Daily Comment (August 6, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

It’s the 75th anniversary of the bombing of Hiroshima. U.S. equity markets are a bit weaker after a strong showing yesterday. We lead off with an update on policy progress (or lack thereof), followed by foreign news, with an update on Lebanon. We also check in on the pandemic, followed by China. Being Thursday, the Weekly Energy Update is available. Here are the details:

Policy news:

- Congressional leaders remain far apart on the next round of stimulus/support. The White House is threatening to take executive actions in lieu of legislation, although there will be limits to how much this can accomplish. Although the process looks unsettling, this messiness is very common in democracies. As Otto von Bismarck is attributed to have said, “There are two things no one should ever watch, the making of sausage and laws.”

- The lack of agreement has probably already affected the economy. Even if the funds are returned, households will note the fragility of the moment and likely save additional amounts of any new stimulus.

- Here’s a twist—dead people may get a stimulus check after all.

- As Congress continues to work on a support package, worries about a rise in evictions are starting to develop. The previous support package had put a moratorium in place, but that measure has expired. At present, the decision to evict is a local issue, unless another moratorium is established.

- The National Guard has provided support for COVID-19 testing and other measures. The funding for these soldiers to participate in this mission will expire on August 21 without new authorization from the White House. However, the demobilization is set to start tomorrow to allow the soldiers to quarantine for 14 days. Some states have vowed to pay for the National Guard personnel to remain, but others lack the available funding.

- The WSJ has a detailed report on the Fed’s foreign swap lines. The decision by the FOMC to expand these lines was critical in maintaining global financial stability.

- In a recent AAW, we discussed monetary policy and social goals, specifically, what the Fed could do to improve the lot of disadvantaged groups. For African Americans, the evidence suggests the best way to narrow the unemployment gap (the gap between racial groups) is by extending the business cycle. Congressional Democrats have introduced new legislation that would give the Fed a mandate to reduce racial inequality. Here are a couple of thoughts:

- The original Humphrey/Hawkins bill was designed to give the Fed the mandate to bring about full employment. Much of this thrust came from the civil rights movement, as leaders of that movement noted that having rights mattered little if one didn’t have work. So, this legislation isn’t anything new; in fact, it is already part of the Fed’s mandate.

- What is being lost here is that the inherent tradeoff is efficiency versus equality. When a society favors efficiency, it gets low inflation at the cost of higher inequality. When it favors equality, it pays for that goal with higher inflation. As we have been saying for nearly a decade, the U.S. is embarking on a cycle shift toward equality and away from efficiency. That will eventually lead to higher inflation, but, given the level of slack in the economy, it will take a long time before that inflation becomes an issue. Part of the reason the Humphrey/Hawkins bill never really did much is that it passed in 1978 when inflation was becoming a crisis. The focus on inflation meant that most of the Humphrey/Hawkins law was ignored. In fact, the most visible vestige of that bill is the fact that the Fed chair has to go to Congress biannually to testify about monetary policy. This used to be known as the “Humphrey/Hawkins testimony.”

- One of the consequences of the TikTok issue is that it is further evidence that the World Wide Web is rapidly going regional, or becoming a “splinter-net.” Europe, China, Russia, and the U.S. are all taking measures designed to limit the global scope of internet traffic. The potential impact on globalization is significant; if data can’t be moved easily anymore, The Great Convergence discussed by Richard Baldwin will reverse itself.

COVID-19: The number of reported cases is 18,835,986 with 708,278 deaths and 11,381,042 recoveries. In the U.S., there are 4,824,175 confirmed cases with 158,268 deaths and 1,577,851 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. Axios has updated its state map; there is clear evidence of improvement.

- There is growing consensus that once a vaccine is developed, supplies will be limited. This means some form of triage will be necessary and the protocol for who gets vaccinated and who must wait will be controversial. Meanwhile, vaccine developers are starting to float pricing schemes.

- One of the common themes we continue to monitor is that societies are struggling with the balance between reopening and virus control. What we are seeing globally is that lockdown rules are eased. In response, people congregate, relieved from the pressures of following guidelines. Shortly thereafter, cases rise, and governments attempt to implement restrictions again. We haven’t yet mastered the balance between the level of interaction and disease proliferation.

Foreign news:

- Here is what we are watching on Lebanon:

- Although the initial reports from Lebanon were so horrific that it seemed logical that it must have been a bombing, the general consensus is that the cause was catastrophic negligence.

- After such events, there is a drive to blame someone. Currently, port officials are under house arrest.

- The Lebanese public is rightfully furious. For this dangerous material to be stored, essentially unsecured, for several years is unfathomable.

- Ultimately, this is a problem of governance. Lebanon has the characteristics of a Middle East post-colonial state. The colonial powers tended to create “states” that were not naturally composed. Instead, they were borders that ignored conditions on the ground. Peoples, religions, and ethnic groups that would not have naturally congregated were put together. When the Europeans left, these essentially ungovernable entities remained. Iraq, Syria, and Lebanon are all classic examples of this phenomenon. The current government structure, which emerged from the 1990 agreement that ended a 15-year civil war, is no longer functioning.

