Daily Comment (December 1, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today is dominated by Asian and other international developments, as might be expected after the long Thanksgiving holiday weekend in the US. Our coverage includes several important political and economic developments in Japan, as well as some economic and foreign relations stories related to China. We end with a few lower-profile items from the US and beyond that could also affect the financial markets today.

Japanese Politics: On Friday, Prime Minister Takaichi’s Liberal Democratic Party (LDP) and its junior coalition partner, the Japan Innovation Party, gained a majority in the lower house of parliament when three independent lawmakers agreed to vote with the LDP. That gives the ruling coalition 233 of the 465 seats in the Diet, meaning Takaichi won’t need to rely on opposition parties to approve her budget or other legislation.

- Takaichi also continues to score unusually high approval ratings in public opinion polls.

- We believe that Takaichi’s solid political position will be supportive of Japanese stocks going forward and help them reverse their price pullback from November, so long as the current China-Japan dispute doesn’t worsen (see next section).

Japanese Fiscal Policy: Prime Minister Takaichi’s cabinet on Friday approved a supplementary budget equal to about $117 billion for the fiscal year ending March 2026, with the additional spending requiring about $75 billion in new bond issuance. The plan, which reflects the near-term stimulus program laid out by Takaichi the week before, is likely to put additional upward pressure on Japanese interest rates and consumer price inflation in the coming months.

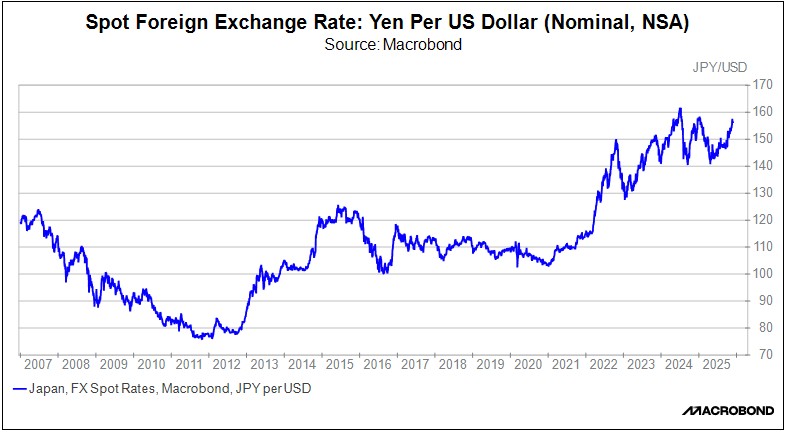

- On a related note, Finance Minister Katayama on Sunday said it is “clear” that the yen’s depreciation over the last few months hasn’t been “based on fundamentals.” Her statement marks the latest expression of the government’s frustration over the currency.

- In contrast to Katayama’s assertion, the weakness in the roughly 6% depreciation in the yen versus the dollar over the last three months and the pullback in Japanese stock prices since the end of October do appear to reflect fundamentals, in the sense that investors are increasingly worried about Prime Minister Takaichi’s willingness to boost debt issuance in order to put into place more stimulative fiscal policy.

- Katayama’s statements raise the specter of impending government action to support the yen. We think that would be even more likely if the US government takes note of the yen’s dropping value and begins to pressure Tokyo to do something about it.

Japanese Monetary Policy: Consistent with concerns that more stimulative fiscal policy will not only boost government debt issuance but also exacerbate price inflation, Bank of Japan chief Ueda hinted in a speech today that he is prepared to hike the central bank’s benchmark interest rate at the next policy meeting this month. Futures trading now suggests there is about a 75% chance that the BOJ will hike rates at the meeting. In response, the yen has appreciated about 0.6% versus the dollar so far today, while Japanese stock and bond prices have retreated.

China-Japan: Diplomatic sources say China has now frozen all youth exchange programs with Japan, marking the latest in a long string of retaliatory measures for Japanese Prime Minister Takaichi’s statement earlier in November that Tokyo would intervene militarily if Beijing tried to take over Taiwan by force. China still hasn’t taken its most disruptive possible steps, such as cutting Japan off from its rare-earth magnets. Nevertheless, the continuing dispute raises risks for the Japanese economy and financial markets if it worsens.

Taiwan-China: Last Wednesday, President Lai touched off an international and domestic political storm with a statement that China is prepping for “complete unification with Taiwan by force by 2027.” Lai’s office later clarified that he meant Beijing is preparing for such an option, but the statement still brought a strong rebuke from China and political attacks by opposition parties back home. The row marks the latest example of Lai’s aggressive rhetoric against China, which likely raises the risk of a dangerous military conflict across the Taiwan Strait.

China: The government’s official purchasing managers’ index for manufacturing rose to a seasonally adjusted 49.2 in November, meeting expectations and improving from 49.0 in October. Still, that marked the eighth straight month in which the index was below the 50.0 level that indicates expansion. Moreover, the November PMI for services merely rose to 50.1 from 50.0 in the previous month, suggesting that sector is barely growing. The data suggests that China’s economy continues to struggle against factors such as trade curbs and excess capacity.

United States-Venezuela: In a Thanksgiving call to US service members, President Trump warned that his administration’s military campaign against Venezuelan drug traffickers would “very soon” expand from attacking drug boats to hitting land targets. With the big US military force that has been assembled in the region, the administration could easily launch such attacks. However, it’s less clear that it can achieve its goal of ousting President Maduro in the near term or avoid anger among the isolationists in Trump’s political base.

- In a more recent development, President Trump on Saturday issued a warning to airlines and private pilots that they should consider Venezuelan airspace “closed.”

- The warning could be just another tactic to heap pressure on President Maduro to resign, but it could also be aimed at laying the groundwork for US air attacks on Venezuelan ground targets.

US Labor Market: In response to last week’s shooting of two national guard members as they patrolled in Washington, DC, President Trump said he’ll ban migration from less-developed nations and push for “reverse migration,” even deporting legal migrants. By late Friday, officials had already begun to follow through on those goals.

- From an economic perspective, a further tightening of immigration policy will likely cut the number of available non-native workers even as firms slow their hiring. That could boost employment opportunities for native workers, at least if they have required skills.

- In turn, that could help keep the unemployment rate low, potentially encouraging the Fed to go slower in cutting interest rates.

European Artificial Intelligence: Since US and Chinese firms are so prominent in the AI space, it’s tempting to think that Europe isn’t a player at all. However, the Financial Times today has a useful article on Germany’s privately held Black Forest, which has quickly become a big player in the exploding market for image-editing AI models. The firm’s valuation has reportedly tripled in just the last year. The article suggests that European AI firms such as Black Forest and France’s Mistral could eventually be attractive opportunities when they have their IPO.

Note: The next and final Asset Allocation Bi-Weekly for 2025 will be published next Monday, December 8.