Daily Comment (December 4, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with notes from the Ronald Reagan Presidential Institute’s annual National Defense Forum over the weekend. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including more risky Chinese moves in the South China Sea and a new intraday record high for gold prices.

United States-China: At the Reagan Institute’s annual National Defense Forum over the weekend, Commerce Secretary Raimondo delivered a passionate, aggressive call for even stronger efforts to keep U.S. advanced technology from the Chinese military. As we’ve noted before, many U.S. business elites continue to resist Washington’s new restrictions on trade, investment, and technology flows to China, including Raimondo’s move in October to clamp down on semiconductors with artificial intelligence capabilities. However, Raimondo offered no apologies, saying, “I know there are CEOs of chip companies in this audience who were a little cranky with me when I did that, because you’re losing revenue. Such is life. Protecting our national security matters more than short term revenue.” Ouch!

- One of Raimondo’s goals is to boost the budget for her department’s Bureau of Industry and Security, which works to stop foreign threats to U.S. industry and national security. According to Raimondo, “I have a $200-million budget. It’s like the cost of a few fighter jets. Come on. Let’s go fund this operation like it needs to be funded so we can . . . protect America.”

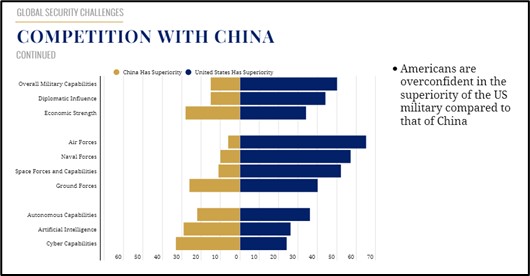

- As more U.S. officials and voters become aware of China’s military buildup and the U.S.’s lagging effort to match it, we see a rising chance that domestic political winds could suddenly shift toward something like the “Missile Gap” controversy of the 1950s and 1960s. The result could be a crash effort to hike U.S. defense spending and expand the military, with politicians who oppose the effort pilloried for being “soft on China.” On that note, the latest Reagan National Defense Survey was released in conjunction with the weekend forum. Some of its key findings include:

- Fully 51% of respondents named China as the greatest threat to the U.S. (including 66% of Republicans and 40% of Democrats), up from 21% in 2018.

- The increased concern about China mostly reflected worries about its military build-up, human rights abuses, and aggressive foreign policy. The survey now shows much less concern about China’s economic policies.

- Despite concerns about China’s military, the respondents appeared overconfident in the U.S.’s military superiority over China. The respondents’ assessments suggest they still don’t appreciate how far China has developed its naval, air, missile, space, and cyber capabilities.

- The survey suggests that if or when voters believe the U.S. is falling behind China’s military, they would be prepared to respond. About 77% of respondents support increased spending on the military (including 87% of Republicans and 71% of Democrats). Fully 69% believe the U.S. needs to increase its defense industrial capacity.

(Source: Ronald Reagan Institute, 2023)

(Source: Ronald Reagan Institute, 2023)

China-Philippines: As if to underscore China’s geopolitical aggressiveness, the Philippines yesterday said some 135 vessels from the quasi-military Chinese Maritime Militia are swarming a reef in the South China Sea that is recognized as Philippine territory under international law but is claimed by China. The incident appears to be the biggest of its kind since the reef was deluged by some 200 Chinese vessels in 2021. The swarming is particularly risky because the U.S. has a mutual defense treaty with Manila that could be invoked if Chinese forces attack the Philippines.

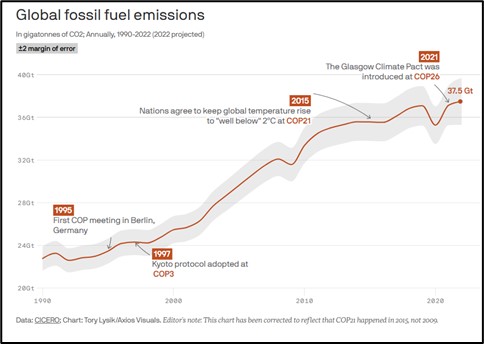

COP28 Climate Conference: As the annual international meeting on climate change continues in Dubai, we’ve noted the following chart of global fossil fuel emissions. The chart clearly shows how emission rates accelerated after China joined the World Trade Organization in 2001 and started its period of rapid economic expansion. What few people are discussing is how emission growth slowed markedly in the last decade and a half, as Chinese economic growth slowed and much of the world was in a laggard recovery from the Great Financial Crisis of 2008.

- As the Chinese economy continues to slow and as developed countries continue to diversify their energy mix to include more renewable sources and nuclear energy, we wonder what would happen if emissions hit a plateau and even start to decline.

