Daily Comment (August 20, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

We are seeing some reversals of recent trends in the wake of the Fed minutes. Currently, equity markets are lower this morning. Some of the weakness is being attributed to the lack of new fiscal stimulus, but we think a better case can be made that the Fed disappointed, which we discuss below. We update news on China, the pandemic and Belarus. And, being Thursday, the Weekly Energy Update is available. Here are the details.

Fed policy: The Fed released the minutes of its July 28-29 meeting. Let’s get to the point—the sentence that has roiled the market is this one: “Many participants judged that yield caps and targets were not warranted in the current environment but should remain an option.” Financial markets have been building in the idea that the Fed was going to engage in financial repression. Specifically, the expected policy mix was fixing interest rates across the yield curve, a slow reaction to rising inflation and continued policy accommodation. This has led to low Treasury yields, higher gold and equity prices and narrowing credit spreads. As the above quote indicates, there was a surprising degree of reluctance to embrace the idea. Some of this hesitancy was due to the lack of upward pressure on interest rates (of course, part of the low rate situation is due to market expectations of yield curve control). It was a decided minority (“a couple of participants”) who seemed to express support for the idea. It won’t really be tested until rates rise. But, in the end, it appears the FOMC is in a “wait and see mode,” keeping current policy in place but seems unlikely to add additional stimulus unless there is a decided decline in economic activity. This is not what financial markets wanted to hear. Our take is that Chair Powell is supportive of the concept of yield curve control, but the lack of support suggests the rest of the FOMC isn’t on board yet. At the same time, we think the market’s assessment of the Fed’s future policy is correct; financial repression is likely. The continued process to avoid preemptive rate hikes to quell inflation, the move to average inflation targeting and extensive forward guidance are all part of this policy. It’s just that markets like clarity, and the Fed has little reason to provide it when the financial markets are already enforcing that policy. The real test will be when there is a whiff of inflation; if long-end yields begin to rise, will the Fed tolerate it? We doubt it will. But we don’t know for sure and, apparently, neither do FOMC members.

In the rest of the minutes, the assessment of financial markets and the economy suggested that there was some improvement in economic and financial market conditions, although both were said to be sensitive to pandemic developments. The staff economic outlook was generally upbeat, expecting stronger GDP and higher inflation in 2021 and 2022. However, they did express concerns about a slowdown in H2 2020. Participants were more guarded, noting the unequal dispersion of economic weakness caused by COVID-19. They also expressed that the economy’s path was still highly uncertain; it is not clear if this uncertainty was due to their own analysis or from comments the regional presidents are hearing from their local business contacts. They also expressed concern about the potential lack of fiscal support. The committee members also noted continued risks to financial stability. Overall, this meeting’s tone was “wait and see.” Markets rarely like such indecision.

China news:

- China’s flooding woes continue. Heavy rains have persistently pummeled southern and central China, putting strain on dams, including the massive Three Gorges Dam. Complicating matters is that Typhoon Higos is hitting the coastal areas. If the Three Gorges Dam breaks, it would be a catastrophe and put severe pressure on the Xi government.

- Apparently, Phase One trade talks are not off. When the president said he didn’t want to talk to China, it wasn’t meant to signal that these specific talks were scuttled. Thus, they are delayed for now, but they will occur.

- The U.S. has formally suspended its extradition treaty with Hong Kong in light of the new National Security law.

- The U.S. is increasing the pressure on Chinese tech as the U.S. has essentially denied Huawei (002502, CNY 2.99) access to U.S. semiconductors. Some are calling this a “death sentence.” The sanctions will also adversely affect U.S. and other foreign chipmakers as Huawei is (was) a major customer.

- It is apparent that China is trying to cool tensions. This may be due, in part, to hopes that it will be dealing with a different president after January. In addition, Beijing may fear that tensions could be used as an election issue, and thus is trying to avoid escalation. At the same time, the U.S. is avoiding provocative actions in other areas. For example, Taiwan was not invited to participate in recent large-scale military exercises. Taipei has expressed interest in joining such events.

- At the same time, the drills were quite extensive. Nuclear capable B-2 bombers participated, and the U.S. Navy sent a destroyer through the Taiwan Strait.

- Chinese students studying at major universities are being told when class material may include items that are politically sensitive in China. This may be done to protect the students from harassment from Chinese authorities, but the decision to engage in such warnings has the appearance of “kowtowing” by U.S. higher education.

- U.S. regulators have warned college endowments to divest of Chinese equities that are at risk of delisting.

- The WSJ reports on China’s global efforts to recruit scientists through a network of 600 recruitment stations.

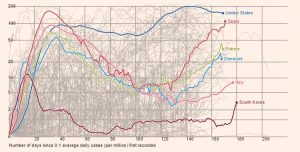

COVID-19: The number of reported cases is 22,427,939 with 788,030 deaths and 14,349,696 recoveries. In the U.S., there are 5,530,247 confirmed cases with 173,193 deaths and 1,925,049 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

- U.S. intelligence agencies have concluded that local officials in China purposely circumvented reporting channels created after the SARS epidemic to prevent the central government from receiving information about COVID-19.

