Daily Comment (August 3, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Happy Monday! U.S. equity futures are ticking higher this morning and the dollar is stronger. There was lots of policy news, which will be our lead. The virus news is next; mask controversy isn’t just a U.S. issue. An update on China follows, and we close with foreign news. Here are the details:

Policy news:

- The U.S. is poised to close TikTok, the video app, but Microsoft (MSFT, 205.01) is interested in buying the U.S. operations of the company. This subsidiary of the Chinese tech company ByteDance claims the U.S. TikTok operations are isolated from China. The U.S. fears the company gathers data on American users that is accessed by Chinese intelligence. And, it’s not just the U.S. Australia shares similar concerns. Although TikTok is catching most of the attention, the U.S. is moving beyond this particular company to Chinese tech firms, in general.

- The Fed has been considering changes to how it manages inflation targeting. Since Volcker, the Fed moved rates in anticipation of rising inflation. This policy was enacted to manage inflation expectations. One of the oft-forgotten elements of inflation is the role of expectations. When economic actors anticipate higher prices, they make balance sheet decisions accordingly. Businesses will hold more inventory to preclude higher prices and households will tend to spend faster and make bulk purchases. In the 1970s, inflation expectations became elevated; Volcker’s shock treatment made it clear to economic actors that the Fed was serious about containing inflation. In the ensuing decades, that trust meant increases in inflation didn’t gain momentum. That was due, in part, to the policy of preemptive rate hikes. It could be argued that the policy has worked so well that despite aggressive attempts to lift inflation by expanding bank reserves, the Fed has been unable to reach its 2% core PCE target.

- This looks to us to be a classic case of “intergenerational forgetfulness.” Policymakers introduce a policy under conditions, often extreme, that is an appropriate response to the problem at hand. The Fed adopted preemptive policy rate hikes because the pain of 19% fed funds rates in the early 1980s was emblazoned on the minds of the FOMC. However, that pain is now 40 years old and we have a different problem now—inflation that is persistently so low that the Fed can lower real interest rates.

- For those of us old enough to remember, abandoning preemption looks like a really bad idea. However, the succeeding generations of Americans who have benefited from low inflation disregard its value, in part, because they don’t know how corrosive inflation can be.

-

- The experience of high inflation is steadily becoming a generational artifact. We are seeing the groundwork of the next great reflation. The end of preemption, MMT, high deficits, etc. will all eventually end in higher inflation. That is certain. What is not certain is the timing. It could take more than a decade before inflation expectations reverse. After all, the Depression children, who came of age in the 1950s, did not engage in behaviors consistent with inflation fears even though financial repression was rife. It wasn’t until the mid-1960s that the policies designed to lift prices gained momentum. Once inflation expectations turned, it got ugly.

- The Fed’s Main Street lending program has been a disappointment thus far. The question is an age old one for lenders—is the borrower facing a liquidity problem or a solvency problem? If it’s the former, lending will support the company until conditions improve. If it’s the latter, lending will only delay the inevitable. The borderline cases are the problem; it can be exceedingly difficult to determine whether a troubled company really isn’t going to make it or, with help, if it can survive. For generations, banks trained loan officers for this task. However, banks noted this was a labor-intensive exercise and decided that lending to larger companies carrying credit ratings was a more efficient way to lend. We doubt the Fed has the wherewithal to make these judgements and is likely erring toward caution, meaning not a lot of money is being lent.

- Meanwhile, congressional and White House leaders met over the weekend. Nothing was accomplished and the support measures passed in March are expiring. There are a number of sticking points, but perhaps the most troublesome is the $600 per week employment insurance supplement. We do expect an agreement to be reached, but the fact that we are seeing a disruption will likely lead households to try to save as much as they can for fear of future disruptions.

- British trade officials are coming to Washington for face-to-face meetings. Westminster was hoping for a quick trade agreement with the U.S. to give the U.K. leverage with the EU over their trade talks. However, the British found that, after Brexit, the U.K. has little bargaining power. The U.S. is demanding concessions (agriculture is a big sticking point) and if the U.K. doesn’t concede, Washington has little need to make a deal.

COVID-19: The number of reported cases is 18,093,891 with 689,625 deaths and 10,700,077 recoveries. In the U.S., there are 4,667,957 confirmed cases with 154,860 deaths and 1,468,869 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

Virology:

- In mid-March, Tomas Pueyo, a tech entrepreneur, published an article in Medium titled “The Hammer and the Dance.” In the article, he outlined the challenges of managing the virus without a vaccine. We reread the article every few weeks. In March, most of the developed world was in lockdown. He correctly predicted that lockdowns would work but were unsustainable. The “dance” part was how much reopening could occur before infection rates returned and triggered partial restrictions. His report showed that the “dance” would be difficult because it would be impossible to predict in advance what openings were possible and what were not. Since lockdowns eased in May, we have seen a resurgence in cases in the developed world. In a sense, we are learning what actions can be safely managed, and what can’t.

- For example, we are learning that “bubble” sports, such as the NHL and NBA, seem to work rather well. MLB is stumbling because it is traveling.

- There is a notion that the controversy over mask-wearing is an American issue. Not so; Germany had a massive protest over the weekend on this issue.

