Daily Comment (December 9, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning! After several days of risk-on, today is shaping up as a risk-off session. Our coverage begins with economics and policy, where we discuss yesterday’s JOLTS data and inflation. Tomorrow we get CPI, and there are worries we will see a yearly rate in excess of 7%. International news is next. The Summit for Democracy begins today, and the situation in Ukraine continues to evolve. China news follows; the real estate sector situation is moving toward restructuring. We close with pandemic coverage.

Economics and policy: Job openings continue to exceed the level of unemployment, and inflation data comes out tomorrow.

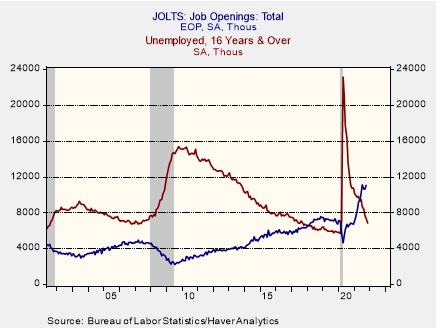

- The JOLTS report shows that job openings continue to exceed the level of the unemployed.

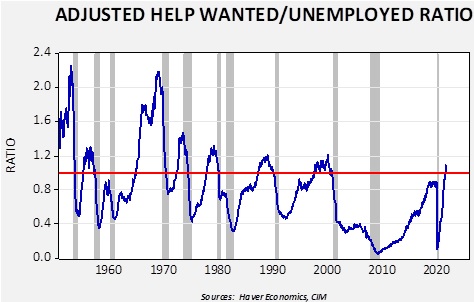

The JOLTS series only has about 23 years of data. To get a feel for the longer-term pattern, we used a model to graft the JOLTS data to the older help wanted/unemployed ratio. That data suggests the current labor market is as tight as it was in the late 1990s.

As this chart shows, the recovery has been remarkably strong and may prompt the Fed to conclude that the labor market has mostly recovered (see below).

- One typical market pattern is the first time an outlier event occurs, it tends to have a major impact on financial markets. Each successive event of a similar nature usually has less impact. That appears to be the emerging pattern on various COVID-19 infection cycles.

- Polls show that inflation has become the most important concern among Americans. Such polls may account for the recent shift in emphasis by the Federal Reserve. The current inflation appears to have both supply and demand characteristics; unfortunately, monetary policy usually only works, in the short run, on demand, meaning that reducing inflation requires weakening the economy. Although we haven’t discussed the idea of a “soft landing” for years (maybe since the mid-1990s) this is what the Fed will be trying to engineer.

- Anecdotal reports suggest rents are rising rapidly. That will typically boost core inflation.

- Starbucks (SBUX, USD, 116.25) is facing its first unionization drive in Buffalo.

- The large fiscal support packages led to a massive increase in household savings. Recent data suggest lower-income households may be near exhausting their saving, which may prompt faster job acceptance.

- The U.S. is taking steps to prevent money laundering in the real estate sector. Increased corporate transparency in terms of ownership is also underway.

- Congress is moving on some key legislation as the end of the year approaches. It appears the debt ceiling issue will be addressed, at least in the short run. However, the marijuana industry was disappointed when measures to give the industry access to banking were excluded from the legislation.

- Due to the lack of support, Saule Omarova, the administration’s nominee for Comptroller of the Currency, has withdrawn from consideration. Her positions on government involvement in banking were considered outside the mainstream.

- Over 200 newspapers are suing the tech industry over monopolizing ad revenue. Amazon (AMZN, USD, 3523.16) has been fined $1.3 billion by Italian regulators.

- The CIA is working on several cryptocurrency projects. We suspect that some of the efforts are going to breaking down the pseudo-anonymous features of many cryptocurrencies.

- The Northwest has been hit by a swarm of earthquakes.

International roundup: The Summit for Democracy kicks off today, and negotiations around Ukraine continue.

- In the face of evidence suggesting democracy around the world is weakening, the U.S. will hold a Democracy Summit today and tomorrow. A list of 110 nations is included, although we note that the list is somewhat inconsistent, where countries generally not considered democracies have been invited, while others with democratic characteristics failed to get a slot. To a great extent, this summit appears to be more about coalition building to isolate China and Russia and less about fostering democracy.

