Daily Comment (August 4, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

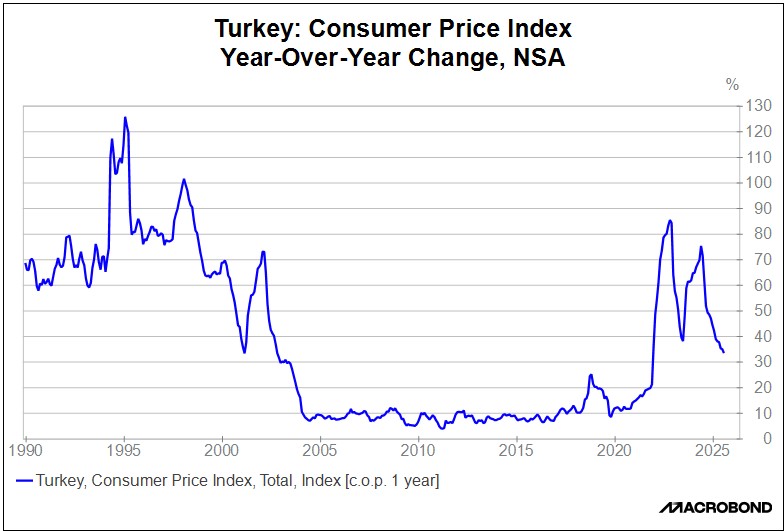

Our Comment today opens with two news items on global energy supplies, which together appear to be weighing on oil prices so far this morning. We next review several other international and US developments with the potential to affect the financial markets today, including a continued slowdown in Turkey’s consumer price inflation and a few observations on President Trump’s firing of the chief of the Bureau of Labor Statistics on Friday.

Global Oil Market: The Organization of the Petroleum Exporting Countries and their Russia-led partners yesterday said they will boost their oil production by a collective 547,000 barrels per day starting in September. The production increases will be led by Saudi Arabia and the United Arab Emirates. Counting the group’s other recent output increases, the September boost will reverse its 2023 output cut of 2.2 million bpd and further raise the risk of excess supply on the global market. Reflecting the news, global oil prices are down about 1.7% so far today.

Brazil: British oil giant BP today announced it has found a major new oil field in the southern Atlantic Ocean about 320 miles off the coast of Rio de Janeiro. The field is believed to contain a mix of oil, gas, and condensate, but BP said it is too early to assess the size or quality of the reserves. Nevertheless, the company said the field is its biggest discovery in 25 years. As of this writing, the news has given a significant boost to BP’s share prices today.

Turkey: The July consumer price index was up just 33.5% from the same month one year earlier, easing from the 35.1% increase in the year to June and marking the third straight month of cooling. The continued slowdown in inflation will likely set the stage for the central bank to cut interest rates further in the coming months.

China: General Secretary Xi’s chief of staff, Cai Qi, today opened a forum of dozens of Chinese academics and scientists in the seaside town of Beidaihe, signaling that the leadership’s annual summer retreat at the resort has begun. Chinese leaders will be ensconced at the resort for the next 10 to 14 days, which means Chinese policy news could be quite limited until late August. With many European countries basically shut down for the summer holidays, that could make for some very slow news days (and quiet financial markets?) for the time being.

Switzerland: Swiss stock prices opened sharply lower today, falling as much as 1.9% before closing down 0.6%. The country’s stock market was closed for a national holiday on Friday, so the downdraft today appears to be a delayed reaction to President Trump’s announcement last Thursday that the US will impose a huge 39% tariff on Swiss imports. Switzerland’s big pharmaceutical firms are seen as especially at risk of Trump’s tariffs.

US Politics: Texas Governor Greg Abbott has called a special session of the state legislature to redraw its congressional election districts in a way that would likely shift five US House seats to Republican control from Democratic control. However, dozens of Democratic state legislators have left the state to deny the needed legislative quorum. Trump is supporting the unusual mid-decade redistricting to boost the Republicans’ chance of keeping control of the House in next year’s mid-term elections.

US Monetary Policy: President Trump last night said he expects to name a replacement within the next few days for Fed governor Adriana Kugler, who resigned on Friday. Outside observers believe the top candidates for the position include Kevin Hassett, director of the White House’s National Economic Council, former Fed official Kevin Warsh of Stanford’s Hoover Institution, and US Treasury Secretary Scott Bessent. Whomever Trump nominates could then be elevated to chair of the policymaking body when current Chair Powell’s term ends in May.

US Economy: In television interviews yesterday, Director of the National Economic Council Hassett denied that President Trump’s decision on Friday to fire the chief of the Bureau of Labor Statistics constituted “shooting the messenger” over the weak July employment report. Hassett cited “partisan patterns” in the data to argue that the president should have his own person heading BLS but declined to provide evidence of problems with the figures.

- Statements by Trump and other administration officials suggest the president was unhappy with the big downward revision in nonfarm payrolls in May and June, as well as the weak job growth in July.

- However, such downward revisions are not unusual. Indeed, they reflect the US’s sophisticated processes to firm up its economic data as new information becomes available. Those processes and the government’s willingness to update its figures have helped make US economic data the gold standard for accurate economic reporting.

- News of the BLS firing on Friday appeared to worsen the day’s sell-off in US stocks, suggesting investors see a risk that this action will politicize the country’s economic data. Investors are likely concerned that future US economic reports could be manipulated to make politicians look good or avoid making them look bad.

- If investors lose faith in the reliability of US economic data, they might also discount the value of US assets, worsening the early signs of capital flight that became apparent early this year. That could potentially drive down prices for US stocks, bonds, and the dollar.

US Defense Industry: Some 3,200 workers in Boeing’s defense division went on strike at midnight today in a dispute over pay and benefits. The strike raises fresh concerns about the US’s ability to produce key weapons systems, such as the F/A-18 Super Hornet and F-15 Eagle fighter jets, as well as various missiles and munitions. Separately, new reporting says China is continuing to limit rare-earth exports used by Western defense industries despite a deal with the US last month to loosen its controls.