Daily Comment (December 18, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens by assessing the president’s 2026 policy shift and its potential market impact. Following a deep dive into the AI-related volatility surrounding Oracle, we will then evaluate high-stakes geopolitical and legislative developments, specifically the US healthcare bill, Tricolor’s fraud crisis, and US arms shipments to Taiwan. Finally, we include a roundup of essential domestic and international data releases.

The President Speaks: With next year’s midterm elections approaching, President Trump is seeking to frame his first year as a success. In a recent address, he highlighted his key achievements, including a crackdown on illegal immigration, policies that lowered the cost of essentials like groceries and travel, and the negotiation of new trade deals to secure foreign investment. He also announced a symbolic $1,776 Christmas bonus for active-duty troops. His address reflects a strategic shift from an offensive to a defensive posture, as he looks to protect his agenda.

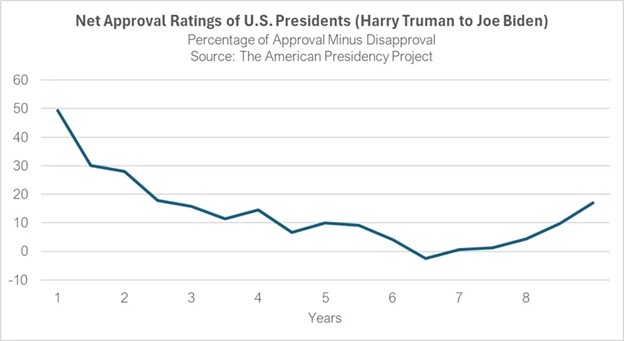

- The president’s current strategy seems designed to circumvent the lame-duck syndrome that historically afflicts second-term presidents. As we noted in our earlier piece on managing an economic slowdown, presidents typically lose popularity heading into their second term. In fact, historical trends show that approval ratings most often bottom in year six, which, for the incumbent, will be next year.

- The administration’s drop in popularity comes at a critical time as key policies are currently stalled in court. The Supreme Court is skeptical of the president’s authority to impose broad tariffs, and his move to nationalize AI standards has triggered a backlash from state governments. These legal and political challenges threaten to leave much of his first-year agenda unresolved.

- Despite the threat posed by recent Democratic gains, the president is currently struggling with a “war within.” His recent move to impose 50% tariffs on Brazil was blocked by the Senate, while his plan to centralize AI regulation has repeatedly failed to gain Republican support. Adding to the friction, moderate Republicans have joined forces with Democrats to bypass leadership and advance an extension of healthcare subsidies, further complicating the administration’s year-end agenda (see more below).

- That said, the outlook is not entirely negative for the president. As the net approval ratings chart above illustrates, his popularity is projected to stabilize in the coming months, allowing him to build momentum ahead of the election. Furthermore, although his approval rating at 43.6% can improve, he is currently outperforming his two most recent predecessors — Barack Obama (42.7%) and George W. Bush (43.6%) — at the same point in their presidencies.

- As we look toward 2026, we anticipate that the president will push for policies designed to stimulate growth and enhance affordability. This may also mean that the president may be less aggressive in imposing new tariffs. This more predictable, defensive posture should be a net positive for equities, offering businesses a stable regulatory environment and households the confidence to increase consumption.

Oracle Problems: Concerns regarding the rapid expansion of AI infrastructure are intensifying following a shift in Oracle’s financing. On Wednesday, it was reported that Blue Owl, a longtime financier of cloud computing firms, has withdrawn its backing for Oracle’s Michigan data center project. While the project is still expected to proceed, Blue Owl’s departure has sparked fresh anxieties regarding Oracle’s debt levels and the long-term sustainability of the AI build-out.

- Oracle has recently become a proxy for the burgeoning AI bubble. The market began paying close attention to the company following a reported jump in orders that wildly exceeded expectations, triggering a 36% single-day stock surge. However, since that peak, concerns have emerged regarding the company’s ability to meet those targets. Questions remain surrounding the profitability of these deals, as well as the company’s rumored reliance on a handful of suppliers.

- Growing skepticism toward AI is increasingly weighing on the technology sector. The central concern is the industry’s structural pivot from a traditionally capital-light model to one that is highly capital-intensive. This escalation in investment has fueled fears that the cost of infrastructure may erode future profitability. According to estimates from Apollo Global Management, capital expenditures for the Magnificent 7 have skyrocketed, rising from just over 40% of operating cash flow in 2024 to more than 60% today.

- The tech sector’s growth story is far from over. Recent market trends show a clear preference for companies with robust balance sheets that avoid the high costs of the debt market. Large cap tech stocks, in particular, maintain an edge over smaller firms by better managing economic volatility. Moreover, because the US government views AI leadership as a matter of national security, the sector likely benefits from an implicit “federal backstop” if growth were to falter significantly.

- We view sector diversification as essential for navigating current market turbulence. Drawing a parallel to the post-tech bubble era, value stocks are again offering a vital outlet for capital preservation. Recent data confirms this shift, with investors rotating heavily into defensive plays, most notably healthcare, which have outperformed to close the year.

Affordable Care: House Republicans have passed the Lower Health Care Premiums for All Americans Act, framing it as a market-based alternative to the expiring Affordable Care Act (ACA) subsidies. While the bill faces steep opposition in the Senate, its passage signals that healthcare affordability will be a defining political flashpoint heading into the 2026 midterm elections. We believe this issue has the potential to significantly influence the congressional landscape next year.

Tricolor Holdings: The founder and top executives of the now-bankrupt Tricolor have been charged with fraud following allegations that they misled lenders. The company reportedly falsified records to portray delinquent auto loans as current, a move that is expected to intensify scrutiny of subprime consumer debt. As investors assess the potential for rising defaults — particularly within the private credit markets — this crackdown serves as a warning sign. While we do not see immediate systemic risks, we remain vigilant.

Taiwan Weapons Sale: The US government has approved the potential sale of over $10 billion in arms to Taiwan. While still subject to congressional approval, the weapons package would be the largest ever offered to the island. The move is likely to provoke a strong reaction from China, which views such sales as interference in its internal affairs, and signals that underlying tensions between the two superpowers remain high despite a recent period of calm.