Daily Comment (August 5, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. Overall, it’s a rather quiet trading day so far. U.S. equity futures are edging higher, although recent market action suggests it may not hold. Our coverage begins with comments from Fed officials who are signaling the end of accommodative monetary policy. It’s been a year since the fertilizer explosion in Lebanon; conditions have become dreadful. We start our regular reporting with economics and policy, and China news follows. International news is next, and we close with our pandemic coverage.

The Fed: Vice-Chair Clarida spoke yesterday and indicated that the economy was progressing at a pace that would lead to the removal of stimulus by 2023, with announcements to that effect, such as tapering, starting later this year. The financial markets didn’t like the message; bond yields rose, equities fell, and commodities slumped. Clarida is important. Using the Dudley Rule, the three most important messengers from the Fed are the Chair, the Vice-Chair, and the head of the NY FRB. According to Dudley, these are the opinion leaders, and as long as they stay unified, the level of dissent doesn’t really matter. Clarida’s positioning appears to us to be out of sync with Powell and Williams, which could mean evidence of policy dissension later this year. At the same time, Clarida’s term will end in January, and his messaging will likely prompt Biden to pick a dove to replace him. Earlier this week, the newest governor also pushed for an accelerated timeline, a similar message spouted by his former boss, St. Louis FRB President Bullard. Fed tightening will come at some point but preventing a repeat of the “taper tantrum” will be very difficult to prevent.

The unending crisis in Lebanon: It’s been a year since the massive explosion at the Port of Beirut. The explosion has accelerated the collapse of the state. Conditions have become abysmal. Inflation is rampant, reaching nearly 85% last year; the exchange rate has collapsed, with the Lebanese pound losing 95% of its pre-crisis value. Electricity generation is unreliable and diesel for private generators is becoming scarce. Water systems are failing. This podcast offers valuable background on the crisis. So far, the crisis has been contained in Lebanon. Israel occasionally has skirmishes with Hezbollah, which dominates the government. And although conditions in Lebanon are awful, they are worse in Syria, its neighbor. The longer-running problem is that another failed state in the region will trigger refugee flows, destabilizing neighboring nations and spreading to Europe.

Economics and policy: The eviction moratorium may not last, and negative nominal interest rate bonds are expanding again.

- The Biden administration is using the CDC to extend the eviction moratorium. Their legal rationale is shaky, and the courts may overturn the measure, leading to foreclosures and evictions.

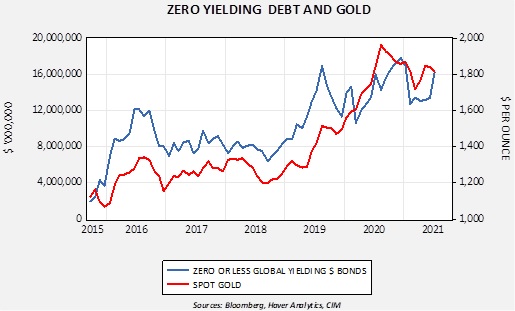

- The bond rally seen in the U.S. over the past quarter is sending global yields into negative nominal territory. The stock of negative-yielding debt is up to $16 trillion. Generally speaking, negative yields tend to support gold prices.

- Many employers struggle to find seasonal help. Tourist or agricultural establishments often rely on foreign seasonal workers who come for the summer and return home in the fall. The U.S., under the H-2B program, offers J-1 visas for such workers. However, COVID-19 issues have disrupted this process. As reopening occurs, seasonal firms are scrambling for workers. Domestic workers usually prefer year-round employment.

- Early indications suggest that the majority leadership in Congress will forego passing the debt ceiling increase in reconciliation and will force GOP members to vote to expand it as well. Although this action might take away the political potency of the measure, it is risky because it may trigger a government shutdown in the fall.

- The crypto industry is reacting against tax proposals, trying to narrow who is considered a “broker” of cryptocurrencies.

- The pandemic has scrambled the global logistics industry.[1] One problem that has emerged is that shipping containers, the backbone of global shipping, are ending up in the wrong places. Much of this is because the U.S. is importing much more than it is exporting, meaning that containers are piling up here when they are needed elsewhere.

China: We continue to monitor China’s regulatory policy.

- Investors continue to struggle with the evolving investing environment. We continue to monitor the situation closely. Although it is still uncertain which firms and industries will avoid problems and which will be targeted, we notice social media and software seem to be catching most of the scrutiny. Manufacturing—companies that make things—seem to be given a wider berth. Overall, the CPC seems to be focusing on three areas:

- Antitrust—the Xi regime appears to view size alone as an area of concern. China has had antitrust rules in place since 2008, but active enforcement didn’t occur until last year. We note this issue isn’t just one for China; there is an active trend in the U.S. to overturn the Bork Rule, but so far, Beijing has been much more effective in this arena than Washington.

- Data security—it’s really hard to know what data are critical and what information doesn’t pose a threat. China has noted that the NSA seems to capture data first and ask questions later. This stance seems to have led Chinese regulators to try to prevent ANY data from falling into foreign hands. So, firms that collect data are being forced to isolate to China in all matters.

