Daily Comment (December 1, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities are trading lower as investors seek to liquidate some of their holdings ahead of Fed Chair Powell’s speech, and the Dallas Cowboys’ defense failed to live up to the hype on Thursday. Today’s Comment starts with our thoughts about changing interest rate expectations. We then examine the continued stability of oil prices and the potential challenges of providing military aid to other countries. As always, our comprehensive report encompasses the latest domestic and international data releases.

Inflation Cooling: While central bankers unanimously agree on the need for prolonged rate hikes, certain countries are better equipped to withstand the economic implications of this policy stance.

- Inflationary pressures remain pervasive across the developed world, yet price increases have moderated at a rate exceeding most analysts’ forecasts. The latest eurozone data indicates that headline inflation has climbed 2.4% since November 2022, substantially lower than the consensus forecast of 2.7%. Notably, Portugal and Italy have both reported annual price increases well below 2%. Concurrently, the Federal Reserve’s preferred inflation measure rose 3.4% from the prior year, well below consensus estimates of 3.5%. This progress has emboldened central bankers, who are now signaling their intent to maintain current interest rates while pursuing measures to address underlying price pressures.

- Despite concerns about a resurgence in inflation, several areas, including the eurozone, the U.K., and Canada, may find it untenable to maintain elevated interest rates without jeopardizing their economic growth prospects. These countries have all experienced economic contractions in the third quarter of 2023, highlighting the delicate balance between curbing inflation and fostering economic growth. In stark contrast, the U.S. economy surged at its fastest pace since 2021 from July to September. This divergence in growth prospects has fueled speculation among investors that other developed economies may be forced to loosen monetary policy ahead of the U.S.

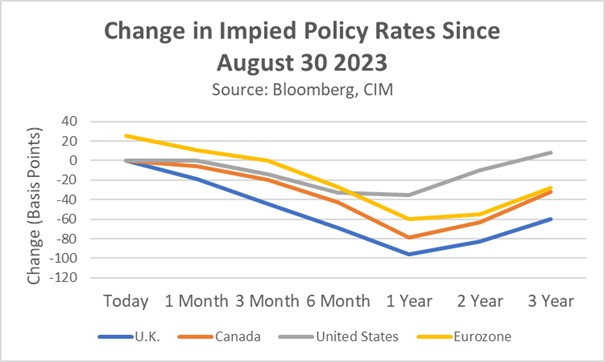

- The chart depicted above showcases the shift in implied policy rates since August. Implied policy rates refer to market-derived forecasts of future interest rates. During this period, investors adjusted their anticipated policy rates downward for the U.K., Canada, and the eurozone for the next few years. Notably, the U.S. has bucked this trend, with investors revising their expectations for the upcoming year. This divergence in policy paths should be supportive of the U.S. dollar against its major counterparts.

Crude Prices Under Pressure: Despite lingering supply concerns, oil prices have remained subdued, falling short of the previous year’s level.

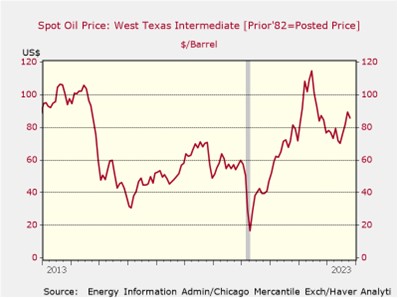

- Oil producers’ efforts to achieve a sustainable rise in crude prices faced a setback due to supply cuts. In an attempt to bolster prices, OPEC+, which includes Russia, reached an agreement on Thursday to deepen production cuts by an additional 1 million barrels per day. While the agreement was nonbinding, it was meant to convey the oil-producing nations’ resolve to collaborate. Despite an initial surge, Brent crude prices closed the day lower, partly due to concerns that producers might not be able to implement the agreed-upon cuts fully. As a consequence, oil prices ended the day down 2%.

- The stability of oil prices has been partially attributed to weaker demand from China, which is grappling with internal economic challenges, and the looming threat of a global economic downturn. Notably, last year it was expected that oil demand would surge in 2023 as the lifting of China’s Zero-COVID policy was anticipated to increase energy consumption significantly. These expectations were dashed as the country’s low consumer confidence and industrial output have led to a sluggish economic recovery. Furthermore, the Organization for Economic Co-operation and Development (OECD) has forecast a slowdown in GDP growth for member countries to 1.4% in 2024, which will further contribute to weakened demand.

- This year, energy has been a major headwind for inflation. The base effects from last year’s energy price surge have largely dissipated, narrowing the gap between core inflation and headline inflation. The lack of drag from energy will put pressure on other components of inflation as central banks look to bring inflation back to their 2% target next year. Hence, a possible reversal of oil prices could force central banks to rethink the path of interest rates. If oil prices remain relatively stable in the coming year, policymakers may be encouraged to stand pat.

Wars Far From Over: Conflicts in Central Asia and the Middle East show no signs of waning, putting Washington in a difficult position.

- Ukrainian President Volodymyr Zelenskyy has pivoted strategically amidst the evolving conflict with Russia. Acknowledging the constraints of recent counteroffensives, Zelenskyy has redirected attention toward expediting the construction of robust military fortifications along the eastern front line. This shift in focus emphasizes a defensive stance aimed at fortifying Ukraine’s defenses against a potential resurgence of Russian aggression during the winter months. Additionally, there are concerns about Moscow’s preparations, including the accumulation of missiles, which could potentially target Ukraine’s power grids. The actions taken by both Ukraine and Russia signal a readiness to persist in the conflict, indicating that neither side is inclined to cease hostilities.

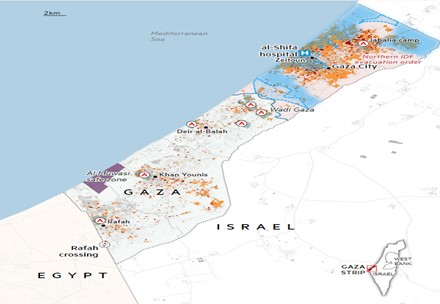

- At the same time, Israel has stated that it is preparing for a prolonged conflict with Hamas. The remarks come after a seven-day cease-fire ended and the two sides resumed fighting early Friday morning. Although the timing may vary, Israel is expected to maintain its ground offensive until at least early 2024. The objective of the attack will be to kill three of the top Hamas leaders—Yahya Sinwar, Mohammed Deif, and Marwan Issa—and dismantle the group’s capacity to govern effectively in Gaza. Israeli officials caution that the resolution of the conflict won’t be sudden, emphasizing their commitment to prevent the group from regaining influence.

- Facing mounting fiscal pressures, U.S. lawmakers will likely face heightened scrutiny when justifying foreign military aid, particularly for prolonged conflicts. While Americans generally support limited assistance to other nations, their tolerance may dwindle, especially when faced with persistent domestic challenges. These concerns likely explain the recent instances where lawmakers have conditioned military aid for Israel and Ukraine on the inclusion of funding for border security. Hence, we may be moving toward a world in which countries will be forced to be less reliant on the U.S. for protection. This scenario should lead to greater trade and supply chain uncertainty, which should favor commodity prices in the longer term.

Other News: Oil prices are also being impacted by the use of bot traders. This highlights technology’s growing influence on markets and raises questions about potential risks. In a separate event, Florida Governor Ron DeSantis’ one-on-one debate with California Governor Gavin Newsom fell short of expectations. While DeSantis hoped the debate would reinvigorate his campaign, he failed to clearly differentiate himself from Republican frontrunner Donald Trump.