Daily Comment (December 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with several public statements made yesterday by Federal Reserve policymakers, all of which suggest the policymaking committee remains split on whether to cut US interest rates further in the coming months. We next review several other international and US developments with the potential to affect the financial markets today, including a significant rollback in the European Union’s environmental regulations and a dangerous incident involving an out-of-control drone from Russia or Ukraine that was shot down as it approached Turkey.

US Monetary Policy: Fast on the heels of last week’s interest rate cut, remarks by Fed officials yesterday showed the policymakers remain split on further rate cuts. New York FRB President Williams said the Fed’s policy stance is now “well positioned as we head into 2026,” and Boston FRB President Collins said she wants to wait for more data on price inflation before cutting rates further. However, board member Stephan Miran argued that true inflation is at target after stripping out distorting prices, warranting more rate cuts.

- Miran argued that tough-to-measure housing costs, portfolio management prices, and other distorting figures are making the inflation rate look higher than it really is. After stripping out those costs, Miran said true inflation is only a hair above the Fed’s target rate of 2.0%.

- Miran is widely seen as the White House’s representative on the Fed’s policymaking committee, and he is expected to keep pushing for more aggressive rate cuts. Indeed, we still think the Fed will ultimately cut rates more aggressively in 2026 than in 2025. However, the faster rate cuts may have to wait until current Chair Powell is replaced in mid-2026.

US Automobile Market: Auto giant Ford said yesterday it will take $20 billion in charges through 2027 to abandon much of its planned shift to all-electric vehicles. Instead, the firm will focus future investment on hybrid vehicles and energy storage equipment. Ford tagged its retreat to customer demand for cheaper vehicles that don’t compromise on performance, but the move also shows the impact of dramatic policy shifts from the Biden administration to the new Trump administration – costly shifts that have become more common with political polarization.

European Union Automobile Market: The European Commission today will reportedly propose scrapping the EU’s complete ban on manufacturing cars with internal combustion engines by 2035. Instead, it will allow EU automakers to sell vehicles representing 10% of their 2021 greenhouse gas emissions. If approved by the EU’s member countries and the European Parliament, the move would dismantle a key plank of the bloc’s “Green Deal” program.

- The change would also be consistent with our view that the EU is in the early stages of an important deregulation phase aimed at boosting economic growth and precluding more electoral gains by right-wing political parties.

- If such a deregulatory program is carried out widely, it would likely help boost Europe’s economic growth and potentially support European industrial stocks.

- We discuss this thesis in our new Geopolitical Outlook for 2026, which we published yesterday.

Turkey-Russia-Ukraine: Turkish military jets today shot down an out-of-control aerial drone approaching the country’s airspace, bringing it down over the Black Sea. At this writing, it isn’t clear whether the drone was Russian or Ukrainian. Nevertheless, amid a spate of unidentified drone incursions that have shut down European airports, the incident highlights the risk that armed or unarmed drones could malfunction and cause unintended damage in noncombatant nations, potentially sparking an international crisis that would disrupt financial markets.

- Despite the risk from rogue drones, global oil prices have fallen 1.5% so far today, extending their recent declines as traders become increasingly convinced that the US will force Russia and Ukraine into a peace deal. Investors are betting that any such deal would involve eased sanctions on Russian energy exports.

- As of this writing, Brent crude is trading at $59.66 per barrel, and West Texas Intermediate is trading at $55.89 per barrel.

Estonia: In a little noticed development last week, Estonia installed the first of 600 military bunkers planned for the “Baltic Defense Line” being built by Estonia, Latvia, and Lithuania to deter invasion by Russia. The expensive string of bunkers illustrates how Eastern European countries have become especially worried about future territorial grabs by Russia once the Ukraine war winds down. Continued defense investment to deter Russia is one reason we expect strong returns from European defense stocks in the coming years.

Japan: Starting Thursday, Tokyo will begin enforcing its new “Act on Promotion of Competition for Specified Smartphone Software,” which aims to curb the dominance of technology giants and foster competition in Japan’s digital services market. Since the law is partly patterned on the European Union’s Digital Services Act, which has drawn Washington’s ire due to its impact on US technology firms, it could lead to renewed bilateral tensions and potentially even put Japan at risk of US sanctions despite the recent improvement in relations.

- The new law could have an especially big impact on US tech giants Apple and Google as it requires them to allow third parties to run independent app stores and offer their own payment options, while ensuring search engines other than those they run are immediately visible to the user.

- On the other hand, consumers would enjoy a wider range of options for apps and payments, while developers, in principle, will have more leeway showcasing their products and expanding their presence in digital markets.

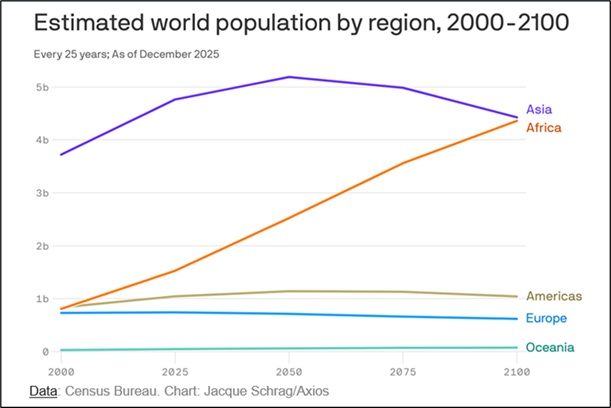

Global Demographics: New research by the Census Bureau finds that Africa’s continued high birth rates compared with other regions will make it the world’s demographic center of gravity by 2100, with several “mega-nations,” more geopolitical power, and potentially the fastest economic growth of all regions. Coupled with Africa’s valuable mineral resources, we think the continent’s population growth could also help make it a rising investment destination, especially if African nations can improve their political and economic institutions.

China: According to state media, the Chinese government will expand its national healthcare insurance next year to fully cover all out-of-pocket expenses related to childbirth. The move will be China’s latest effort to lift birth rates and avert a looming demographic crisis that threatens to undermine long-term economic growth. However, since childbirth costs are only a small fraction of the resources needed to raise a child, it seems unlikely that the policy change will spur enough new births to significantly support population growth.

Argentina: The central bank yesterday said it will accelerate the widening of the peso’s exchange-rate band, allowing it to increase in line with monthly consumer price inflation instead of the current 1.0% per month. The move is set to bolster the central bank’s effort to quickly rebuild the country’s foreign currency reserves now that it has survived the October political crisis. However, many observers are skeptical that investors will be willing to accumulate significant Argentine assets in the near term.