- Since many in the West are already pushing back against the “green transition,” we wonder if flattening or falling emissions could also sap some of the political support for green investment.

Israel-Hamas Conflict: After restarting its attacks on the Gaza Strip on Friday, Israel now appears to be training its sights on the southern sections of the territory. The renewed attacks and continued violence between Israelis and Palestinians in the West Bank mean there is still a risk that the conflict could widen. Indeed, Iran-backed Houthi rebels in Yemen launched retaliatory missile and drone strikes over the weekend against commercial ships and a U.S. destroyer operating in the Red Sea. At least two commercial ships were hit, while the destroyer shot down the drones sent against it.

Venezuela-Guyana: In Venezuela’s “consultative” referendum yesterday, the government said more than 95% of the 10 million citizens who participated voted in favor of claiming sovereignty over Guyana’s oil-rich region of Essequibo. Although it appears that authoritarian President Maduro has pushed the issue mostly to stoke nationalism and help his party in next year’s general election, the vote could potentially provide an excuse for more concrete steps to seize Guyana’s territory. That risk could buoy oil prices to some extent in the coming months.

Japan: As the U.S. and other developed countries deal with falling birth rates and population aging, Japan may offer lessons about how the labor market may evolve. Now that Japan has faced those issues for decades, one new trend to deal with labor shortages is “spot workers,” who work during their free time, separate from their primary jobs and household responsibilities. Unlike traditional gig workers or part-time workers, spot workers only work when they want to and have no on-going relationship with the employers. They work for companies on a one-off basis, aided by apps that help them find openings, which offer streamlined on-boarding processes that allow them to get productive on an expedited basis.

U.S. Monetary Policy: In a speech Friday before the blackout period ahead of the Fed’s next policy meeting, Chair Powell said interest rates are now “well into restrictive territory.” He also said the policymakers would only hike rates further “if it becomes appropriate to do so.” The statements suggest the Fed is unlikely to hike its benchmark fed funds rate further. All the same, Powell also tried to dissuade investors from thinking the Fed would cut rates in the near term, saying it’s still too soon “to speculate on when policy might ease.” We continue to think investors should believe the Fed policymakers when they say they intend to keep interest rates “higher for longer.”

- Nevertheless, many investors continue to have visions of rate cuts dancing in their heads. One result of that has been continuing downward pressure on the U.S. dollar.

- Earlier today, the prospect of falling U.S. interest rates and further dollar weakness boosted intraday gold prices to an all-time record of $2,135 per ounce before pulling back.

- Over the longer term, we also think gold is being buoyed by increased geopolitical tensions as the post-Cold War period of relative peace and globalization gives way to the new era of Great Power competition and U.S.-China rivalry.

U.S. Retirement Economics: New analysis from Harvard University’s Joint Center for Housing Studies finds that nearly 70% of older people will eventually need long-term care services, but few will be able to afford it. The study finds that more than half of older Americans live alone. Among those living in metro areas, only 13% of adults 75+ could afford assisted living without diving into assets. Only 14% could afford a daily visit from a home health aide along with their housing costs.

U.S. Momentum Investing: New research suggests that momentum stock investing stopped performing well early this century in large part because of a change in the way rating firm Morningstar (MORN, $284.30) assigns “stars” to mutual funds. Prior to 2002, Morningstar assigned its top 5-star rating to the funds posting the best recent returns versus all other stock funds. The researchers believe that incited investors to pile into those funds, creating momentum. Beginning in 2002, however, the firm started assigning stars based on how a fund performed against others using the same investment style. The researchers believe that diluted the impact of performance chasing and took much of the wind out of momentum investing.

U.S. Quantum Computing: We write a lot about artificial intelligence, autonomous vehicles, green energy, and other rapidly advancing technologies that have the potential to transform the global economy and create new opportunities for investors, but one technology we’ve neglected so far is quantum computing. In a report today, IBM (IBM, $160.55) is expected to unveil 10 projects demonstrating how quantum calculations can be used to speed up scientific research and business decision-making. The announcements aim to reassure investors that quantum computing still offers opportunities even if progress has come slower than anticipated.

- In a nutshell, quantum computing leverages the properties of sub-atomic particles that make it possible for them to be in many different states at the same time. This enables quantum machines to carry out large numbers of calculations simultaneously— potentially solving problems beyond the scope of traditional computers.

- One main challenge, however, is that the “qubits” on which the systems are based are unstable and only hold their quantum states for very short periods, introducing errors, or “noise,” into the calculations. IBM is hoping to show progress in dealing with that problem.