Daily Comment (December 7, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Risk assets are enjoying a lift as investors eagerly await tomorrow’s crucial jobs data. Meanwhile, former Padres’ outfielder Juan Soto is making his way to the Big Apple for his next adventure. Today’s Comment kicks off with our insights on the anticipated rate cuts for next year, then explores why banks are wary of the new Basel regulations, and finally delves into how China’s economic struggles might ultimately benefit the rest of the world. As always, our comprehensive report encompasses the latest domestic and international data releases.

Are Rate Cut Bets Overdone? Investors are having second thoughts on how aggressive the Fed will be when cutting rates next year.

- Despite rallying nearly 9% in November, the S&P 500 has been relatively sluggish in the first week of December. This lackluster performance can partially be attributed to market participants rethinking their expectations of a Federal Reserve policy shift. Projections based on fed funds contracts show that investors are predicting a 125 basis point cut in key interest rates, while economists have offered a more pessimistic view, predicting at most a 50 basis point cut in 2024. This divergence in views has led investors to seek protection against market volatility in the form of options.

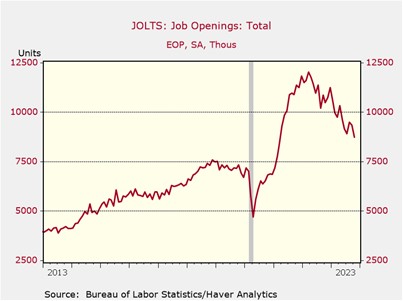

- While concerns remain, expectations for a moderating interest rate environment are not entirely unfounded. Federal Reserve Board Governor Christopher Waller, a traditionally hawkish member, recently suggested that the central bank could cut rates as early as April if inflation continues to make significant progress towards the 2% target. Additionally, signs of a cooling labor market may further incentivize action from Fed officials. Last week, data from the Bureau of Labor Statistics revealed a two-year low in job postings for October, while the latest private payroll data from ADP indicated a reduction in new hires by firms. These developments suggest a potentially more dovish stance from the Fed in the near future.

- Although inflation remains significantly above the Federal Reserve’s 2% target, it is still too early to predict with certainty whether the Fed will cut rates or stand pat next year. Furthermore, aggressive cuts, as anticipated by the market, are highly unlikely without a major economic crisis. The Atlanta Fed’s latest forecast projects a modest 1.3% annualized growth for the final quarter of 2023. Therefore, if we assume there will be no recession or perhaps a mild one, then any potential rate cuts in the coming year will likely be moderate.

Wall Street Woes: CEOs from major banks gathered on Capitol Hill to express their concerns about new financial regulations.

- Implementation of new banking standards dubbed the “Basel III Endgame,” which are due to take effect in 2028, was the central topic of discussion. The chief executives argued that the proposed changes, which have not been finalized, are likely more burdensome than regulators realize. For example, the new capital requirements could make it harder for financial institutions to lend to households and small businesses, particularly those who already struggle to access credit. Additionally, the executives argued that the changes could push lending into less regulated sectors of the financial system. The banks’ concerns about the impact of the new regulations on lending come amid a significant rise in private credit lending, which has seen a dramatic increase in recent months.

- The new rules were announced in July in response to growing concerns about the weakness within the financial system. These rules will apply to banks with holding over $100 billion in assets, exempting smaller institutions. The aim is to compel banks to adopt a more conservative and standardized approach to risk measurement, effectively requiring them to hold more capital as a buffer against losses. Regulators estimate a 19% average capital increase for globally systemically important banks (G-Sibs), although industry groups believe the actual increase could be significantly higher. Nevertheless, the stricter rules should help bring U.S. banks into compliance with international standards.

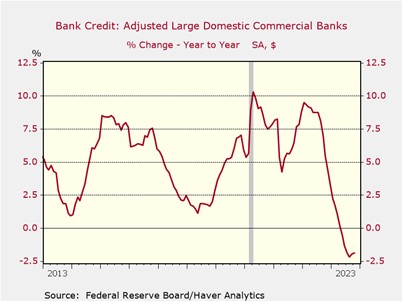

- New rules often have a good purpose, but they typically come at a cost to the overall economy. The combination of higher interest rates and regulatory scrutiny has already weighed on lending. As the chart above shows, large banks have reduced the amount of credit issued compared to the year prior. However, the new Basel rules’ ability to prevent another crisis may not be as clear-cut as regulators may think, as it could lead to unforeseen consequences. For example, the rise of collateralized debt obligations (CDOs) was spawned by the first Basel Framework, highlighting the possibility of unintended side effects. That said, the proposed rules are still under development and open for public comment until January 16, 2024.

China Needs a Break: The country faces a growing number of obstacles as it seeks to expand its global reach and revitalize its struggling economy.

- China’s Belt and Road Initiative has suffered a significant setback with Italy’s formal withdrawal from the program. Though Italian Prime Minister Giorgia Meloni’s earlier criticism of the initiative foreshadowed the decision several months ago, it will likely strain relations with China. Italy’s 2019 participation in the BRI marked a historical first — the only G-7 member to join the program. However, this decision drew criticism from other EU countries and the United States, highlighting divisions within the Western alliance. Italy’s withdrawal may lead to some retaliation from Chinese consumers, but the decision to leave is a further indication of Beijing’s waning influence in Europe.

- U.S. ratings agency Moody’s ( MCO, $374.43) downgraded the outlook for eight Chinese banks, including the “Big Four” state-owned commercial banks (Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, and China Construction Bank Corporation), from stable to negative. The negative outlook reflects Moody’s earlier downgrade of China’s sovereign debt rating, as the agency believes the government has less fiscal capacity to support struggling banks. Additionally, they signaled the potential downgrade of several government-backed entities supporting infrastructure. Fearing potential retaliation from the Chinese government, similar to surprise audits faced by Mintz Group, Bain & Co., and Capvision Partners earlier this year, Moody’s advised its staff to work from home following the downgrade.

- The country’s escalating economic problems will likely discourage Beijing from seeking major disruptions in its international relations in the near term. This is evidenced by Xi Jinping’s recent efforts to foster warmer ties with the United States, despite President Biden’s earlier remarks referring to him as a dictator. As the government seeks to manage its debt burden, promoting exports becomes an increasingly important strategy for generating growth and maintaining industrial production levels. This explains Xi Jinping’s recent trip to the EU, where he aimed to convince lawmakers not to place barriers on trade. In all, China’s shortcomings may lead to more stability as it may be too distracted to start a fight with the West.

Other News: Venezuelan President Nicolás Maduro recently unveiled a controversial map claiming Guyana’s Essequibo region as part of Venezuela. This action marks a significant escalation in Maduro’s ongoing efforts to assert control over the eastern region. President Biden suggested that there are Democrats who could possibly defeat Trump in an election, a possible sign that he may be weighing his options. Meanwhile, the Senate’s failure to pass legislation funding Ukraine due to demands for increased aid for U.S. border security highlights a growing trend of inward-focused politics as the nation grapples with its changing role in the global landscape.