Daily Comment (August 31, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including the latest on Ukraine’s new counteroffensive to push the Russians out of the southern city of Kherson. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a potentially dangerous new commitment by Taiwan to defend itself against Chinese military incursions. We wrap up with a few additional words on the stock market’s reaction to Federal Reserve Chair Powell’s hawkish speech last Friday in Jackson Hole.

Russia-Ukraine: The Ukrainian counteroffensive to push the Russians out of the southern Ukrainian city of Kherson continues with ground forces pushing against the Russians’ front lines and long-range missiles and artillery attacking their ammunition depots, troop concentrations, and lines of communication far behind the lines. Meanwhile, the Russians are trying to reinforce their most vulnerable defensive positions by ratcheting down their offensives in the northeastern Donbas region and redeploying their best and most experienced troops southward toward the Kherson battlefield. We believe it is far too early to gauge the success and likely outcome of the Ukrainians’ counterattack. Indeed, their methodical approach to the offensive so far suggests it could play out over an extended period. We may not know the true outcome of the offensive for several weeks.

- Retaking Kherson would provide major military, economic, and political benefits to Kyiv. For example, seizing the city and pushing the Russians out of the region would reduce the Kremlin’s control over Ukraine’s coastline and could help reopen Ukraine’s trade flows through the Black Sea. A victory would also help convince Western governments to keep supporting Ukraine in the fight.

- Separately, U.S. officials stated that Russia has picked up the first shipments of what could be dozens of Iranian drones designed to attack radars, artillery pieces, and other military targets. The drones are part of a recent deal to help Russia in its war with Ukraine. However, Russian tests have reportedly discovered that the drones malfunction frequently and may not be very effective in Ukraine’s congested battle space in which Ukraine is fielding many modern, sophisticated weapons provided by the West.

- Finally, as anticipated, Russia has once again shut off natural gas shipments through its Nord Stream 1 pipeline to Western Europe, ostensibly for “maintenance.” European officials remain in the dark as to whether the shipments will truly resume on Saturday as the Russians say. The move has boosted European gas prices by another 5.5% so far this morning.

Russia: Mikhail Gorbachev, the former leader of the Soviet Union whose efforts to reform the Communist state led to its dissolution, died yesterday in Moscow at the age of 91. Although Gorbachev was instrumental in ending the Cold War and bringing down the USSR peacefully, he remained vilified by many in Russia because of the economic chaos the breakup caused in the early 1990s.

European Bond Market: Based on the Bloomberg Pan-European Aggregate Total Return Index, Europe’s market for high-grade government and corporate debt was down 5.3% for the month through yesterday, putting it on track to post its worst month since 1999. As in the U.S., bonds in Europe have been hammered by rapid consumer price inflation, aggressive interest-rate hikes by central banks, and fears of impending recessions.

- Coupled with the downtrend in stock values so far this year, the fall in bond values has illustrated how the traditional portfolio benchmark of 60% stocks and 40% bonds can falter in a period of high inflation and rising interest rates. Better performance this year would have come from a portfolio putting less emphasis on bonds and more on commodities, as many of our asset allocation strategies do.

- Illustrating the continuing challenging environment in Europe, the Eurozone’s August consumer price index was up 9.1% year-over-year, marking the region’s highest inflation rate since records began in 1997 and accelerating from the gain of 8.9% in the year to July.

China: At long last, Communist Party leaders have decided their 20th National Congress will begin on October 16. The meeting will likely be historic, given that President Xi is expected to use it to cement his grip on power by being named to a third consecutive term.

- Xi will also use the meeting to announce major new initiatives in international relations, economics, and social policy.

- In the run up to the meeting over the next six weeks, we suspect Chinese officials will pull out all the stops to make the economy look stable and robust, producing positive vibes for Xi. At the same time, officials are likely to crack down hard on any sign of political unrest that could mar the proceeding.