- One of the key goals to reducing the impact of COVID-19 and returning the global economy to some semblance of normal is the development of herd immunity. Immunologists generally argue that if 70% of a population is immune, the risk to those who are not immune is insignificant. Essentially, at the point of herd immunity, the virus can’t find enough people to infect and it dies out. For older Americans, we saw this firsthand with diseases like measles, mumps and chicken pox; our classmates tended to lose class time in the early grades, but by fifth grade, enough people had suffered these maladies that losing time to them was uncommon. New modeling work suggests that herd immunity might be met with only 50% of the population immune. That may mean we are close to herd immunity in some communities. For example, reports indicate that about a third of people tested in the Bronx are carrying the antibody.

- Infection data from California shows that new cases are hitting the Central Valley, a key agricultural area. Farm workers are adversely affected.

- We are seeing a surge in cases in a number of countries that had earlier reduced their case count. The chart below shows new cases per million. Spain has seen a resurgence; South Korea’s increase appears to be driven, in part, by religious services. Night clubs were cited as well.

- The mask debate isn’t just a U.S. issue. The Scandinavian countries have provided very loose guidelines for using masks, citing that the benefits from using them do not offset the social issues of face coverings.

Economics and Markets

- As interest rates decline, it is becoming increasingly difficult for financial firms that usually generate revenue from interest rate spreads to survive. They are increasingly turning to extra fees and slow responses to rate declines. Although these actions support their profitability, they undermine the power of monetary policy.

- For years, Warren Buffett and Charlie Munger have derided gold as an asset. In their latest disclosure report, it turns out they have decided to purchase a position in gold miners. This suggests that even long-time critics are seeing value in an asset designed, in part, to offset currency debasement.

- The real estate industry is warning that it is facing a wave of rent delinquencies.

- Twenty-two percent of college students have decided to delay the start of their college careers until campuses reopen. The declines in enrollment will put additional pressure on cash-strapped colleges.

- Copper prices lifted to +$3.00 per pound on stronger Chinese demand, rising U.S. housing activity and supply disruptions in South America tied to COVID-19.

Belarus: Although Lukashenko has lost the workers and urban dwellers, the security forces remain loyal. There have been anecdotal reports of former security forces rejecting the leader, but these rejections do not appear to be systemic at present. Lukashenko remains adamant that he will remain in power. The EU is trying to walk a narrow diplomatic line; it wants to reject Lukashenko’s actions but doesn’t want Putin to fear he will “lose” Belarus and militarize the situation. Therefore, EU leaders have condemned Lukashenko’s actions, calling the elections a sham, but have not called for a new vote. We could see targeted EU sanctions against individuals in the Lukashenko government. President Putin has warned the EU against “meddling” in Belarus, but Lukashenko should not take comfort that the Russian president wants to keep him in power.

One interesting twist to the Belarus saga is that the country was a participant in China’s belt and road project. Although investment levels were not all that large, China did arrange a line of credit to Minsk. Lukashenko tried to diversify Belarus’s economy away from its deep dependence on Russia and thus cultivated China’s interest. It isn’t clear if this investment will be secure if Lukashenko is ousted.

Navalny poisoned: Russian opposition leader Alexei Navalny is in a coma after an apparent poisoning. His condition appears grave. Poisoning is an oft-deployed tactic of Russian security agencies against political enemies. There is always a risk that such a blatant attack will backfire and lead to unrest; however, we believe that risk is low.

Coup in Mali: Mali has had its share of troubles in recent years. There has been a constant fight against Islamist groups that has drained resources and displaced millions. And, the government was seen as corrupt. Although President Ibrahim Boubacar Keita was elected to office twice, he initially took control after a coup in 2012. Yesterday, elements of the armed forces staged a coup, and the president has left office. The coup leaders are promising to hold new elections soon. Mali is Africa’s fourth largest gold producer; several gold mining companies with operations in Mali suffered a selloff in light of the news.

Brexit: Although talks continue, negotiators are stuck on the degree to which British truck drivers can traverse the EU and conduct business. The U.K. wants drivers to have the ability to move across Europe and make multiple stops and deliveries. The EU sees that as too close to being a member and wants to grant less freedom. Although this issue probably won’t completely derail talks, it does suggest that a number of contentious issues remain; if talks fail, the GBP could decline.

Going postal: No, this isn’t about the recent mail controversy. One of the proposals we have seen circulate would be for the Fed to offer limited banking services to the general public. The banking system appears incapable of providing basic banking services to low-income households, leaving them to the tender mercies of payday check cashers and money orders. The idea is that the Fed could provide basic services, but they would need a venue for such services. In other countries, the venue has been post offices (Japan’s Postal Savings system is perhaps the most famous). Of course, this would be a major expense for the Fed and perhaps for the USPS. However, we note that JP Morgan (JPM, 98.55) has offered to install branch offices in postal stations. This may be a way to head off the threat of competing directly with the Fed or it may offer the Fed a path to providing basic services but use the infrastructure that JP Morgan would provide. We will continue to monitor this idea.

Policy odds and ends: Treasury Secretary Mnuchin has indicated that talks remain stalled but suggested the parties might resume negotiations because the House has returned to deal with the USPS. Speaker Pelosi has suggested she would consider reducing the $3.0 trillion package passed by the House. Republicans haven’t directly responded. Both parties remain divided on the path forward on stimulus. Business leaders are indicating that they probably won’t implement the payroll tax cut executive order because it only delays the tax, setting up a situation where companies will have to send the tax to the Treasury early next year. The order is being dubbed as “unworkable.”