Daily Comment (August 3, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Beer Day![1] Also, it’s employment data day. We detail the data below but the quick take is that the data is a bit better than expected but not so strong as to change policy. Financial markets are treating the report with some caution, mostly due to the weaker headline data on payrolls; initially, equities fell modestly on the news, the dollar retreated and bonds held mostly steady. Here is what we are watching today.

Trade update: China has announced a series of retaliation acts against the U.S., a $60 bn list of goods for tariffs. We have seen some pullback in equity markets on the news, although the impact was rather modest. Meanwhile, talks with Mexico are showing signs of improvement and Canada appears poised to join the negotiations. For now, trade hostilities are focused on China.[2]

Mileage standards: The Trump administration took action yesterday to roll back Obama-era mileage standards for autos.[3] The new standard will be held at 2020 levels, which is around 37 mpg for fleets. Obama’s original plan was for fleet standards to reach 54.5 mpg by 2025. Perhaps even more important is the goal of ending California’s dominance in setting environmental rules by ending the state’s authority to establish its own auto emissions standards. That will allow the auto industry to focus on a 50-state regulatory environment and no longer be forced to adjust to the actions of a single, but very important, state in terms of auto demand.

On its face, this is a major win for the automakers and oil companies. For automakers, it will free them from difficult to achieve standards and allow them to sell cars Americans seem to prefer, which are larger SUVs and light trucks. For the oil industry, the Obama mileage standards were part of a two-part nightmare. Not only did the standards mean that gasoline consumption per vehicle was poised to decline but, in addition, the industry is dealing with a major trend change in miles driven.

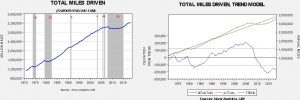

The chart on the left shows total annual miles driven by autos and light trucks. We have put gray bars during periods when that month is below the previous peak. As the chart shows, most of the time, until 2008, we made new highs each month. The chart on the right shows the level of miles driven per year relative to trend. As the lower line shows, we fell below trend during the financial crisis and have not returned to trend.

The reason for the continued stagnation in miles driven is complicated. The slow development of household formation among the 19-35 age cohort likely plays a role. The advent of social media likely affects the trend as well (one no longer has to “cruise” the local burger joint or go to the mall to meet up with friends). We may have reached “peak sprawl,” ending the ever-expanding commutes that bolstered the upward trend. There is little evidence that we are returning to trend anytime soon, so the oil industry is being forced to cope with a loss of demand that will be hard to offset. Consequently, the change in mileage standards has to be welcome news for the oil industry because the miles driven trend coupled with increased efficiency is a clear path to weaker consumption.

Losers with this news are the electric car sector, copper and lithium and public transportation projects. There will be a tendency for households to lean toward gasoline powered vehicles, which are usually less expensive.

However, there is an important underlying issue that this event highlights. Put oneself into the position of a vehicle manufacturer. If the Obama-era rules were to remain in place, about the only way to reach those standards would be through increased hybridization. Building hybrid cars and introducing new generations of larger, battery powered electric motors, along with a plug-in capability, was the likely path forward. And, doing research to expand and improve hybridization would be reasonable as well. Now that the standards have changed, does the industry now stop that process?

There is a risk to doing so and it has to do with how government works now. The Cold War consensus led to mostly steady policies in regulation. That isn’t to say policies never changed, but change was usually legislated, making it “sticky,” and was maintained by the subsequent administrations with modest tweaks. But, in our current age of discord, policy is often made by executive order. Even when legislation passes, much of the actual rule-making is still done by regulatory bodies. Thus, the next executive can simply reverse the previous policy by either changing it or not enforcing earlier rules. If a populist left-wing government takes power in 2020 or 2024, these mileage rules could revert back to the Obama-era rules or perhaps become even stricter. If an auto company abandons hybridization research, it could find itself at a horrible disadvantage of not being able to meet the new standards.

This age of discord means that the potential for policy “whipsaw” increases and forces companies to gamble on where future regulation will go. In addition, it increases the stakes in elections, making them more “life and death,” and thus encourages not only more lobbying efforts but also election interference.

Although the media will focus on what just passed, investors and companies have to look beyond the present and estimate how likely it is that policy will change in the future. That means forecasting political outcomes as well as the path of development and future consumer demand. It will be interesting to see how automakers react to this change.

[1] http://ec.europa.eu/eurostat/web/products-eurostat-news/-/EDN-20180803-1?inheritRedirect=true&redirect=%2Feurostat%2F and https://www.youtube.com/watch?v=e3WkVUe8xRI

[2] https://www.ft.com/content/425448b8-9674-11e8-b747-fb1e803ee64e?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[3] https://www.nbcnews.com/business/autos/trump-administration-revokes-obama-era-fuel-economy-standards-n896846