Daily Comment (August 4, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will discuss three topics: recent optimism about the global economy, the Bank of Japan’s recent intervention in bond markets, and the increase in global defense spending due to the rift between the U.S. and China.

Turning Tide: While a possible recession was a hot topic at the start of the year, there is now growing optimism that the economy may be more resilient than previously thought.

- Persistently strong economic data has shifted the conversation from an imminent downturn to sustained growth. Earlier this week, Bank of America (BA, $31.41) concluded that a recession is unlikely to occur in 2023. Meanwhile, Richmond Fed President Thomas Barkin expressed confidence that the Federal Reserve may be able to achieve a soft landing if inflation continues to ease. This increased confidence is supported by a wave of positive economic data, which suggests that the labor market remains tight, and spending remains robust despite rising borrowing costs. However, this does not mean there is no risk of a downturn.

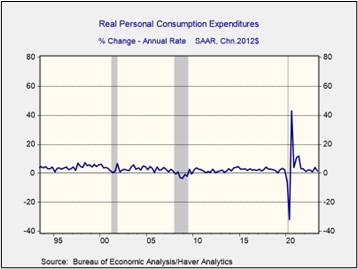

- Despite some encouraging signals, the state of the business cycle remains uncertain, as there are still several risks. The government’s inability to agree on a budget agreement will likely impact bond yields, which could lead to higher borrowing costs over the next few weeks. At the same time, there appears to be a notable deceleration in the rate of consumption and hiring. The latest GDP report showed a significant slowdown in consumption from an annual pace of 4.16% in the first quarter of 2023 to 1.64% in Q2. At the same time, the jobs report showed that job creation disappointed for the second consecutive month.

- During the pandemic, households and firms took advantage of transfer payments and lower interest rates to pay down debt and extend loan duration. As a result, consumers were prepared and able to absorb higher prices in the months following, while firms were less pressed for financing. This dynamic explains why monetary tightening has not yet led to a sharp increase in defaults. However, it is unclear how long the economy can keep this up, as the farther away we move from the pandemic, the more vulnerable households and firms will be to rising borrowing costs. This may mean that the economy will slow down this year, even if it is able to avoid a recession.

Not So Fast! A week after its historic shift in monetary policy, the Bank of Japan (BOJ) is signaling that it is not ready to be completely hands-off.

- On Thursday, the Bank of Japan (BOJ) made an unscheduled intervention in the bond market for the second time this week, by offering to buy $2.09 billion of bonds with five to 10 years left until maturity in an effort to control the rise in yields. The announcement came in response to a sudden rise in 10-year Japanese government bonds, which saw yields rise to a nine-year high of 0.65%. The purchases highlight the central bank’s unwillingness to tolerate a massive spike in interest rates following its decision to loosen its grip on 10-year debt yields.

- Investors were confused by the BOJ’s actions, as it was unclear how much the bank was willing to tolerate in terms of the pace of the increase in yields. Although the central bank’s intervention led to a modest decline in yields, the bond market was not significantly impacted as rates quickly returned to their previous level. A similar situation occurred in the currency market, as the yen (JPY) bounced back after initially depreciating against the dollar. However, equities were negatively affected, with the TOPIX index ending the day down 1.45%.

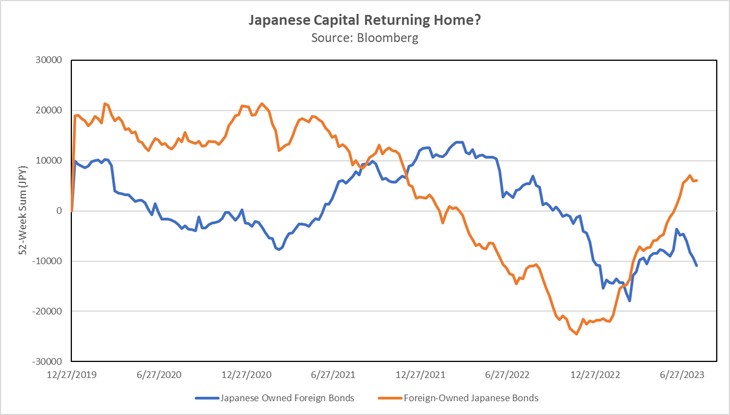

- As the world’s largest creditor, Japan’s monetary policy significantly impacts the global economy. Data from the Japanese Ministry of Finance shows that foreign investors have been increasing their holdings of Japanese long-term debt since the BOJ first tweaked its policy in December 2022. Simultaneously, Japanese investors have been offloading their holdings in the weeks leading up to the central bank’s latest rate decision. As short-term rates in Japan begin to rise, we expect higher yields will encourage residents to bring capital back home. However, this shift is likely to take time to materialize, as rates in the United States and Europe remain attractive.

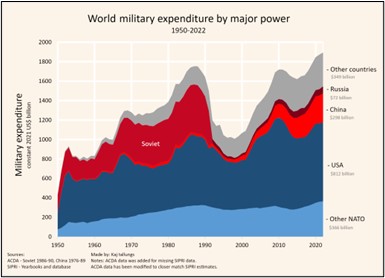

Military Rising: The United States and its allies are continuing to increase their military spending in an effort to create a stronger deterrent to China in the Pacific.

- The U.S. plans on investing in more sophisticated missile technology in the next spending bill. Last week, lawmakers revealed a bill that earmarked $13 million to expand and manufacture chemical compounds that can be used to propel missiles or replace the explosive material in warheads. Similarly, the White House plans to ask Congress to fund arms for Taiwan as part of its supplemental budget request for Ukraine. Although officials still need to come to an agreement on the final spending package, there does seem to be a bipartisan consensus that the government needs to do more to counter China in the Indo-Pacific.

- Across the ocean, Japan and New Zealand are also looking to increase their defense spending. Japanese lawmakers are considering selling some of the government’s stakes in major companies to fund additional military spending. This is intended to avoid raising taxes or increasing the national debt, as the country seeks to expand its defense capabilities. Meanwhile, a government review of New Zealand’s military capabilities found that the country is not prepared to deal with the growing challenges in the Indo-Pacific region. As a result, the report recommended that the government increase its military budget.

(Source: Wikimedia Commons)

(Source: Wikimedia Commons)

- The growing rivalry between the United States and China is driving a global arms race. Countries are ramping up spending on defense as they look to choose sides and protect their own interests. Rising military demand will likely benefit the defense and aerospace industries, as they will likely be the recipients of much of this new spending. However, the major obstacle to this increase in investment is the need to generate the necessary revenue to pay for new weapons. As a result, we believe that the world’s shift towards building up military capacity will likely be gradual.