- Even before this catastrophe, Lebanon was in deep trouble. It was in the midst of a currency and debt crisis with no clear path to resolution. The state is trying to avoid direct involvement in the Syrian debacle and has persistent tensions on its southern border with Israel. What this blast lays bare is that the government probably can’t cope with all the pressures it faces.

- We would not be surprised to see fighting break out between rival groups and another refugee crisis emerge.

- Azerbaijan and Armenia have been at loggerheads since the breakup of the Soviet Union. Outside powers, including Iran, Russia, and Turkey, have routinely intervened to support one side or the other. Recently, Turkey has been sending signals that it is willing to support Azerbaijan as tensions rise.

- Liam Fox, the former U.K. trade secretary, admitted that classified documents related to U.K./U.S. trade talks had been leaked after Russian hackers broke into his account. The episode highlights the risk of Russian technology infiltration.

- It is likely that Belarus is Russia’s closest ally. President Lukashenko is an autocrat much like President Putin. In addition, Belarus’s close proximity to Russia means that the former needs to get along with the latter, although Lukashenko has tended to follow the small nation handbook of playing Russia against the West for aid. Recently, relations have been strained as Lukashenko faces a real election threat and he has accused Russia of interfering in the election. The latest is that Belarus claims Russian agents have penetrated the country; it is not clear what the goal was, although intimidation is likely. The Russians have been detained, which won’t sit well with President Putin.

Markets and Economic news:

- Gold prices have broken above the $2,000 per ounce line with little resistance. Negative real interest rates, currency debasement fears, and societal stability fears are all combining to lift the yellow metal.

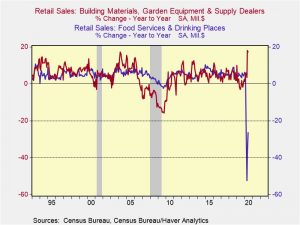

- Housing has always been a difficult asset to value. Total return is calculated by the price change of the asset plus any benefits derived from ownership. Calculating total return from a financial asset is usually straightforward. How much did the price change over the period of ownership and was other income, interest or dividends, captured? Housing is different because the benefits can be difficult to calculate. It is possible to estimate the price gains of a property, although given the characteristics of the market (homes are not universal in quality and thus prices are best estimates), one doesn’t know for sure until the house is sold. At the same time, there are benefits of living in a home. And, if we are stuck at home, getting more benefit from the house becomes important. We are seeing ample anecdotal evidence that homeowners are undertaking remodeling projects. In the hard data, if we look at retail sales of building supplies and restaurants, it is evident that we are seeing a massive divergence. The WSJ has a nice reflection piece on the benefits of homeownership; although they can be difficult to value, they are nonetheless real and enhanced under current conditions.

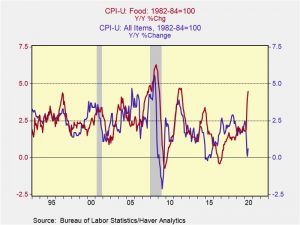

Although inflation has generally been modest, one area that has seen rapidly rising prices is food. Such divergences are not unprecedented, but rising food prices do have distributional effects, harming lower income households. Historically, rising food price inflation is not generally persistent and we would expect this episode to end fairly soon. However, it highlights that any disruption in income support could have an increasingly adverse effect on lower income households.

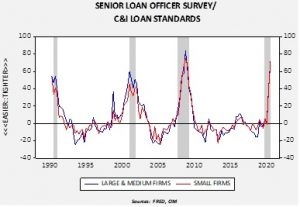

- Commercial banks are notoriously procyclical. They tend to be too easy during expansions and too tight during recessions. The most recent Senior Loan Officer Survey suggests a dramatic tightening of lending standards, which will tend to hamper the recovery.

China news:

- SoS Pompeo indicated the U.S. is prepared to expand its crackdown on Chinese tech firms by expanding into cloud-computing companies.

- Globalization and the drive for efficiency rested on an assumption of geopolitical stability. Specifically, it needed the U.S. to act as global hegemon, reliably providing security and a reserve currency and the rest of the world accepting that condition. As China has threatened this assumption, it is starting to expose previously unforeseen risks. Simply put, under conditions of efficiency, there is little worry about where one produces a good. The only thing that matters is whether production is cost-effective. However, as the assumptions that underpinned globalization come under question, the U.S. finds itself in a position where it has supply chain risks it hadn’t acknowledged before. The pandemic has revealed that the U.S. is dangerously exposed to China when it comes to pharmaceuticals. That vulnerability isn’t a problem when the U.S. is the hegemon and China agrees, but it’s a big problem when the U.S. doesn’t know whether it wants to be the hegemon and China would like to remove our influence from that part of the world.