Daily Comment (August 28, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a review of Federal Reserve Chair Powell’s address to the Kansas City FRB’s symposium in Jackson Hole on Friday. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including signs that U.S. private investments in China are already starting to fall sharply while China launches a new cut in securities transaction taxes to spur more demand.

U.S. Monetary Policy: At the conference in Jackson Hole on Friday, Fed Chair Powell suggested that the monetary policymakers would likely hold interest rates steady at their upcoming meeting in September, but that they would be prepared to hike rates further if economic growth accelerates and pushes price pressures higher. He also reiterated his warning that the Fed is likely to hold interest rates “higher for longer” in order to make sure consumer price inflation comes down to the policymakers’ 2% target.

- Based on market indicators, it appears that investors have bought into that view. We also believe the policymakers will try to hold rates at a high level for an extended period, although it is unclear whether they could maintain that discipline if a financial crisis were to erupt or if the economy starts to slow precipitously.

- Investors’ focus on the likelihood of a pause in the Fed’s rate-hiking campaign allowed risk assets to appreciate in value on Friday, while bond yields rose. So far today, however, the yield on the benchmark 10-year Treasury note has fallen back to 4.201%.

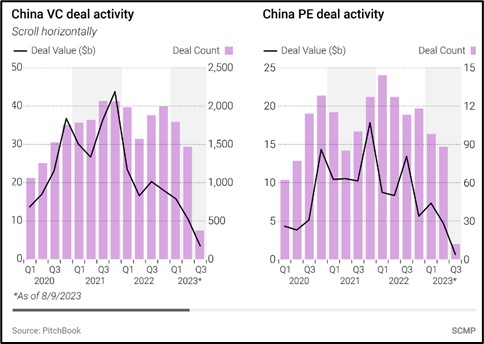

United States-China: Based on new data, the U.S.’s move to restrict investors from privately funding certain advanced-technology startups in China has already begun to discourage private equity and venture capital investments in the country. The restrictions, which were confirmed in a recent executive order, are apparently freezing investment flows not only into the targeted industries, but also into related industries that the funds and their investors fear could be restricted in the future. Separately, in her visit to Beijing today, U.S. Commerce Secretary Raimondo warned that the U.S. would not compromise its national security to maintain trade and investment flows, but she argued that there would still be opportunities in non-sensitive areas.

- It’s important to remember that the private investment restrictions don’t just cut the amount of funding available to Chinese firms. Private-equity and venture-capital funds also tend to take a hands-on approach to the companies they invest in, including providing strategic and operational guidance or consulting from the funds’ network of experts. If the funds stop investing in China’s high-tech startups, the Chinese firms as a whole are likely to develop more slowly than they otherwise would.

- The development is therefore just the latest example of how U.S.-China tensions are exacerbating the other factors weighing on Chinese economic growth, including weak consumer demand, high debt levels, and poor demographics.

Russia-China: Now that China has banned all food imports from Japan in response to the country’s release of treated radioactive water from the stricken Fukushima nuclear plant, Russia’s food safety agency said it will try to sharply increase Russian food exports to China. The move comes as Beijing is also whipping up popular boycotts against Japanese imports. The statement shows how China and Russia are drawing closer to each other amid their various disputes with the West.

- More broadly, the move illustrates how the evolving geopolitical and economic blocs that we’ve written so much about are coalescing, with countries pulling back from their ties with other blocs but deepening ties with countries in their own bloc.

- We count Japan as a key member of the U.S.-led bloc, while we see Russia as the junior partner in the China-led bloc.

Russia-Ukraine War: In a report that suggests Kyiv’s counteroffensive may now be making more substantial progress, Ukrainian forces are said to have penetrated the first line of Russian defenses at the village of Robotyne, in Ukraine’s eastern Zaporizhzhia region. The Ukrainian defense ministry says its forces are now driving southeast despite fierce Russian resistance.

- If the report from Kyiv is true, and if the Ukrainians can maintain or build their momentum, it would revive optimism that they can push the Russian forces out of more territory and perhaps even sever the important “land bridge” linking Russia proper with the occupied Crimean Peninsula.

- That kind of progress could also help maintain Western resolve to keep sending arms and supplies to the Ukrainians without putting undue pressure on Kyiv to go to the negotiating table.

China: In a further move to shore up the local stock market, the Ministry of Finance and the State Tax Administration said the stamp duty of 0.1% on securities transactions will be halved starting today. The China Securities Regulatory Commission also said it will cut the margin requirement for securities purchases from 100% to 80% starting September 8.

- The moves aim to give a boost to Chinese securities markets, but we suspect buying activity will remain weak in the face of slowing economic growth and increased regulatory risk because of the worsening in U.S.-China trade tensions.

- In fact, Chinese stocks initially jumped some 5% on today’s news, but then they gave up most of those gains and closed up only about 1%.

Taiwan: Terry Gou, the founder of iPhone assembler Foxconn Technology (HNHPF, $6.72), announced he will run as an independent candidate in January’s presidential election. The move will further split the relatively pro-China opposition parties on the island. According to recent polls, current Vice President Lai Ching-te of the anti-China, pro-U.S. Democratic Progressive Party maintains a comfortable lead over the Kuomintang Party and a smaller third party. Since Gou argues that the government is needlessly stirring up tensions with Beijing, his candidacy is expected to draw further support from the Kuomintang.

Eurozone: In a release today, the European Central Bank’s key measure of the money supply showed an annual decline for the first time since 2010. The new data showed that M3 (which encompasses deposits, loans, cash in circulation, and various other financial instruments) was down 0.4% in the year ended in July, after being up 0.6% in the year to June. The figures illustrate the impact of the ECB’s monetary tightening over the last year, which has helped reduce price pressures but also threatens to further weigh on economic growth going forward.

Japan: At the Kansas City FRB’s conference in Jackson Hole, Bank of Japan Governor Ueda said he and his fellow policymakers are maintaining their basic yield-curve control strategy because they still see underlying inflation running below their target of 2.0%. Even though Japan’s core consumer price index for July was up 3.1% year-over-year, Ueda said he expected core inflation to fall back before the end of the year. Since the statement suggests it’s still too early to expect the BOJ to abandon its yield-curve control strategy, the news helped boost Japanese stocks by about 1.7% today.