Daily Comment (December 6, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the latest on the potential for a Venezuela-Guyana crisis. We next review a wide range of other international and U.S. developments that could affect the financial markets today, including Italy’s widely expected decision to pull out of China’s controversial Belt and Road Initiative and several items related to U.S. monetary policy going into 2024.

Venezuela-Guyana: It still appears that domestic electoral politics were the main reason President Maduro held last weekend’s referendum on taking control of the Essequibo territory of Guyana. However, new steps that he called for yesterday appear much more concrete and menacing than mere political posturing. If implemented, the steps requested by Maduro would likely lead to a serious case of territorial aggression in South America.

- The new steps called for by Maduro include the following:

- Immediate legislative debate and approval of a bill creating a new Venezuelan state of “Guayana Esequiba” (Venezuela’s term for the Guyana territory).

- Creation of a new High Commission for the Defense of Guayana Esequiba.

- Creation of a Guayana Esequiba Comprehensive Defense Zone, with administrative and military headquarters in Tumeremo, a town in eastern Venezuela close to the border with Guyana.

- Designation of Maj. Gen. Alexis Rodríguez Cabello as the Sole Authority of Guayana Esequiba, with administrative and military headquarters in Tumeremo.

- Creation of a new Essequibo Division within state-owned oil company PDVSA and state-owned mining company CVG, with exclusive administrative and operational powers for the exploitation of natural resources in Guayana Esequiba.

- Publication of a new official map of Venezuela, including Guayana Esequiba, and ensuring it is sent to all schools, high schools, and universities in the country.

- Development of a comprehensive social plan for the inhabitants of Guayana Esequiba, including the provision of official Venezuelan identification cards.

- Establishment of a three-month period for the withdrawal of foreign companies/unilateral concessions in Guayana Esequiba.

- Creation of a Special Law for the protection of Guayana Esequiba.

- Besides seeking to boost his prospects in Venezuela’s planned 2024 elections, Maduro is likely hoping to wring more sanctions relief from the U.S. The Biden administration may indeed be tempted to further ease restrictions on U.S.-Venezuelan energy trade to avoid an invasion that would likely boost global energy prices ahead of the U.S. elections.

- On the other hand, if Maduro miscalculates and actually follows through on an attempt to seize Essequibo, we suspect the U.S., Brazil, and potentially other countries in the region would come to Guyana’s aid. Any such move by Maduro could therefore backfire on him, but even Venezuela would see some temporary fiscal benefit from the likely spike in oil prices that would result.

Guinea: In another reminder of the mineral riches in less-developed regions like Latin America and Africa, mining giant Rio Tinto (RIO, $68.49) today said its single biggest investment over the next few years is likely to be a huge new iron ore mine in the West African country of Guinea. In partnership with Guinea’s government and a Chinese firm, Rio expects to contribute about $6.2 billion to cover half the cost of developing the southern part of the projected Simandou mine, which some analysts think could eventually produce enough ore to drive down global iron and steel prices and take market share from today’s leading producers, Australia and Brazil.

Argentina: Back in South America, Argentina’s newly elected president, populist libertarian Javier Milei, is making news by backing away from some of the radical economic policy changes that got him so much attention during his electoral campaign. For example, he has fired some top economic advisers who were enlisted to help him kill the central bank and adopt the U.S. dollar as the national currency. He has also aligned with officials from a previous center-right government that he previously derided, and he has toned down his rhetoric against China.

- Ahead of his inauguration this coming Sunday, Milei is likely running head-on into the messy realities of governing, especially since some of his proposals would be socially disruptive and costly for many Argentines.

- Besides that, Milei’s party has only a modest number of seats in the country’s legislature, presenting challenges for getting his reforms passed into law.

European Union-United Kingdom: As part of a deal to extend tariff-free trade in electric vehicles between the EU and the U.K., the European Commission proposed a program today offering 3 billion EUR ($3.2 billion) in subsidies to EV battery producers in the bloc. The program would operate even as the EU continues its investigation into Chinese subsidies for its electric vehicles exported to the EU, which could ultimately lead to punitive EU tariffs against Chinese EVs.

- The EU program would pale in comparison with the big subsidies provided in the U.S. under the Biden administration’s Inflation Reduction Act.

