Daily Comment (December 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Note to readers: The Daily Comment will go on holiday after Friday’s comment and return on January 3, 2022. From all of us at Confluence Investment Management, have a Merry Christmas and Happy New Year!

We open today’s Comment with a range of U.S.-focused items, touching on monetary policy, fiscal policy, the labor market, and relations with China. Next, we shift to several international and global issues, including an important new cybersecurity threat that stems from a flaw in some widely used computer server software. We close with a number of important developments related to the coronavirus pandemic.

U.S. Monetary Policy: The Fed today wraps up its latest two-day policy meeting. When the new policy statement is released, the officials are expected to say they will accelerate the tapering of their bond-buying to end the program by March. It would position them to start hiking the benchmark fed funds interest rate in the first half of the year if they so choose. However, Chair Powell’s abrupt mutation into an inflation hawk has some investors nervous about what the policymakers will actually do at the meeting.

U.S. Fiscal Policy: Last night, Congress passed a measure raising the government’s borrowing limit by $2.5 trillion, sending to President Biden’s desk legislation that is expected to push the next debt-ceiling standoff past the midterm elections. The Senate voted 50-49 to approve the legislation in the afternoon, and the House later passed it 221-209.

U.S. Labor Market: Reflecting workers’ bargaining power amid the nation’s massive shortage of relatively lower-skilled workers, employees at two stores of Starbucks (SBUX, USD, 114.71) in the Boston area have petitioned to unionize. Although successful unionization efforts across industries are still limited, the trend is for increased organization, potentially increasing workers’ pay and crimp corporate margins going forward.

United States-China: The U.S. government announced it would bar investments in eight more “Chinese military-industrial complex” companies based on their involvement in the surveillance and repression of China’s Uyghur Muslim minority. The firms added to the investment blacklist include privately held DJI, the world’s largest commercial drone maker, as well as companies primarily involved in facial recognition, cybersecurity, supercomputing, and cloud services.

- All eight companies added to the blacklist were already on the Commerce Department’s “entity list,” which restricts exporting technology or products from the U.S. to the Chinese groups without a government license.

- The Commerce Department is also expected to place dozens of additional Chinese companies on its entity list on Thursday, including some involved in biotechnology. The Thursday action reportedly may include a clampdown on exporting U.S. technology or services to major Chinese computer chip manufacturer Semiconductor Manufacturing International Corp. (981 HK, HKD, 18.72).

- The new announcement demonstrates that one key implication of the U.S.-China geopolitical rivalry is that capital flows between the two countries are gradually getting squeezed because of Chinese and U.S. policies. As we have been warning all year, that presents significant risks for investors in Chinese companies.

China-Lithuania: The Lithuanian government has pulled all its remaining diplomats out of China following Beijing’s demand that they hand in their diplomatic IDs to the foreign ministry to have their diplomatic status lowered. The Chinese move illustrates Beijing’s hardline approach to punishing foreign countries trying to strengthen ties with Taiwan.

Japan: Prime Minister Kishida admitted that the government’s land ministry had overstated construction orders for years, potentially inflating Japan’s reported gross domestic product.

Global Cybersecurity: Researchers warn that a newly discovered flaw in some widely used computer server software is one of the most dire cybersecurity threats to emerge in years and could enable devastating attacks, including ransomware, in both the immediate and distant future. Hackers linked to China and other governments are among a growing assortment of cyberattackers already seeking to exploit the vulnerability. Widespread, successful attacks could have a negative impact on individual companies, sectors, or potentially even entire economies.

COVID-19: Official data show confirmed cases have risen to 271,615,381 worldwide, with 5,324,652 deaths. In the U.S., confirmed cases rose to 50,236,602, with 800,043 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 239,553,956. The data show 72.2% of the U.S. population has now received at least one dose of a vaccine, and 61.0% of the population is fully vaccinated.

Virology

- Apple (AAPL, USD, 174.33) said it is once again requiring all customers and employees in its U.S. retail stores to wear masks after making mask-wearing optional at the beginning of November.

- JP Morgan Chase & Co. (JPM, USD, 159.13) said its unvaccinated employees are no longer welcome in its New York offices and would have to start working from home. The firm said it was unfair that admitting unvaccinated employees requires vaccinated workers to wear a mask at their desks. It also relaxed mask-wearing requirements for vaccinated employees.

- Despite measures like those, health experts have warned that the U.S. faces an enormous challenge to contain the fast-spreading Omicron variant due to relatively low vaccination rates, inadequate testing, and inconsistent rules about mitigation measures such as mask-wearing.

- New research shows that two doses of the Chinese-made Sinovac vaccine, whose efficacy against the virus was already under question, provide “insufficient” antibodies to be effective against the Omicron mutation. Beijing-based Sinovac today responded with a statement saying a third shot of its vaccine could improve its ability to neutralize Omicron, citing its own laboratory studies.

- The Sinovac vaccine has been widely used in China and throughout the poorer countries of the world.

- Therefore, if it really is ineffective against the fast-spreading Omicron variant, it would suggest much of the global population could be at high risk from the new mutation.

- Adding to the challenge for poorer countries, the World Health Organization has warned that the rollout of aggressive booster-shot campaigns in the developed countries will leave poorer nations with an even greater shortfall of doses than they currently face.

- Yesterday in the U.K., Parliament approved Prime Minister Johnson’s new “Plan B” pandemic measures, including the establishment of a “vaccine passport” allowing access to some venues. However, Johnson still faced the humiliation of almost 100 of his Conservative Party legislators voting against him. The vote illustrates the high political risks for politicians trying to reimpose pandemic restrictions, especially once they’ve loosened them and promised not to go back to tight lockdowns.

- In Germany, police carried out raids in the country’s southeast, targeting a network suspected of conspiring to murder local politicians for their role in implementing pandemic restrictions. Officials are becoming increasingly worried about the radicalization of some anti-vaccine militants as the country edges toward a general vaccine mandate that could come early next year.

Economic and Financial Market Impacts

- In China, the government’s “zero-COVID” policy and strict new measures against the Omicron mutation are constraining manufacturers and threatening a broader slowdown in the economy.

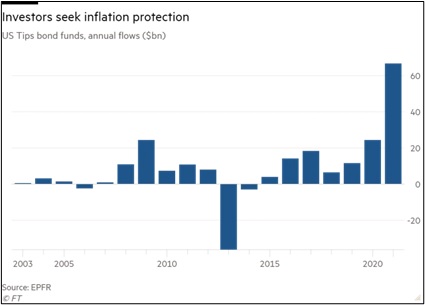

- As post-pandemic supply disruptions and demand recovery continue to boost inflation worldwide, investors are piling into inflation-linked assets in a bet that consumer prices will continue to soar even as central banks gear up to tighten monetary policy. Inflation-protected government bonds, commodity funds, and real estate investment trusts are among the products absorbing cash. The chart below shows the enormous surge in purchases of U.S. Treasury Inflation-Protected Securities (TIPS).