gone sour due to the pandemic.

Brexit: According to reports, we are getting close to a Brexit deal. In fact, the last sticking point may be fish, which should be manageable. Both sides are still taking steps just in case talks fail. One sign that we are close is that Parliament may reconvene from their Christmas break to vote on the treaty. Another sign? The GBP has been on a tear based on Brexit optimism.

China: A new look at rebalancing and tensions with Australia rise further.

- Recently, General Secretary Xi held a talk about the need to bring about demand reform. If this speech is an outline of policy, it could be significant. One of heterodox economics’ criticisms of capitalism is the tendency toward underconsumption. Post-Marx analysis argued that colonialism was a response to this problem. Essentially, capital ends up taking too much income from labor, leading to persistent underconsumption and income inequality. One way to address the problem of underconsumption is to export the excess production. China has been doing that for a while. However, it appears that Xi may have concluded this path isn’t likely to be open in the future and the Belt and Road Project may not offer relief either. Thus, actually changing income distribution to put more money into households and absorb the excess production through domestic consumption would be an epic change because it would also adversely impact the wealthy in China.

- China is apparently blocking imports of Australian coal, a notable escalation of the trade fight between the two countries. Canberra is threatening to take the issue to the WTO. One reason China is picking on Australia is because it views it as the weakest link in the U.S. alliances against Beijing, e.g., the Quad, the “Five Eyes.” There may be something to this; the political opposition is harshly criticizing the Morrison government for its handling of China.

- As winter sets in, there has been a spike in coal prices and domestic mines are ramping up production.

- The BBC has a special report on forced labor and Chinese cotton.

- MSCI has dropped Chinese stocks cited by the U.S. for their ties to the People’s Liberation Army (PLA). The stocks will be officially removed on January 5.

- China has been pushing digital currencies and is one of the central banks in the forefront of developing official digital currencies. The PBOC warned merchants that they must accept cash for payment.

- The EU is in negotiations with China over investment. We note that Beijing is making it easier to invest in China, and Germany is giving some leeway on Chinese communications equipment.

- For the first time ever, Chinese military officials have decided not to participate in a semiannual military safety meeting.

COVID-19: The number of reported cases is 74,372,756 with 1,652,117 fatalities. In the U.S., there are 16,984,580 confirmed cases with 307,543 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The Axios map is showing improvement in cases.

Virology

- Perhaps the most important “known unknown” is the type of immunity that the current COVID-19 vaccines will provide. In general, we don’t know whether or not these vaccines will provide “sterilizing immunity.” Sterilizing immunity means that a person can’t be infected by the virus if exposed to it. The lack of sterilizing immunity means that a vaccinated person can be infected by exposure to the virus but doesn’t get sick or exhibit symptoms. The whooping cough vaccine, for example, does not give sterilizing immunity. Thus, a vaccinated person could become an asymptomatic spreader of the virus. If sterilizing immunity can be achieved, the world will get back to normal much quicker. If the current vaccines do not bring sterilizing immunity, then societal protection will require widespread adoption of the vaccine to be effective and will require mask-wearing and social distancing to continue even for those who have been vaccinated. In other words, if sterilizing immunity isn’t possible but a large number of people are vaccinated, then any spread would not be a major problem. Although there have been polls suggesting reluctance to accept the vaccine, recent studies suggest a growing level of acceptance, which is good news.

- The Moderna (MRNA, USD, 137.03) vaccine is expected to get approval from the FDA. Its refrigeration requirements are less stringent than the current vaccine.

- The U.S. and Pfizer (PFE, USD, 37.84) are negotiating a new supply arrangement.

- The FDA has approved the first OTC test for COVID-19.

- Although adverse reactions to the Pfizer vaccine seem to be rare, they are not unprecedented. Health care workers in the U.K. and Alaska have reported reactions to the vaccine that have required hospitalization.

- French President Macron has tested positive for COVID-19.

- Germany will begin vaccine distribution on December 27.

- Airlines are proving to be a critical part of the logistical chain for vaccine distribution.

- Sweden’s light response to COVID-19 is getting increased scrutiny as the health care system is overwhelmed.

- Firms are lobbying for their workers to be considered “essential.”

- The WHO is sending a team to Wuhan to investigate the origins of COVID-19.

Policy and economic news: A fiscal deal appears close and tech comes under further pressure.

- Although a stimulus agreement is said to be close, we have not crossed the finish line quite yet. It does appear stimulus checks will be part of the bill, while state aid and liability protections were too difficult to pass. The lack of state aid may prove to be an “own goal” in terms of boosting economic growth, a mistake that was made in the last business cycle. States are critical to supporting the economy, but many are now being forced to cut spending in order to balance budgets. For example, it will be the states that mostly manage the eviction situation.

- Although the Senate remains undecided, it should be noted that if the Democrats manage to win the two Georgia seats, the most important senator may be Joe Manchin (D-WV), who will likely become the pivot vote. A centrist, he will act as a brake on items like tax hikes and ending the filibuster. This development has started to alarm the LWP.

- There is no doubt the pandemic has had a terrible impact on much of the economy. At the same time, we should not underestimate the flexibility of the economy in recovery. In economics, one of the factors that affects industrial organization is the ease of entry and exit. Perhaps one of the easiest industries to close and open is restaurants. So, yes, a myriad of restaurants will and have closed, but don’t be surprised to see a surge of new entrants once vaccine distribution expands.

- Ten states have joined a suit against Google (GOOGL, USD, 1757.19), accusing the firm of collusion.

- Massachusetts has implemented legal action against Robinhood. The firm has also agreed to pay the SEC $65 million to settle a “pay for flow” arrangement.