Daily Comment (August 28, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Happy Friday! Equity markets are moving higher this morning; we cover the consumer spending data below. There is a lot happening today. PM Abe, suffering from chronic digestive track issues, has resigned. We recap the historic Powell speech from yesterday. Hurricane Laura news follows. We have a comment about the current political environment. These items are followed by our regular update on China and foreign news. We wrap up with economic news and a pandemic update. And, being Friday, a new Asset Allocation Weekly is available, along with the associated podcast and chart book. This week, we take a look at the impact of expanded unemployment insurance and employment behavior. Let’s get to it:

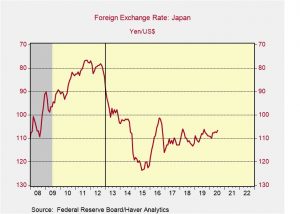

Abe: PM Abe, the longest serving leader in the G-7, is stepping down. He suffers from ulcerative colitis, and apparently his condition has deteriorated to the point where he can no longer continue his duties. He has been the longest-tenured PM in Japanese history, holding the leadership position since 2012. Under Japan’s parliamentary rules, the Liberal Democratic Party will replace Abe without new elections. The most likely successor will be Shigeru Ishiba, the current Defense Minister. Perhaps his most important legacy is that he was able to weaken the JPY without triggering a negative response from the U.S.

This chart shows the JPY on an inverted scale, with a vertical line showing when Abe took office. He was able to engineer a noteworthy depreciation of the currency which has supported Japan’s economy. We would not be surprised to see the U.S. pressure the next PM to allow the currency to appreciate; this would be expected regardless of who wins in the U.S. November elections.

What does Abe leave unfinished? The biggest failure of his administration was his inability to change Japan’s constitutional defense posture to allow for offensive military actions. If the U.S. is reducing its position in the world, Japan will need to be able to protect itself. If the U.S. does force the JPY to appreciate, Japan may need to offset that economic pressure; defense spending might help in that endeavor.

The Fed: Jay Powell spoke yesterday and made it clear that the singular focus on inflation suppression that dominated the Fed’s thinking from 1978 to 2006 has ended. We have lived through a period, from 2007 to the present, where financial stability was the key policy goal. That policy led to interest rates being held at low levels well beyond the expectations of market participants. The chair indicated that the focus of monetary policy is essentially going to shift toward boosting employment. Although various Fed chairs have paid lip service to the employment mandate, in reality, it was clear that preventing a return of rising inflation expectations was driving policy.

Market action yesterday suggests that participants believe the chair and are preparing for higher inflation. Here are the key issues going forward:

- How comfortable is the FOMC with rising long-term interest rates?

- If the Fed wants to support the financial system, it will let long-term rates rise and steepen the yield curve. A steeper curve should support bank lending and encourage investors back into the fixed income markets.

- However, there is likely a limit to how high of a rate the Fed will tolerate. As we noted yesterday, we are seeing a nice rise in real estate activity, which is led by the millennial generation. Higher mortgage rates will tend to undermine that trend, although some of that problem could be offset by falling home prices.

- Another complicating factor is that rising rates may trigger financial stress. In March, the fragility of the financial system was revealed; the Fed stopped the problem in its tracks by aggressive rate cuts and a broad spectrum of programs to support numerous areas of the financial system. Allowing rates to rise could unexpectedly trigger problems in the financial system.

- Simply put, this news today is bad news for long-duration bonds. Anytime a central bank signals that it is willing to allow inflation to rise on a permanent basis, the inflation expectations should be lifted, which is arguably the most critical element to long-term interest rates. At the same time, the Fed can control the level of long-term rates by purchasing bonds and expanding its balance sheet. Bond vigilantes only exist if the Fed allows them to, at least for assets it is willing to purchase.

- Is there a rate level on bonds that would trigger yield curve control?

- The Fed may prefer a steeper curve, but how steep and how fast it steepens is an issue. Let’s say the Fed wanted to allow the fed funds/10-year T-note spread to widen to its non-recession average of 1.41% observed since 1981. Assuming fed funds of 9 bps, that would require a 10-year T-note yield of 1.32%. That level is certainly not abnormally elevated compared to history but would jar the markets if it happened quickly. If market participants concluded that this average was the terminal rate, the Fed may need to intervene to at least slow the rise.

- It should also be noted that rising long-term rates may end up being a negative factor for employment. If the Fed is serious about reducing unemployment, it may need to control the yield curve to achieve this aim.

- What are potential market effects?

- We do expect the Fed to eventually engage in yield curve control because a sharply rising long end will thwart its employment goals. As a consequence, the policy change will tend to reduce the diversification power of long Treasuries. Let’s assume the Fed sets a ceiling of 1% on 10-year T-notes. If the non-capped rate was really 1.50%, and the economy weakened or inflation fell, the non-capped rate would need to fall 50 bps before there would be any protective effect from falling long-duration rates. It has been our position that the protective impact of duration to a portfolio has likely been exhausted. The policy announcement appears to have confirmed our position.

