Daily Comment (August 6, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a flat open this morning. We begin with a discussion about the effect the new variant may have on the recovery. Our international news coverage includes escalating tensions between Israel and Lebanon and India’s removal of a controversial tax. U.S. economics and policy news are up next, with details about the infrastructure bill. China news follows, and we will end with our pandemic coverage.

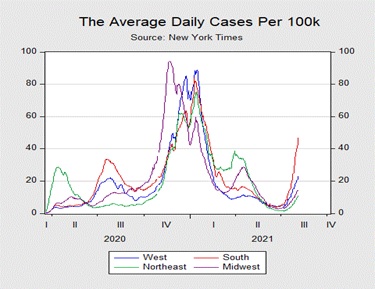

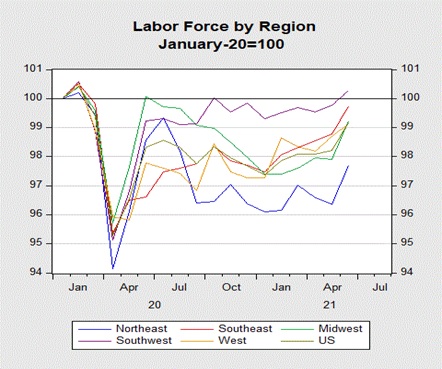

State Labor Force: As new COVID-19 cases spread throughout the country, there may be a glimmer of hope that the recovery will not be significantly affected. Although infections are rising throughout the U.S., most of this increase has been concentrated within the Southern region. Average daily cases per 100,000 in the South are almost double its nearest competitor. Despite the increase in cases, the political situation in the South makes the likelihood of new restrictions doubtful. As a result, this region should remain relatively stable regardless of the rise in infections. Additionally, the fact that southern states have the lowest vaccination rates compared to the rest of the country suggests that hospitalization rates will likely be manageable for other parts of the country. Hence, the chances of another lockdown are relatively small.

Despite having higher infection rates, the South has seen a faster labor force recovery than its peers. As of June, the labor force in the Southwest and Southeast regions has returned to their January 2020 levels. Although there have been new restrictions imposed in certain states, most notably in New York, it should be worth noting that these states are more prepared than they were in December of last year when the country saw a similar uptick in cases. We believe that although the employment data may be relatively weak in the coming months, the impact of the variant on the labor market, as well as the broader economy, may not severely derail the recovery. That being said, the spread will likely not ease concerns of potential workers who are sitting out of the labor market until the pandemic is better controlled.

International news:

- Prime Minister Narendra Modi’s government removed a controversial tax that would allow the government to impose taxes retrospectively on foreign investment. The move comes as India struggles to get its economy back on track following pandemic-related setbacks.

- On Wednesday, Israel carried out airstrikes in Lebanon. The attack was in response to a barrage of rockets launched from southern Lebanon into northern Israeli territory. Israel has attributed the attack to Palestinian terrorist groups operating within Lebanon. On Friday, Hezbollah responded with missiles of their own toward military outposts along the border of the two countries. In its defense, Hezbollah explained that its response was due to Israeli airstrikes within the country that killed two of its operatives.

- An Eyewitness report suggests that Tigrayan forces have taken control of Lalibela. The town is known for its orthodox churches and is regarded as a culturally important site by the United Nations. The report has not been verified.

- Brazilian President Jair Bolsonaro’s request to have printed ballots in case of an electoral challenge was denied by the Brazilian congressional committee. Bolsonaro has argued that electronic voting machines cannot be trusted and warned that he may not accept the result of the elections if he loses. Over the last few months, Bolsonaro has seen a significant drop in popularity due to his handling of the pandemic and the economy. His insistence on printed ballots appears to be a way to delegitimize the election in case he is defeated.

Economics and policy:

- President of the AFL-CIO labor organization, Richard Trumka, died unexpectedly on Thursday. He was an ally of President Biden. The Federation’s secretary-treasurer, Liz Shuler, will take over as president until a successor is elected.

- S. President Joe Biden directed the Department of Homeland Security to offer a “safe haven” for Hong Kong residents who fear returning home.

- The Congressional Budget Office (CBO) announced that the infrastructure bill does not pay for itself, contradicting the claims of the bill’s negotiators. The CBO report claimed the federal budget deficit would expand by $256 billion.

- In other news, there seems to be more clarification on the provision within the infrastructure bill regarding how cryptocurrency will be reported to the IRS.

- In an effort to reduce carbon emissions, President Biden introduced a plan that will expand upon the tailpipe regulations from the Obama era to help push Americans toward electric vehicles. The plan will look to strengthen auto mileage standards and implement more stringent auto pollution rules for passenger vehicles and heavy-duty trucks. The president is also pushing for 500,000 electric vehicle charge stations.

- A software update in Apple (AAPL, $147.06) will scan the phones for child abuse imagery. Researchers fear the update could lead to an increase in surveillance of phones.

China:

- Antitrust regulators in China are preparing to impose a $1 billion fine on food delivery platform Meitaun (MPGNY, $54.97). Regulators have accused the firm of using its position to disadvantage small companies. The latest fine represents a larger crackdown by Chinese authorities as a way to reign in tech firms.

- Australia is expected to introduce new powers that will allow it to target individuals who are associated with human rights violations. The proposal is believed to be aimed at Beijing, following its treatment of Uyghurs and dissidents in Hong Kong. Those believed to be affiliated with human rights violations could be subject to sanctions and a travel ban.

- Chinese semiconductor foundry company SMIC (0981, HK$28.15) plans to build two new manufacturing plants in Beijing and Shanghai. The new plants are part of China’s broader goal of being more self-reliant. However, possible U.S. restrictions could prevent it from receiving the production equipment these factories need to operate.

COVID-19: The number of reported cases is 200,939,775 with 4,267,859 fatalities. In the U.S., there are 35,440,509 confirmed cases with 615,320 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 403,047,945 doses of the vaccine have been distributed, with 348,966,419 doses injected. The number receiving at least one dose is 193,199,353, while the number of second doses, which would grant the highest level of immunity, is 165,637,566. The FT has a page on global vaccine distribution.

- Leading U.S. infectious disease expert Dr. Anthony Fauci announced that the country would start to give additional booster COVID-19 shots to people with compromised immune systems. The booster is still waiting to be authorized for emergency use.

- Moderna (MRNA, $416.26 ) announced that its COVID-19 shot was 93% effective four to six months after the second dose. This is a better outcome than its competitor Pfizer (PFE, $45.06), which had a reported effectiveness rate of 84%.

- China has seen an increase in coronavirus cases in the mainland. In the past, China has dealt with containing the virus through lockdowns. At this point, it is unclear whether such measures will be used this time around while the country tries to maintain growth.

- The Biden administration is considering using regulatory powers and the threat of withholding federal funds from institutions as a way to encourage people to get vaccinated. The proposal will likely impact long-term care facilities, cruise ships, and universities.