Daily Comment (August 28, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

It’s midweek; halfway to Labor Day weekend! Boris moves against Parliament, Parliament moves against Boris and we are reacting to the Bill Dudley op-ed. Here are the details and other items we are watching:

Brexit: For the first time since 1948, PM Johnson has asked Queen Elizabeth to suspend Parliament on September 10, only a week after it returns from summer break, until October 14, which would severely limit the ability of the MPs to block a no-deal Brexit. There are currently court challenges against the move in Scotland and former PM John Major has promised similar action in English courts. By convention, the sovereign accepts the PM’s request for proroguing Parliament, although it is possible she might reject the suggestion. The move increases the odds of a no-deal Brexit. The GBP tumbled on the news. The opposition in Parliament is trying to cobble together a response, which seems similar to what was used to delay Brexit at the end of March. Meanwhile, the Johnson government is pushing for additional fiscal spending, which is normal if one is preparing for elections.

We note the move comes a day after Boris Johnson told German Chancellor Angela Merkel and European Commission President Jean-Claude Junker that he was willing to accept minor changes to the Brexit agreement if they agreed to changes to the Irish backstop. This proposal was likely to assuage fears of a broader rewriting of the bill. That said, by suspending Parliament, Boris Johnson’s Brexit agreement would likely force MPs to accept his agreement as-is or nothing at all. As a result, the likelihood of a no-confidence vote and a no-deal Brexit is extremely elevated. Following the news, the pound weakened significantly against the dollar due to growing uncertainty of Brexit.

The Dudley op-ed: Bill Dudley, the former president of the NY FRB, penned an essay for Bloomberg where he suggested that the Fed should not accommodate the president’s trade policy, essentially acting as a governor against the trade war. His concern is that by reducing rates to offset the negative effects of tariffs, the Fed is enabling the president’s trade policy.

As a private citizen, he has every right to express his opinion. Additionally, he isn’t the first person to make such observations. However, as a former member of the FOMC and permanent voter on monetary policy, the expression of his views is dangerous, even if he firmly believes them.

- The Federal Reserve is an unelected body. Although the Fed governors are approved by the Senate, the regional bank presidents are not so there is limited democratic oversight of monetary policy. The U.S. government does give power to unelected organs of government but limits their scope by giving them specific mandates. The Fed has a relatively simple mandate, full employment and low inflation with fairly limited tools to meet these goals. After 2008, the Fed veered closely into fiscal policy, but we do note that instead of simply recapitalizing the banks itself, which it had the wherewithal to do, Chair Bernanke insisted on the passage of TARP to ensure recapitalization had democratic legitimacy. We let the Fed do a lot with its powerful tools, but with limited scope. Tensions between the legislature, the executive and the Fed are nothing new, but Dudley’s recommendations would suggest that the Fed should take steps to thwart the desires of elected officials. This may only be done within the strict limits of its mandate, not to simply stop a policy it may not favor.

- Dudley’s comments as a former official are inappropriate because they will apply a political taint on the central bank. A theme that runs through populism is that the elites are a cabal that use the tools of government to support the goals and aspirations of the elite. Populists of all stripes are, at best, jaded over free trade or, at worst, support autarky. For a former central banker to suggest that the Fed should engage in behaviors that undermine an administration’s trade policy simply confirms to populists that the “game is rigged.”

- A political taint for the Fed raises worries that yet another non-elected part of government is becoming politicized. For those in the political sphere, manipulating bodies like the Fed or the Supreme Court is fair game because their goal is to further their political aims. That is what power is all about. We create these apolitical bodies to limit the scope of political power, to make groups in government that can make decisions based on considerations other than simply political concerns. When these apolitical bodies shift into policy advocacy, problems develop. In general, one can either change the world or understand it, but you can’t do both. If one decides to change the world, everything becomes a tool to meeting that goal. If one decides to understand the world, they must avoid crossing over into altering the world, because at that point bias sets in. Some have argued that we are political at heart and no one is unbiased. We disagree, but the costs of being unbiased is that one cannot cross the line into advocacy. History has shown periods when the Supreme Court appeared to venture into advocacy; once that occurs, faith in the court diminishes and its decisions can be seen as merely political. Justice Roberts appears to be disappointing some in the political sphere for not moving toward their goals, but we suspect the chief justice is trying to uphold the integrity of the institution. The concern now, in the wake of Dudley’s comment, is that decisions made by the Fed will be subject to political analysis. In other words, Dudley may have inadvertently undermined the integrity of the Federal Reserve.

The Fed has officially rejected Dudley’s comments, as it should, but the damage has been done. Chair Powell was already facing a difficult task of conducting monetary policy under a constant barrage of criticism. Now, Dudley’s comments can be used to frame unpopular monetary policy decisions as having a political agenda.

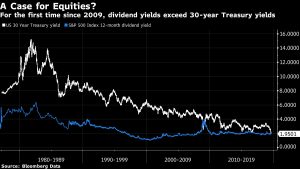

A rare occurrence: Yesterday, the dividend yield on the S&P 500 rose above the yield on the 30-year T-bond.

The 30-year T-bond has a relatively short history; the first issuance occurred in 1977. The only other time this occurred was in 2009 and was due to the collapse in equity prices. This time, it was due to the drop in Treasury yields.

Conte returns? The Five-Star Movement and the Democratic Party are close to coming to an agreement that would avoid new elections. Under the new government, Guiseppe Conte would return as prime minister, with Five-Star’s Luigi Di Maio returning as his deputy, and co-deputy Matteo Salvini would likely be replaced by a member of the Democratic Party.

Last week, the parliament dissolved after the League Party decided that it no longer wanted to form a coalition government with the Five-Star Movement. To say that the relationship between the two sides was rocky from the start would be putting it lightly as the two parties represent populist wings of opposite sides of the political spectrum. Following the dissolvement of the coalition, Italian President Sergio Mattarella gave the parties the opportunity to form a government in order to avoid snap elections; within that time, the Five-Star Movement held talks with the Democratic Party. In the event of an election, the co-deputy and League leader Matteo Salvini, who helped initiate the procedure, is favored to take over as prime minister. Optimism about a possible coalition between the Democratic Party and the Five-Star Movement has resulted in a rally in Italians bonds.

Big Tech project on hold: A plan to build an undersea cable that would link the U.S. and mainland China has been put on hold due to national security concerns. The Justice Department has concerns over one of the Chinese backers, Dr. Peng Telecom & Media Group Co. (600804, CNY 6.81). U.S. official involvement is another example of the growing distrust between the U.S. and China.

Russia-Turkey: At the opening of a major airshow in Moscow yesterday, President Putin personally gave Turkish President Recep Tayyip Erdogan a tour of Russia’s newest stealth fighter jet, the Su-57. Putin continues to take advantage of Turkey’s growing estrangement from the West (see our Weekly Geopolitical Report from August 5). Ankara’s purchase of a Russian air defense system this summer prompted President Trump to prohibit any sales of the U.S. F-35 stealth fighter to Turkey, so Putin is now dangling the Su-57 and other aircraft in front of Turkey with the hope of pulling Ankara further onto Russia’s side.