Daily Comment (August 8, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with new evidence of military aggressiveness from the China/Russia bloc, which we continue to believe will produce risks for investors exposed to China or to companies dependent on China. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a surprise windfall profits tax on Italian banks and a credit-rating cut on several regional banks in the U.S.

China-Russia-United States: It was reported yesterday that almost a dozen Chinese and Russian navy vessels sailed close to the Aleutian Islands off Alaska last week, in what is believed to be the largest such joint operation ever. In response, the U.S. Navy dispatched four destroyers and a surveillance plane to shadow the flotilla.

- Even though the Chinese and Russian ships did not enter U.S. territorial waters and have since left the area, officials are considering it unusually brazen and provocative.

- The incident also highlights our concern about the potential for increased Chinese and Russian naval cooperation.

- Even though China now has the world’s largest navy in terms of the number of its combat ships, it still consists mostly of smaller vessels geared toward defending the waters along China’s coast. Over time, China intends to build a “blue water” navy that can project power globally, but that remains a work in process.

- In contrast, the Russian navy, which ranks as the world’s third-largest (just behind the U.S. Navy) has long been able to project power globally, especially via its advanced submarines. Many of its ocean-going surface ships have also been modernized with highly capable cruise missiles, as shown in the war in Ukraine.

- If the Chinese and Russian navies set their minds to cooperating more fully and building synergies, and if they build up enough bases or port rights in friendly countries, they could potentially help the China/Russia bloc become a much more formidable military force around the world.

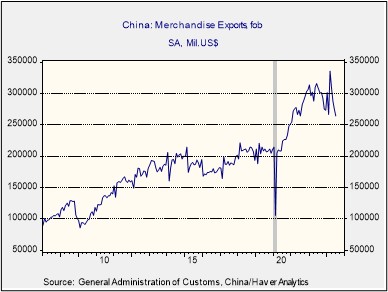

China: July exports were down a whopping 14.5% from the same month one year earlier, after June exports were down 12.4% year-over-year. Along with similarly bad export declines for other Asian economies, such as South Korea, the figures show how regional economies are being hurt as Western consumers shift from pandemic-driven goods consumption to post-pandemic services. For China, the export challenges also exacerbate domestic issues, such as the state’s increasing interference in the economy and worsening demographics.

Russia-Ukraine War: As Ukraine’s forces continue their slow, plodding counteroffensive against the Russians in the eastern parts of the country, new reports suggest that the U.S.’s recent provision of “cluster munitions” has helped improve their progress. The new munitions are reportedly helping the Ukrainians hit concentrations of Russian infantry, groups of vehicles, and other targets, allowing Kyiv’s forces to make better progress than before.

Pakistan: Prime Minister Sharif said he plans to dissolve parliament on Wednesday and transfer power to a caretaker administration, a step that would normally lead to new elections within 90 days. However, a Sharif-led committee on Saturday also said it would redraw the country’s electoral districts in response to Pakistan’s latest census, potentially pushing the next elections into next year.

- If the elections are postponed until early 2024, it would produce a prolonged period in which the country is led by a government not backed by parliament.

- Coupled with the recent jailing of opposition leader and former Prime Minister Khan, the moves suggest Pakistan’s democracy is being steadily undermined. In turn, that could produce further political and social instability.

Italy: The right-wing populist government of Prime Minister Meloni unexpectedly announced a windfall tax on bank profits generated by higher interest rates. According to the government, the tax proceeds will be used to provide relief to families hurt by higher interest costs. The move follows Meloni’s recent criticism that banks have been too slow to boost interest payments to depositors. As might be expected, the announcement is weighing heavily on Italian banking stocks so far this morning.

U.S. Energy Prices: With global crude oil prices trending up again in response to OPEC+ supply cuts and stronger-than-expected demand, retail gasoline prices last week rose to an average of $3.87 per gallon, reaching their highest level since last November. If gasoline prices continue to rise, they could start to put ever more upward pressure on the consumer price index, potentially reversing some of the recent moderation in overall price inflation.

U.S. Banking Industry: Moody’s (MCO, $342.41) said it has cut the credit ratings of 10 key regional banks and is reviewing the ratings of six other institutions, based on concerns that the Fed’s continued interest-rate hikes will undermine their funding and impinge on their capital. Each cut was only one notch, and all the banks kept their investment-grade rating. Nevertheless, the move has rekindled concerns about mid-sized lenders like those that failed in March. That’s helping push down the value of risk assets so far this morning.

U.S. Commercial Real Estate Industry: Leading mortgage real estate investment trusts Blackstone Mortgage Trust (BXMT, $22.79) and KKR Real Estate Finance Trust (KREF, $12.51) said they extended no new commercial mortgage loans in the first half of 2023. Before this year’s problems in the sector, the firms would have likely provided billions of dollars of new loans each quarter.

- The REITs’ pullback in lending offers further evidence of just how much investors have soured on the prospects for commercial real estate, especially office buildings.

- Eventually, the sentiment on commercial real estate will hit rock bottom and potentially produce great bargains in the REIT sector. However, we believe it’s still too early for that to happen.