Daily Comment (August 13, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] U.S. equity futures have grinded to unchanged, while global equity markets remain weak. The dollar is higher which is putting downward pressure on commodity markets. Treasuries are mostly steady. Here is what we are watching:

Talking Turkey: The Erdogan government announced a series of measures this morning that have clearly underwhelmed the financial markets.[1]

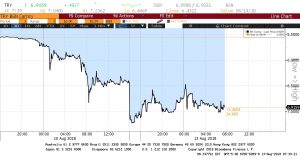

Above is the three-day chart of the Turkish lira (TRY). It did decline below the psychologically important TRY 7.0 level, then bounced and is currently moving sideways. However, it should be noted that the announced measures have not worked to boost the currency. The announced actions so far have included reduced reserve requirements for banks, as if the problem is being caused by lack of liquidity.

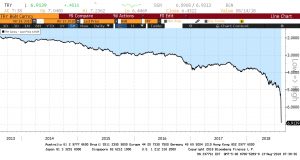

As the chart below shows, the TRY is in a freefall. There are really two paths the country could take to stop what Turkey is experiencing:

The orthodox plan is austerity. The central bank raises the overnight rate 500 bps to squeeze the shorts, and fiscal spending is cut dramatically. The subsequent drop in economic growth and the already weak currency usually leads to a rapid reversal in the current account deficit to stop the decline. The cost is usually a deep economic recession.

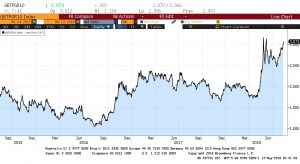

The heterodox alternative is twofold. One path is to effectively abandon the TRY and replace it with a currency board that issues TRY with a tie to dollars held in reserve.[2] Currency boards are effective in ending these currency routs at the cost of losing monetary sovereignty. Depending on which nation the currency board tracks (it is usually the dollar but could be the EUR), the monetary policy of Turkey would become indistinguishable from the monetary policy of the targeted currency used by the currency board. For the most part, authoritarian rulers are loath to give up sovereignty so this option isn’t likely. The other option would be capital controls, which is more likely. We would look for Erdogan to limit outflows through legislative measures. Given that Turkey’s foreign denominated debt is about 30% of GDP, debt service could become problematic and this has led to weakness in European banks and rising sovereign yields in periphery Eurozone countries. The chart below shows the rise in Italian 10-year yields.

The best argument for capital controls is that history tends to show that the driving force behind currency weakness usually comes from the citizens of the beleaguered nation. The citizens of the country in trouble have the best knowledge of actual conditions in the country. As citizens begin to realize the government is resisting orthodoxy, they move quickly to acquire hard currencies, exacerbating the depreciation in the local currency. Capital controls can slow this process.[3] We note that the finance minister (and Erdogan’s son-in-law) has warned Turks not to liquidate foreign currency accounts; the temptation to do so is that Turkey might seize these accounts to service foreign debt.

Our expectation is that Turkey will likely go the heterodox route and implement capital controls. At the same time, look for the Turkish leader to try to work out some sort of face-saving arrangement to get U.S. sanctions relief. That will be tricky for Erdogan; he has already played the “we can make new friends” card that worked so well during the Cold War.[4] Turkey, a key state in containing the Soviet Union, has fewer options that matter today. Yes, Turkey could reach out to Moscow for help but Russia is already in trouble. Iran might be helpful, too, but Ankara is wary of Iran’s power projection in the region. China could be accommodating but will extract onerous terms. In the end, Turkey will have to make a deal with President Trump. Unfortunately, much damage has been done. Even if Andrew Brunson is released immediately without conditions, faith in Turkey’s economic policy has been shattered and will take a long time to restore, even if the U.S. lowers sanctions pressure.

[1] https://www.reuters.com/article/us-turkey-currency/turkish-lira-pulls-back-from-record-low-after-central-bank-frees-up-liquidity-idUSKBN1KY0H5

[2] https://www.wsj.com/articles/erdogan-can-save-the-turkish-lira-1534110387

[3] https://apnews.com/fb982fad4cfa49dd865ca4141b4d2226/Turkey’s-finance-chief:-Action-plan-ready-to-ease-markets

[4] https://www.ft.com/content/12877668-9e4f-11e8-85da-eeb7a9ce36e4?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56