Daily Comment (August 1, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] It’s global PMI day today. As we note below, most of the data came in around expectations. Australia was unusually robust while the U.K. was rather weak. Overall, the data suggests a global economy that is mostly steady.

We had two fed officials speak over the weekend, Dallas FRB President Kaplan and NY FRB President Dudley. Kaplan was mostly hawkish, suggesting that September was a live meeting, but also expressed the need for “patience.” Dudley, on the other hand, spent most of his time talking about the problems the economy faces. Despite these comments, financial markets continue to project a slow path for tightening; for now, the market doesn’t have the probability of an increase greater than 50% until the June 2017 meeting (based on the fed funds futures).

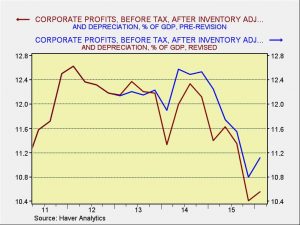

One item we neglected to mention with last week’s GDP benchmark revisions is that corporate profits, after inventory adjustments and depreciation, were revised higher. As the chart below shows, profits were stronger than originally reported, which is supportive for the equity markets.