China-Taiwan: Today, in a development that could dramatically raise the risk of a military clash, Taiwan warned that it will defend itself and strike back as China ramps up its military incursions in the island’s territorial airspace and waters. Taiwan has also reportedly begun targeting Chinese drones overflying its outlying islands. The more assertive approach suggests Taipei is trying to balance the risk of sparking outright conflict against its desire to block China from demonstrating effective control over nearby waters and airspace or even Taiwanese territory.

- The risk is that continued shooting at Chinese drones, or destroying one, could invite retaliation in kind from the Chinese.

- The development is a reminder that China-Taiwanese relations remain a major geopolitical risk for investors, especially as any conflict would likely draw in the U.S., Japan, and other Western allies.

China-Solomon Islands-United States: After the Solomon Islands recently refused to allow a U.S. Coastguard ship to dock for supplies, President Sogavare said his government will temporarily bar ships from all foreign navies while it reviews its approval processes. The move deepens concerns that China is now firmly pulling the international policy strings within the Solomon Islands government. Sogavare struck a secretive new security deal with Beijing earlier this year, presumably in return for Beijing’s support in keeping him in power.

U.S. Monetary Policy: Yesterday, New York FRB President Williams warned that with the economic momentum still strong and the labor market tight, the Fed will not only need to boost interest rates into restrictive territory, but it will also have to hold them there for some time in order to bring inflation back to the policymakers’ target of 2%.

- Investors now seem to accept that the Fed plans to keep ratcheting up interest rates for the time being, but the statement from Williams may be designed to show that the policymakers also aren’t likely to pivot to rate cuts nearly as soon as some investors think.

- As investors re-price the likely trajectory of interest rates, stocks and other risk assets, along with bonds, continue to depreciate.

U.S. Labor Market: With companies still faced with labor shortages despite the Fed’s effort to slow economic growth, some are trying to lure workers with what could be a relatively low-cost perk. Some manufacturers, hotels, warehouses, and restaurants are allowing new hires to work just a few days a week, take on four-hour shifts, or even choose new hours daily using phone apps. In other words, on-site workers are starting to gain the same flexibility enjoyed by remote workers.

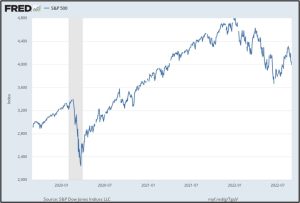

U.S. Stock Market: Finally, now that investors have been able to digest Fed Chair Powell’s hawkish speech at Jackson Hole last Friday, we thought it would be helpful to provide some perspective on where monetary policy and the stock market are probably headed. The overall picture that we see is that the market had become way too optimistic that the monetary policymakers would stop hiking interest rates and even pivot to rate cuts at the slightest sign of economic weakness. We suspect there is something of a consensus that the incoming economic data will show significant weakness around the end of the year or in the first quarter of 2023. Prior to Friday, that weak data would have suggested the hoped-for pivot was at hand. It would have been a classic case of thinking that “bad news is bullish.” Now, however, Powell’s commitment to hiking rates further has sunk in, and investors over the last few days have adopted the view that “good news is bearish,” and “bad news is just as bearish.”

- A case in point was yesterday’s JOLTS report showing a strengthening labor market. That good data sparked yet another sell-off in equities as investors mulled over the implications now that the “Fed put” is gone.

- We would note that a range of technical indicators are also pointing to further weakness in the market. For example, the S&P 500 price index is now trading below its 20-, 50-, and 200-day moving averages. The index is now also threatening to fall below a key support level at approximately 3,920. Momentum indicators on the index are also weakening.

- All in all, we would say Powell has succeeded in convincing investors that the Fed won’t come riding to the rescue if the economy falters. Indeed, to re-establish the Fed’s inflation-fighting bona fides, Powell may actually need a recession so he can show just how much pain he’s willing to inflict. He may even need to let the recession reach a certain level of severity, perhaps to the point of risking a financial crisis. After all, the issue isn’t just bringing down the inflation number, but rebuilding the Fed’s credibility.

- The implication is that monetary headwinds to the stock market are likely to intensify and continue longer than investors previously thought. It is probably far too early to get bullish on stocks at this point.