- Because Hungary wasn’t invited, it vetoed EU participation, meaning that European nations can only take part as individual countries, but the EU cannot.

- China has been making loud statements that the CPC is a democracy, too, even though there are no elections of consequence held outside the party. China’s narrative shows the power of democracy as a concept. China is also upset that an activist from Hong Kong will speak at the summit.

- We are carefully watching U.S. actions on Ukraine. In the wake of a call with Putin, Biden is calling for meetings with NATO partners to address Russia’s concerns. This may be a serious concession to Moscow. As we have noted in the past, Russia’s primary defense is maintaining influence in its “near abroad” to force invaders to move greater distances to attack the Russian core. If Ukraine is unfriendly, Russia is insecure. Thus, for Russia, controlling Ukraine is seen as existential. It is true that the U.S. could seriously threaten Russia by dominating Ukraine and accepting it into NATO, but the cost would be significant. The U.S. is clearly signaling there are limits to American involvement. Simply put, the U.S. isn’t putting troops on the ground. That doesn’t mean the U.S. doesn’t have tools at its disposal. For example, SoS Blinken warned the U.S. could deploy “high-impact economic measures.” Germany’s new Chancellor Scholz has warned that an invasion of Ukraine by Russia would put Nord Stream 2 at risk. It is looking increasingly like the U.S. will end up endorsing the “Finlandization” of Ukraine to ease tensions. Eastern European nations will be horrified at this prospect because Russia will probably use this playbook for other nations in the region.

- Both Blinken and Chief of Staff General Milley have warned that China is attempting to revise the global rules. Beijing sees parts of the U.S.-directed international order as detrimental to its goals.

- As we noted earlier this week, the EU is putting together a new trade tool that would give it significant trade power independent of the individual nations in the EU. If the European Parliament approves the measure, it would be an important vehicle for EU power.

- India’s military chief, Bipin Rawat, died in a helicopter crash yesterday; so far, it appears the event was an accident.

- Latin America has been facing a series of unsettling events. Chile is dealing with a constitutional convention, and presidential elections and Peru’s new government is already getting impeachment calls (which it managed to avoid…so far). Brazil has presidential elections next year in the face of rapidly rising inflation. In Mexico, AMLO has decided to not nominate the former finance minister Arturo Herrera to the head of the central bank, instead choosing a loyalist. Although the political risk is nothing new in the region, it is unusually elevated.

- Turkey is skating dangerously close to conditions conducive to hyperinflation.

- As we noted yesterday, Germany has a new Chancellor. Thus far, he is taking a tough stance on Russia but looks conciliatory toward China.

- The U.K., upset that it was unable to remove steel tariffs applied by Washington, is threatening retaliation.

- Falling investment flows are hurting the emerging markets.

China news: More nations join the diplomatic boycott, and the real estate sector glides toward restructuring.

- After the U.S. decided to engage in a diplomatic boycott of the Winter Olympics, Australia, Canada, and the U.K. decided to follow suit. There may be others. China will not be pleased with these actions, but retaliation will likely wait until the 2024 Summer games.

- The House has passed a bill to ban all imports from Xinjiang unless it can be proven with clear and convincing evidence the products were not made with forced labor. The Senate passed a similar measure in November, but it appears the House bill is more restrictive than the Senate version, meaning a conference committee will create the final version.

- The U.S. has blacklisted the Chinese AI company SenseTime over Xinjiang connections.

- Although the PBOC has never been as independent as western central banks, the bank has been a given rather wide latitude relative to other financial entities in China. Anticorruption officials are said to be investigating the bank, which is likely a move to increase party control over the bank. It is possible the Xi government is concerned that regulators were corrupted by the real estate sector and is looking for evidence of such activity.

- In the past, China has tended to lose its nerve when acting to delever. Authorities know China’s debt levels are dangerously elevated, but when they move to discourage lending, the economy often weakens. We note that credit growth rose in November for the first time since January. The PBOC and finance officials want to provide some credit but avoid a rapid recovery. That will be difficult to manage.