- Nevertheless, the EU program is another reflection of how the world is fracturing into relatively separate geopolitical and economic blocs, and how industrial policy and more active government involvement in the economy is a part of that.

Italy-China: The Italian government today said it has formally notified China that it is pulling out of President Xi’s signature Belt and Road Initiative. Under that program, China has channeled more than $1 trillion to mostly underdeveloped countries around the world to build ports, railroads, and other infrastructure aimed at easing Chinese trade.

- The BRI has been criticized as a debt trap by many officials and economists in the West. The Chinese-led projects reportedly often come with opaque and onerous loan obligations.

- Italy’s move shows that the populist right-wing government of Prime Minister Meloni is now back in closer alignment with other states in the European Union, which have begun to push back against China’s rising geopolitical and economic aggressiveness.

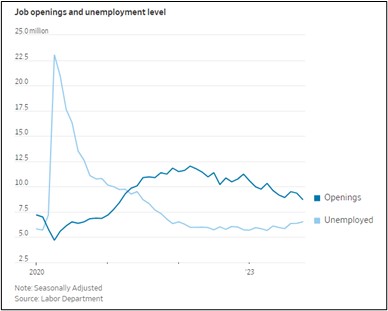

U.S. Labor Market: In a release yesterday, the monthly Job Openings and Labor Turnover report showed October job openings fell by 617,000 to a level of 8.7 million, well below the record high of 12.0 million in March 2022. The number of quits and hires also remained well below the levels reached in early 2022.

- Coupled with the recent rise in the unemployment rate and an increase in the number of people drawing jobless benefits, the data points to continued gradual weakening in the labor market.

- That will probably help keep price inflation moderating and discourage the Fed from hiking interest rates further.

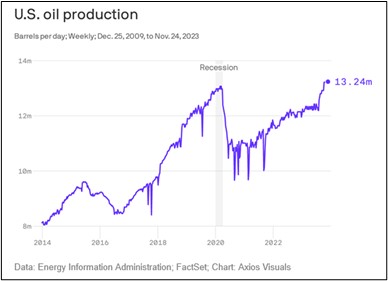

U.S. Energy Industry: New data from the Energy Information Administration shows domestic oil production has now reached a new record high for the first time since the coronavirus pandemic hit. In recent years, U.S. output was held back by a decline in new exploration and development, reflecting factors such as investor insistence that drillers focus more on profits and policymakers’ drive to impose new green regulations. Now, domestic supply has rebounded enough that it is helping push energy prices downward.

- On the demand side, energy prices are also being cut by weak economic growth in China and some other major markets.

- Increased use of electric vehicles around the world may also be sapping petroleum demand to some extent.

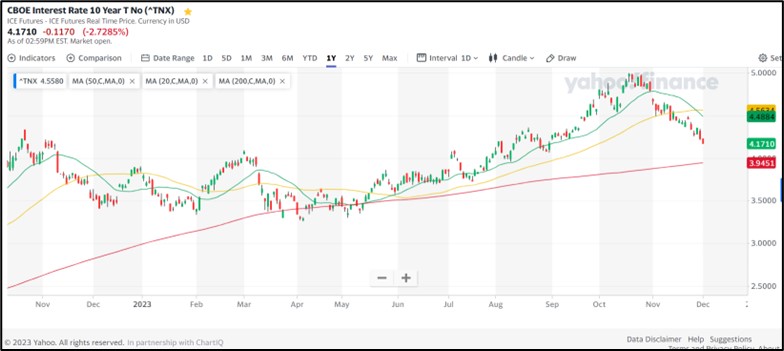

U.S. Bond Market: Reflecting the softening labor market, lower energy prices, and hopes that the Fed will cut interest rates soon, the yield on the 10-year Treasury note continues to decline. In fact, we’ve noted that the 10-year yield’s 20-day moving average has now decisively slipped below its 50-day average. Such a cross-over, when the 50-day average is still trending upward, is often a harbinger of further declines. Nevertheless, we still think investors are overly optimistic about near-term rate cuts.

U.S. Monetary Policy: Consistent with our view that many bond investors are too optimistic about near-term interest-rate cuts, a new poll of economists by the Financial Times found that almost two-thirds of the respondents think the Fed won’t start to cut rates until July 2024 or later. About three-quarters of the respondents expect the Fed to cut the benchmark fed funds rate by half a percentage point or less by the end of 2024.