Daily Comment (August 28, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our analysis of Nvidia’s recent earnings and what they suggest about the ongoing AI boom. We then examine key global developments, including a strategic move by US allies to boost investment in rare earths production, Mexico’s decision to raise tariffs on Chinese goods, and a discussion of a recent Russian attack that damaged buildings housing EU officials. The report concludes with an overview of other critical domestic and international factors shaping the current financial landscape.

Tech Momentum: Nvidia, the world’s largest chipmaker by market capitalization, reported another strong quarter, demonstrating that the AI boom continues to offset the headwinds from trade friction. The tech giant’s revenue reached $46.7 billion in the previous quarter, a notable increase from $46.1 billion. Despite this success, concerns persist about the sustainability of AI-related spending. There are also doubts surrounding its sales to China due to US government regulations and scrutiny from Beijing.

- Despite strong quarterly results, Nvidia struck a cautious note by forecasting a sales deceleration. This near-term pessimism contrasts with its long-term optimism for AI spending, which it estimates will reach $3-4 trillion by 2030. The warning was underscored by data center revenue of $41.1 billion, which narrowly missed estimates of $41.3 billion, suggesting companies may delay investments in large-scale AI infrastructure if financial returns fail to materialize.

- This cautious outlook raises concerns about the AI boom that has fueled equity markets over the last three years. A recent MIT study showed that 95% of AI deployments fail to significantly boost revenue or productivity, validating concerns that the AI rally may be overdone. While the low success rate has been attributed to poor implementation rather than the technology itself, it suggests infrastructure investment is outpacing companies’ ability to use it effectively.

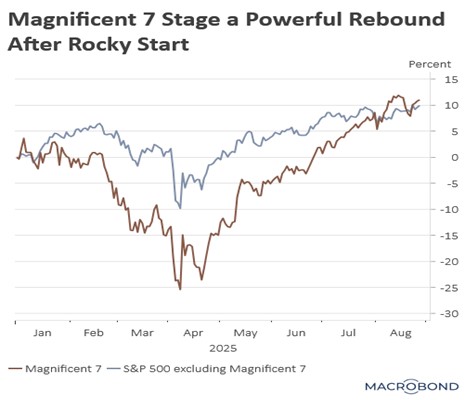

- While it may be too soon to declare the AI rally over, we believe it is prudent to identify opportunities in other market segments. In fact, excluding the Magnificent 7, the broader S&P 500 has performed quite well. This strength is partly due to shifting sentiment around trade policy, but more attractive valuations have also been a key driver. Consequently, we view this as an opportune moment to broaden investment exposure.

US Rare Earths Mining: Lynas, the world’s largest rare earths miner outside of China, is planning to raise $500 million to fund an expansion of its operations and acquire a stake in US magnet manufacturers. This strategic move is part of a broader effort by the US and its allies to establish a rare earths supply chain independent of China, which currently dominates the market. The move is another sign of the government’s growing involvement in the broader economy.

- In a significant effort to incentivize domestic production and reduce reliance on China, the US government has taken a major step in the rare earths market. Earlier this month, the Department of Defense entered into a public-private partnership with MP Materials, the American company that operates the country’s only active rare earth mine. It also established a price floor for key rare earth minerals at nearly double the current market rate.

- The increasing government intervention suggests that companies aligning with US policy objectives may receive preferential treatment. While this could benefit key sectors like industrial materials and technology in the long run by bolstering domestic production, it also makes these industries highly vulnerable to shifts in government leadership and policy changes.

Mexico Takes on China: The Mexican government plans to raise tariffs on Chinese goods, a move that aligns with the recent strategy of the US. Although specific rates are undisclosed, the new levies are expected to target Chinese cars, textiles, and plastics. This decision appears to be part of a broader, long-term strategy to use tariffs to force its allies to present a united front against Beijing. The goal is to counter Chinese export dumping, a practice used to address its domestic industrial overcapacity.

European Sanctions: The EU is prepared to reimpose sanctions on Iran for its failure to hold talks about its nuclear program. This move would allow the EU to penalize Iran under the snapback mechanism in the 2015 Iran Nuclear Deal. Since the attack on its facilities earlier this summer, Iran has been unwilling to resume negotiations and has not allowed access to its nuclear sites or stockpiles of 60% highly enriched uranium. While the sanctions are designed to pressure Iran’s economy and may provoke a response, the risk of near-term direct conflict remains low.

The Three Amigos: In a move signaling a unified front against what they perceive as a US-led international order, North Korean leader Kim Jong Un is set to join Russian President Vladimir Putin and Chinese President Xi Jinping at a major military parade in Beijing. This marks the first time all three leaders will attend an event together. The gathering takes place ahead of anticipated talks between each of these nations and the White House on key issues including trade, conflict, and restoring diplomatic communication.

Russian Attacks Continue: Buildings housing the EU and British Council in Kyiv were damaged in a Russian drone attack that killed at least 10 people and injured 48. Although the buildings may not have been the primary target, the EU and UK are likely to view the incident gravely and could respond with additional sanctions. The attack on diplomatic premises signals a concerning escalation, though it falls short of an action that would provoke a direct military conflict between the EU and Russia.

Milei Controversy: Argentine President Javier Milei was forced to abruptly end an election campaign event on Wednesday after protesters threw stones at him. The unrest follows allegations that members of his administration, including his sister, received illegal kickbacks from the drug distributor Suizo Argentina. This controversy has triggered a sell-off in Argentine equities, as investors express concern over the potential impact on the upcoming election scheduled for October 26, 2025.