- In this vein, China has eased restrictions on asset-backed high yield lending often used by property firms, further evidence that regulators are trying to provide some credit support but avoid a rapid expansion. This lending is a form of factoring, where firms supplying products to builders sell their accounts receivables to firms who package the obligations for investors. Obviously, the payments depend on the builders making payments on these goods received.

- Although variable interest entities (VIE) have not been completely eliminated, China appears to be cutting off these instruments to tech startups. It appears that China is grandfathering those firms that used VIEs for funding but is denying the use in the future, at least for technology firms.

- China’s economic situation has always been difficult to decipher. For example, it is well known that China’s GDP numbers in the first decade of the century were partly fabricated. However, as General Secretary Xi increases control over the economy, data is being treated as a state secret, and economic reporting is getting become harder to acquire.

- China’s CPI rose 2.3% in November, almost entirely due to higher food prices. Core CPI rose 1.2%. PPI rose 12.9% from last year but was unchanged on a monthly basis.

- Private international primary and secondary schools are facing curbs from the CPC on curriculum. Some schools are closing rather than submitting to oversight.

- Recently we have reported that China may have seen its growth peak already. Reports that marriages have hit a 13-year low would support that idea.

- Evergrande (EGRNF, USD, 0.23) has been sliding toward bankruptcy and will need to restructure its debt. After failing to make debt payments, Fitch has placed the company on “restricted default.” According to reports, the government has added several officials to the company’s risk committee, perhaps signaling that the Xi administration has decided to intervene directly in the troubled company. Expect a long, drawn-out process to manage the wind-down of the company.

- The U.S. and Taiwan have announced measures to increase investment in important technology sectors. As we have previously discussed, Taiwan is a critical bottleneck for semiconductors, and the U.S. has been encouraging Taiwanese firms to build capacity outside of the island.

- China has been cracking down on social media companies. According to reports, some of these companies have started layoffs.

- When the scandal surrounding Peng Shuai erupted, Chinese regulators were able to quickly remove references to her in Chinese social media. However, controlling the narrative abroad was more challenging, requiring bots and fake Twitter (TWTR, USD, 45.72) accounts.

- New Caledonia will vote on Sunday to decide if it will remain a French dependency or declare independence. China is said to be encouraging independence, likely to extend Beijing’s influence in the area.

COVID-19: The number of reported cases is 268,035,994, with 5,283,305 fatalities. In the U.S., there are 49,538,960 confirmed cases with 793,228 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 586,471,075 doses of the vaccine have been distributed with 475,728,399 doses injected. The number receiving at least one dose is 237,087,380, while the number receiving second doses, which would grant the highest level of immunity, is 200,400,533. For the population older than 18, 71.8% of the population has been fully vaccinated, with 60.4% of the entire population fully vaccinated. The FT has a page on global vaccine distribution. The Axios map shows a widespread rise in infections.

- Although COVID-19 continues to dominate the media, infectious disease officials are worried that we could be heading into a difficult influenza season.

- PM Johnson has stumbled into a row over a Christmas party held last year in his residence. His staff apparently denied the event took place, only to be caught discussing the soiree on camera. News of the gathering is coinciding with unpopular new pandemic restrictions. Reports of new measures have sent the GBP lower.

- One mystery of the virus is why it seemed to be more lethal in overweight patients. A new study suggests COVID-19 “hides” in fat cells, triggering excessive immune responses.

- Reports suggest boosters offer some degree of protection against the Omicron variant.

- There is clear evidence that the Omicron variant spreads easily, but also some hints it is a milder version. We have been expecting (hoping?) that such a trend would develop, which would be consistent with similar viruses.

- Life insurance payouts reached their highest level since the 1918 flu pandemic.

- The Senate passed legislation blocking vaccine mandates. Although it may not pass the House and will almost certainly be vetoed, the fact it passed the Senate shows increasing opposition to containment measures.

- A serious fallout from last year’s containment measures as a sharp setback in educational progress.