- We may see investment-grade corporates become the signaling device for the financial markets. That would mean we could see credit spreads rise in the absence of credit problems but due to rising inflation. To clarify, if the Fed caps the 10-year T-note but not the 10-year investment-grade corporate, inflation concerns should cause the latter yield to rise, which may be incorrectly viewed as increasing credit stress. This is a factor that bears close monitoring. We are also assuming the Fed won’t cap corporate rates but admit we could underestimate how aggressive the Fed will be in lowering unemployment.

- Precious metals fell yesterday, although we are seeing a recovery this morning. There is a general belief that gold is an inflation hedge. That’s not exactly accurate. A better way of thinking about gold is that it is a hedge against currency debasement and negative real interest rates. In a situation of 10% inflation and 15% interest rates, gold would suffer. However, with 2% inflation and zero interest rates, gold will do just fine. We remain bullish on precious metals, and the Fed’s shift, if anything, supports that position.

- We have been expecting dollar weakness; the Fed’s policy position supports a weaker dollar. This is good for commodities and foreign stocks.

- Equities tend to be a better inflation hedge than bonds. But, rising inflation does tend to weaken multiples, and if tighter labor markets cause narrowing profit margins, the change in Fed policy may not be all that supportive for equities over time. However, in the short run, with ample slack in the economy, there is nothing bearish about the change in Fed policy for stocks.

Laura: The storm was massive, although initial reports suggest the damage was less than one would have expected given its magnitude. Lake Charles may have suffered the worst devastation from the storm. It does appear that refineries were mostly spared, which led to a sharp drop in gasoline futures prices yesterday. The latest reports indicate there were six fatalities.

Political news: We generally haven’t covered either convention in great detail; these are events for the party faithful and rarely offer much for markets. That doesn’t mean we are not paying attention. Underneath all the party “talk” we continue to watch coalition shifting within the parties. The GOP is becoming increasingly populist, the right-wing variety. As it does so, its capital-supporting policies implemented by Ronald Reagan are slowly being reversed. One sign of this is that the GOP is pushing for greater government involvement and investment in the economy. Since Reagan, the Republicans have generally been the party of small government and supportive of the private sector. As it becomes more populist, the resistance to government intervention is falling. This shift is being noticed; the Chamber of Commerce is backing more Democrats for congressional level offices, a controversial move within the Chamber.

China news:

- Buzzfeed has a long report detailing the construction of the Uighur detention camps, including some digital sleuthing to remove an attempt by someone to obscure satellite photos. China’s suppression of the Uighurs is not exactly news, but these reports add detail to the systemic lengths the Xi regime has taken to prevent any degree of autonomy for this ethnic and religious group.

- Defense Secretary Esper made a speech yesterday calling for allies in the Pacific to unite against the Chinese threat. It is just another in a long series of talks by U.S. officials making it clear that China is being seen as a threat.

- We rarely quote Global Times, a Chinese tabloid run by the CPC. We consider it a mere mouthpiece for CPC propaganda. However, we do monitor it for occasional articles that may reflect internal thinking of the CPC leadership. Today there was a report on what a Biden presidency would look like. The report argues that American policy toward China has changed, and regardless of who occupies the White House, there is no going back to American permissiveness toward China. That doesn’t mean there would be no differences. Under Biden, the use of tariffs would be reduced, but there would likely be a greater emphasis on human rights.

- TikTok will likely sell its U.S., Canadian and New Zealand operations in the next few days.

- Chinese companies are issuing dollar bonds; interestingly enough, they have been able to fund these bonds without tapping U.S. investors. There are enough dollars in Asia to meet the supply of these issues.

Foreign news:

- Putin is warning protestors in Belarus that there are limits to how much unrest Moscow will tolerate. According to reports, Putin has created a squad of security personnel he will send in to restore order. At the same time, it is clear Putin has little regard for Lukashenko and would likely be just fine with someone else running Belarus.

- New Zealand’s stock exchange has been hit hard by a series of cyberattacks that have forced the exchange to close trading for parts of the past four sessions. The country’s spy agency will be used to try to protect it from further attacks. It is not clear who is responsible.

- We are seeing protests around the world; Thailand has been seeing increased activity.

Economics and Markets:

- The World Bank is delaying its publication of its widely followed business competitiveness report due to data irregularities from four countries—China, Azerbaijan, the UAE and Saudi Arabia. There have been accusations that countries are manipulating the data to improve their rankings. This issue is sensitive; there is a dearth of such reports, and if the World Bank is being influenced by political factors then the usefulness of such reports is in question.

- There is modest progress on new stimulus talks; we don’t expect anything of substance until later in September.

COVID-19: The number of reported cases is 24,492,452 with 832,433 deaths and 16,027,948 recoveries. In the U.S., there are 5,869,877 confirmed cases with 180,857 deaths and 2,101,326 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. In the Rt data, 18 states are showing rising infection rates, while 32 have declining rates. Washington State has the lowest, and South Dakota has the highest.

Virology:

- The U.S. government has purchased 150 million of the new Abbott Labs (ABT, 111.29) rapid testing kits.

- Germany is facing a resurgence of cases. Although it isn’t reversing its recent reopening, further measures will be on hold until cases decline. Most notably, it is keeping schools open, although reports suggest that some schools are being forced to retreat as infections return.

- The WHO did not visit Wuhan as part of its investigation of China’s pandemic response.