Daily Comment (December 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with changes to Washington’s policy limiting Chinese access to advanced US computer chips and what the changes say about power dynamics in the US and between the US and China. We next review several other international and US developments that could affect the financial markets today, including a shift in investor expectations regarding foreign interest rates and an update in US artificial intelligence policy.

United States-China: President Trump yesterday said his administration will lift its ban on Nvidia selling its nearly cutting-edge H200 artificial-intelligence computer chips to China. In return, the US will get a 25% cut on all Chinese revenue from the H200s. The deal marks the federal government’s latest extraordinary intervention into private markets and suggests the administration is continuing to favor the “tech bros” element of its political coalition over its “China hawks” element.

- Nevertheless, reports this morning say Beijing plans to limit access to the H200 chips as it focuses on achieving self-sufficiency in semiconductor production. Sources say Chinese firms will likely have to apply to the government to buy the chips and show why they can’t rely on domestic semiconductors.

- Taken together, these developments illustrate a changing, complex balance of power within and between the US and China. Domestically, the US government is sharply expanding its power over the private sector and has become much more willing to flex its muscles. Internationally, however, the US this year has often discovered that it has less leverage against China than it thought, and that China is less dependent on US goods and technology than previously expected.

European Union Immigration Policy: The EU’s national internal affairs ministers yesterday signed off on a dramatic tightening of the bloc’s immigration policy, making it easier to deny asylum claims and allowing failed asylum seekers to be detained and deported to “return hubs” outside the EU. The modifications still must be negotiated with, and approved by, the European Parliament. However, whatever their final form, they are likely to herald much tighter immigration into the EU, despite the region’s low birth rates and weak population growth.

European Union Environmental Policy: EU officials early today agreed to sharply curtail the bloc’s controversial supply-chain regulations, which aimed to address environmental and social concerns throughout supply chains touching the EU. The changes will sharply limit the rules to a relatively small number of huge enterprises that will be more able to absorb their costs. As we note in our upcoming Geopolitical Outlook for 2026, the shift reflects a nascent, politically driven trend toward deregulation in the EU that could help boost the region’s economic growth.

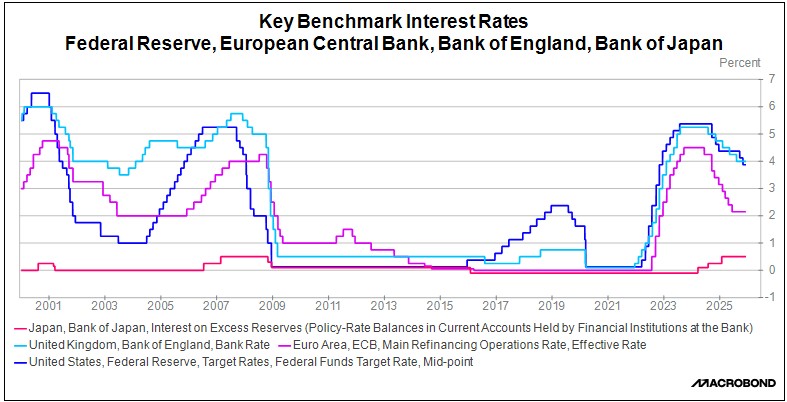

Eurozone Monetary Policy: For the first time, swap market trading suggests investors now think the European Central Bank is more likely to hike its benchmark interest rate in 2026 than to cut it. Investors also expect the Canadian and Australian central banks to start hiking their rates next year, while the Bank of England is expected to stop cutting its rate by mid-2026. The change in sentiment reflects less pessimism about economic growth and more concern about price inflation and debt. The Bank of Japan began slowly hiking its interest rates in early 2024.

- Even if the key foreign central banks do start hiking their interest rates, we continue to believe the Fed will cut its benchmark fed funds rate more aggressively in 2026 than in 2025 as it faces a softening US labor market and outside political pressure.

- Any rise in foreign interest rates while US rates are falling would likely put additional downward pressure on the dollar. As we have noted many times in the past, periods when the greenback is depreciating have typically led to better returns for foreign stocks than for US stocks.

US Monetary Policy: The Fed today begins its latest policy meeting, with its decision due tomorrow at 2:00 PM ET. This meeting will also include the policy committee’s updated economic and financial projects (the “dot plots”). Based on futures prices, investors are virtually unanimous in expecting the policymakers to cut their benchmark fed funds short-term interest rate by 25 basis points to a range of 3.50% to 3.75%.

US Artificial Intelligence Policy: President Trump yesterday said he will sign an executive order this week to prevent US states from imposing their own regulations on the AI industry. Instead, the order will give the federal government the sole right to impose a uniform set of regulations, with the goal of fostering a rapid build-out of the industry.

- The order will be further evidence that the administration is favoring the tech industry over other interests, including states’ rights.

- The administration’s preference for the tech industry is probably one reason why tech stocks have performed so well this year.

US Energy Policy: A district court judge in Massachusetts yesterday nixed President Trump’s January order freezing federal approvals of new wind energy projects, arguing that the order was “arbitrary and capricious.” Despite the setback, however, the order is likely to be appealed, and the ban could well be reinstated. In other words, the court decision doesn’t definitively clear the road for further green energy projects in the US.

US Agriculture Industry: President Trump yesterday announced a $12-billion federal bailout of US farmers, who have been struggling with low prices due to record production and weaker purchases by China. According to the American Farm Bureau Federation, more than half of US farmers are currently losing money. The new aid will likely help buoy demand for a range of agricultural inputs and help support the stock prices of firms ranging from agricultural equipment manufacturers to seed and fertilizer producers.

US Stock Market Strategy: According to the Wall Street Journal yesterday, banking giant JPMorgan Chase has not only launched its $1.5-trillion fund to invest in US defense firms and other enterprises building US innovation and resiliency, but it has also formed a panel of outside advisors for the fund ranging from Amazon CEO Jeff Bezos to former US Secretary of State Condoleezza Rice.

- We at Confluence have long argued that the growing US-China rivalry and global fracturing will create investment opportunities in defense firms and companies related to economic resiliency.

- JPMorgan’s establishment of a large fund dedicated to the theme, along with an advisory board stocked with high-level executives and national security experts, is evidence that the opportunities are finally being recognized even by big, traditional financial firms.

Global Energy Market: According to the chief economist at commodities trading giant Trafigura, the global oil market could face a “super glut” in 2026 as huge new supplies arrive and global demand weakens. For example, the economist cited the completion of big, new production projects in Brazil and Guyana but slowing demand growth in China as it relies more heavily on electric vehicles.

- The top oil trader at Trafigura recently said that he expects Brent crude prices to fall below $60 per barrel in the near term, versus about $62.50 today and more than $80 in early 2025.

- If the current oil glut does worsen as Trafigura expects, it would naturally help hold down consumer price inflation, but it would also weigh on global energy equities.