Daily Comment (August 9, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest news on China’s deteriorating relations with the West and the problems in its domestic economy. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including reports of rising inflation expectations in the eurozone and negative signs regarding the current labor contract talks in the U.S. auto sector.

China-Taiwan-Japan: During a rare visit to Taiwan by a high-ranking Japanese official, former Prime Minister and current Vice President of the ruling Liberal Democratic Party Tarō Asō said the current period of peace in the region is now “tilting toward a time of emergency.” Without specifically naming China and its intention to retake control of Taiwan, he warned that Japan, the U.S., and their allies would only be able to maintain peace in the Taiwan Strait if they bulk up their armed forces enough to deter any military action from a third country. The warning is consistent with the analysis in our latest Bi-Weekly Geopolitical Report, published on Monday.

China-United States: In the U.S.’s latest effort to keep the Chinese military from acquiring cutting-edge technology, President Biden will sign an executive order today requiring U.S. investors to report any private-equity or venture-capital stakes that they take in Chinese firms involved with semiconductors, quantum computing, or artificial intelligence. Under the order, U.S. investors would also be banned outright from making direct investments in specific areas of those sectors.

- The new rules will reportedly be less stringent than China hawks in Congress and the military advocated, probably because of lobbying by business elites and some in the administration who want to limit tensions with China.

- Nevertheless, coming less than a year after the administration’s tough restrictions on sending advanced semiconductor technologies to China, the new rules will surely be seen by Beijing as a further attempt to hamstring China’s economic development. U.S. investment in China has fallen sharply in recent years, but the new rules could push it down even further.

- In any case, the new rules will worsen U.S.-China tensions further, which we continue to believe will dramatically affect the global economy and create risks for U.S. investors in the coming years.

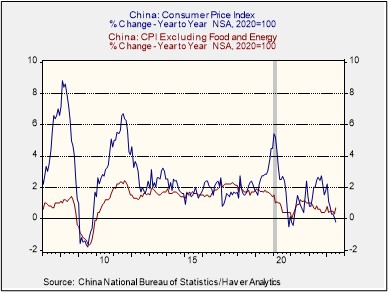

China: In the latest bad omen for China’s domestic economy, the July consumer price index was down 0.2% from the same month one year earlier, marking the first bout of deflation since 2020. Unlike the U.S. and many other developed countries, China experienced little inflation amid the supply disruptions at the end of the coronavirus pandemic, at least in part because the government never provided much financial aid to help households get through the crisis. Now that the pandemic has passed, however, many consumers are focused on rebuilding their savings rather than buying.

- Weak consumption demand and government interference in the economy are also discouraging investment, as is weak demand for Chinese exports. The situation is making it increasingly difficult for Chinese firms to hike prices.

- For the global economy, Chinese deflation translates into lower export prices which may help hold down inflation around the world. On a less positive note, however, low-priced Chinese goods dumped on the global market could weigh on foreign corporate margins.

Eurozone: Despite the deflation in China, a popular gauge of future inflation expectations in the eurozone suggests investors are becoming more pessimistic about price hikes there. The region’s “five-year, five-year forward inflation swap — a measure of the markets’ expectation of price growth over the second half of the next decade — hit 2.66% this week,” compared with the eurozone’s average inflation rate of about 1.3% in the decade before the coronavirus pandemic.

Italy: Prime Minister Meloni’s right-wing populist government was forced to partially backtrack on its surprise windfall profits tax on lending institutions, which we described in our Comment yesterday. It appears the government was unsettled by the big drop in Italian bank stocks yesterday, so it has instead said the tax will be capped at 0.1% of the banks’ risk-weighted capital. That’s about one-fifth of the originally estimated hit.

U.S. Labor Market: In a worrisome sign for the ongoing contract negotiations between the United Autoworkers Union and Stellantis (STLA, $19.34), UAW chief Shawn Fain has complained that concessions demanded by the automaker are a “slap in the face” to union workers. Coupled with militant statements by other UAW officials recently, Fain’s statement underscores that the union is likely to drive a very tough bargain, as workers and their representatives know they have increased leverage amid today’s tight labor market. We suspect the major U.S. automakers will need to agree to significant pay increases and improved benefits to avoid a strike this fall.

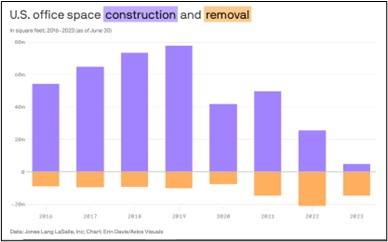

U.S. Commercial Real Estate Market: New figures from Jones Lang LaSalle (JLL, $175.05) show real estate developers demolished 14.7 million square feet of office space in the first half of 2023, while breaking ground on only 4.8 million square feet. That marks the first time in recent memory in which developers tore down more office space than they built. The data provides further evidence of today’s pessimism regarding the prospects for commercial office space.

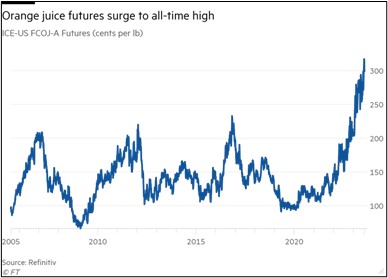

U.S. Orange Juice Market: Nearby futures for frozen concentrated orange juice have hit a record high above $3.00 per pound, reflecting a dramatic decline in Florida’s citrus crop due to a string of hurricanes and tree blight in recent years. Production in the state has fallen from about 240 million boxes per year two decades ago to just 18 million boxes this year.