- Lockdowns are especially difficult for younger people. The natural desire to socialize creates “lockdown fatigue” and eventually breaks down. Europe is seeing a rise in cases as younger Europeans return to beaches and bars.

- Australia is implementing regional lockdowns after a surge of cases.

- One of the persistent mysteries of COVID-19 has been the variability of symptoms. Generally speaking, a “mild” case of the flu is a real pain. A bad one is never forgotten. But, with COVID-19, there is ample evidence of completely asymptomatic cases. At the same time, other cases have led to death or permanent damage to cardiovascular systems. In other cases, patients can’t seem to shake the disease and bear severe symptoms for weeks.

- A recent Nature article offers an interesting perspective. COVID-19 is a coronavirus, a broad family of viruses that include SARS, MERS and the common cold. Studies were conducted to determine the immune response from those who had contracted the disease. For comparison purposes, researches looked at blood samples from others who had not tested positive for COVID-19. To their surprise, a large number of the unexposed showed similar immune responses to those who had been diagnosed.

- Researchers speculate that earlier coronavirus infections may have created a degree of immunity, which would either lead to a mild or asymptomatic case of COVID-19.

- However, they also noted that the wide dispersion of symptoms may be tied to existing immunity triggering a massive immune response once exposed to COVID-19, and it is this cytokine storm that leads to a severe case of the disease.

- The existence of pre-immunity will complicate vaccine testing. For those with a high level of pre-immunity, the vaccine may very well lead to a robust immune response and suggest smaller doses of the vaccine will be effective. At the same time, if the vaccine triggers an excessive immune response, it could lead researchers to conclude the vaccine has failed.

- Additional research is necessary. If confirmed, a pre-test may be required to measure native antibodies in a patient and tailor the vaccine to the existing level of immunity. That may make the vaccine much safer and effective, but it would likely slow the rollout.

- A recent Nature article offers an interesting perspective. COVID-19 is a coronavirus, a broad family of viruses that include SARS, MERS and the common cold. Studies were conducted to determine the immune response from those who had contracted the disease. For comparison purposes, researches looked at blood samples from others who had not tested positive for COVID-19. To their surprise, a large number of the unexposed showed similar immune responses to those who had been diagnosed.

- Eli Lilly (LLY, 150.29) is testing an experimental drug that could potentially protect the elderly and staff at nursing homes.

- Russia is planning a mass vaccination program in October with its vaccine. There are fears that the vaccine hasn’t been fully tested and there is a possibility that extensive vaccinations could lead to adverse outcomes. This is a situation that will be closely watched.

China news:

- The U.S. has sanctioned a paramilitary group in Xinjiang. The Xinjiang Production and Construction Corps (XPCC) is a group that controls much of the economy of the province. The U.S., deploying the Global Magnitsky Act, has sanctioned two CPC members tied to the XPCC. This move will infuriate Beijing as it suggests the U.S. will take actions against individual members of the CPC for executing Chairman Xi’s policies.

- Although we maintain skepticism that the CNY will replace the USD as a global reserve currency (primarily because Beijing has a closed capital account), we do watch for evidence that our position may be wrong. We are seeing broadening use of CNY in Indonesia, suggesting in that country the CNY is being seen as an alternative store of value. So far, we haven’t seen other nations take similar steps, but the actions China has taken to increase the use of CNY in Indonesia are notable.

- On a related note, the PBOC is experimenting with a digital CNY in a few provinces. Digital central bank currency is a topic of interest and will likely be the focus of a WGR before year’s end.

- Germany has finally suspended its extradition treaty with Hong Kong. Berlin has been slow to sanction China over its behavior in Hong Kong due to Germany’s extensive direct investment in China.

- In a twist, a recent study found that somewhere between $192 million to $419 million of PPP loans went to small firms controlled by China.

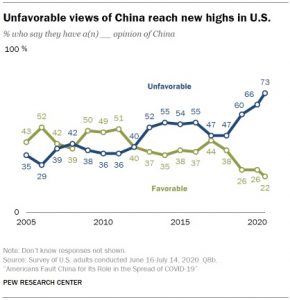

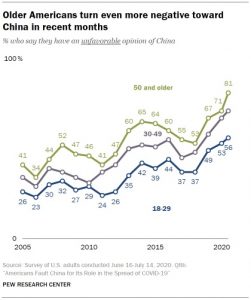

- How have relations between the U.S. and China deteriorated? Here are a couple of charts:

Foreign news:

- In a move that will concern its neighbors, Japan is moving toward a “first use” policy. Since the end of WWII, Japan’s military has struck a defensive posture. It would not initiate an attack against anyone. It could maintain that policy because it had faith in the U.S. security guarantee. It would appear that guarantee is less ironclad, so Tokyo is likely preparing for a world where it may need to defend itself.

- The UAE has a nuclear reactor, the first Arab nation to do so.

- Protests continue in Russia’s far east.

Markets and Economic news:

- Last week, we noted that savings rates remain very high. That would appear to be one of the consequences of the $600 per week unemployment insurance supplement. Consumers have been curtailing their use of credit card debt in response.

- Just a reminder: it’s employment Friday this week.

Odds and ends: There have been rising fears surrounding the November elections. Here’s a new worry to add to the collection—ransomware could be used to take voter data hostage.