- Disorder—capitalism is disruptive. Joseph Schumpeter’s description of “creative destruction” details how free enterprise creates conditions of unending stress. China tends to view disorder and disruption as dangerous.

- So, what is our best guess about what is going on (at least for now)?

- Much of this is industrial policy. As noted above, Beijing wants to direct resources to industries they consider important. Every engineer it can move from gaming to chip production is a win. There are flaws to this thinking; it suggests there are only so many engineers, so they must be marshaled, where, in reality, having gaming might create more engineers. However, that sentiment isn’t making it in the Politburo.

- Regulatory turf wars may be part of this too. Regulators get rewarded for regulating, and we may see a fight among regulators to determine who will be the most powerful.

- Like in the West, there is rising populism in China. The “lying flat” movement and the pushback against “996” are part of the anger against inequality and the difficult labor environment. Beijing may be trying to get in front of these issues.

- The action of regulators has created conditions of volatility, and it will be difficult to unwind that sentiment. In other words, Chinese equity prices will likely build a discount that will simply reflect regulatory risk.

- China is also cracking down on firms thought to be hoarding critical supplies.

- Equities are not the only market that has faced government action. China has released strategic stockpiles of commodities in a bid to reduce prices. So far, the actions have reduced the upside momentum of prices but have failed to bring prices down significantly.

- One little thing we noticed is that two Chinese cyclists who won medals at the Olympics wore Mao pins at their awards ceremony. Not only is this against Olympic protocol, but it also suggests a “great leader” worship that Deng tried to end. Xi has fostered this sort of activity, and this episode suggests it is becoming an acceptable practice.

- Tensions with Taiwan remain elevated. Civil society groups that act to help dissidents leave China are starting to fear that their activities will be next on Beijing’s radar. Taiwan officials confirm that U.S. advisors were present at Patriot missile tests. Yesterday, the Biden administration approved arms sales to the island.

- New research offers an insight into how China structures its sovereign loans. Two items are interesting—the bonds do not participate in the Paris Accord, which is a forum for dealing with default. The other is that China includes language that allows it to call the loan based on certain behaviors, such as increased fiscal spending. The former means that default must be dealt with bilaterally, giving Beijing leverage. The latter is common with commercial loans but usually not with sovereign ones because they infringe on the sovereignty of the borrower. China appears less concerned about this issue.

- Evergrande (EGRNF, USD, 0.65) bonds are being shorted aggressively.

International roundup: Belarus is honing the migration game, and Mexico is suing U.S. gun manufacturers.

- Monitors are seeing a jump in immigrants moving from Iraq to Belarus. From there, they are heading to the EU. It appears that Minsk, like Ankara, is using immigration from the Middle East to try to soften sanctions.

- Facing a constant problem with gun violence, Mexico is suing U.S. gun manufacturers.

- So far, attacks on shipping in the region around the Persian Gulf have had little effect on oil prices. If they escalate further, a spike in oil prices is possible.

- Wildfires are affecting Europe and the Middle East. Greece and Turkey are fighting wildfires, which are being fanned by elevated temperatures. In the latter, President Erdogan is facing political criticism for the response to the crisis.

- Ebrahim Raisi will be sworn in today as the new president of Iran.

COVID-19: The number of reported cases is 200,370,643 with 4,259,874 fatalities. In the U.S., there are 35,334,422 confirmed cases with 614,804 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 402,010,455 doses of the vaccine have been distributed, with 348,102,478 doses injected. The number receiving at least one dose is 192,614,017, while the number of second doses, which would grant the highest level of immunity, is 165,334,987. The FT has a page on global vaccine distribution.

- The WHO is opposing booster shots in the West before the emerging world is vaccinated. Although we understand the sentiment, the idea that an elected official would divert vaccines to foreigners is a non-starter.

- We are starting to see the Delta and Lambda surges affect the economy and sentiment. Recent polls suggest that only 40% of Americans see the pandemic situation as improving, compared to 89% in June. Consumers are beginning to express concern about economic conditions.

- China’s primary measures for dealing with COVID-19 outbreaks are lockdowns. We note that transportation links are being closed due to Delta variant infections.

- Israel, one of the earliest nations to reopen after an aggressive vaccination campaign, is reinstituting some restrictions. However, they are less than a full lockdown.

- South Asia is facing a new surge in infections. India and Thailand are seeing higher cases, and Indonesia now has over 100,000 deaths from the virus.

- Vaccine passports remain problematic, and corporations continue to debate vaccine mandates for their employees. The U.S. is considering requiring proof of vaccination for foreign visitors. Meanwhile, the U.K. has relaxed travel guidance for French visitors.

- One problem that has emerged in the pandemic has been just how little we know about it. Scientists continue to engage in studies to learn more, although the media reporting about these studies has been problematic. Reporters have little ability to judge the power of a study, so the most controversial tends to get the most airtime. With that in mind, a recent study from Imperial College suggests that current vaccines are effective in preventing serious illness. This is consistent with other studies we have seen, and consistency is mostly how the scientific method establishes its findings.

[1] The Odd Lots podcast has held a series of shows on various elements of the logistical snags.