Daily Comment (August 25, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a couple of notes on the global supply of rare-earth minerals, which are critical for many of today’s advanced technologies, weapons systems, and economic prospects. We next review several other international and US developments with the potential to affect the financial markets today, including growing tensions between China and Vietnam in the South China Sea and Federal Reserve Chair Powell’s notable speech last Friday.

China: In a little-noticed announcement on Friday, the Chinese government further tightened its control over the country’s rare-earth mining and processing industry. Most important, China’s system of export quotas for rare-earth materials will now apply not only to materials produced domestically, but also to those coming from abroad for refining. For example, companies in the rare-earth supply chain will face detailed new reporting requirements every month regarding their flows of rare-earth materials from both domestic and foreign mines.

- It is widely recognized that China holds extensive rare-earth reserves and has many large, productive mines, but its stranglehold over the world’s supply of rare-earth materials comes mostly from its near monopoly on rare-earth refining. Even when countries in the West or elsewhere can mine rare earths, the bulk of the ore must be shipped to China for processing.

- With the new reporting requirements for importing, processing, and re-exporting foreign rare earths, Beijing will be able to strategically clamp down on the business and further crimp global supplies of the critical minerals, if it so chooses.

- It can’t be stressed enough that the US-China trade war this year has brought into high relief the enormous economic leverage that Beijing enjoys from its control over global rare-earth supplies. In our view, the new administration in Washington has rightly recognized the broad economic leverage that the US derives from the fact that so many countries are dependent on exporting to it. Now that it is facing Beijing’s concentrated leverage with rare earths, a key question is how the US will shift its approach to China.

Malaysia: In another little-reported announcement last week, Malaysia said it will ban the export of unprocessed rare-earth minerals to help spur the development of its processing industries. The government said it would instead encourage foreign investment in downstream facilities if the projects involve local mineral processing, job creation, and technology transfers. It also said the export of processed rare-earth metals would be encouraged. The development illustrates the growing rush of countries and firms into the rare-earth business.

Vietnam: Based on recent satellite imagery, the Center for Strategic and International Studies says Vietnam has significantly expanded its effort to build artificial islets on reefs and outcrops in disputed areas of the South China Sea. Importantly, the report claims Vietnam’s effort will likely surpass China’s controversial island-building activity in the area. The news portends sharper territorial tensions between the countries and greater potential for a future military conflict that could disrupt global financial markets.

Japan-South Korea: At a summit in Tokyo at the weekend, Japanese Prime Minister Ishiba and South Korean President Lee promised each other that they would work to deepen their recent cooperation on military and economic issues, putting their World War II acrimony behind them. Reflecting the two countries’ new warmth, Lee’s visit marked the first time a new South Korean president has gone to Japan before the US since Tokyo and Seoul normalized diplomatic ties in 1965. Lee now heads to the US for a meeting with President Trump.

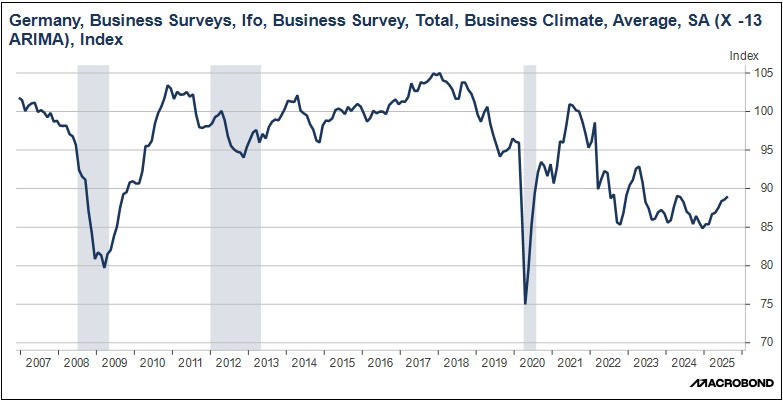

Germany: The IFO Institute today said its August business-sentiment index rose to a seasonally adjusted 89.0, beating expectations and marking its eighth straight monthly gain. The index of German businesses’ optimism about the future is now at its highest level since April 2024, despite the pressure from China’s excess capacity, the strong euro, slowing economic growth, and new US tariffs. The uptrend in optimism probably stems at least in part from Germany’s recent increase in defense spending and broader fiscal loosening.

United States-China: New reporting says Shan Liang, an award-winning HIV researcher and tenured professor at Washington University in St. Louis, will leave that institution to work in the Shenzhen Medical Academy of Research and Translation as director of its Institute of Human Immunology. Liang is the latest in a growing list of high-profile scientists leaving the US to return to his native China.

- We can’t confirm that the returns are more than in years past, but the large number of recent reports raises concerns about a widescale loss of talent to China that could threaten the US position in advanced science and technology. In turn, that could slow US economic growth and reduce investment opportunities over time.

- It also isn’t clear why more Chinese researchers might be returning to China. With the US-China geopolitical rivalry intensifying, some might feel less welcome here. China’s continued economic development could also be a draw. Other potential reasons could be more insidious. For example, Beijing may be pressuring or paying off Chinese researchers to contribute their talents to their home country. Some of the researchers could even be Chinese intelligence assets being repatriated to avoid arrest.

Canada-United States: Prime Minister Carney on Friday said he will remove Canada’s 25% retaliatory tariffs on a wide range of US food and other consumer goods, which were imposed by his predecessor. The US goods will enter Canada tariff-free starting September 1, so long as they comply with the standards of the US-Mexico-Canada trade deal. Removal of the tariffs should help reduce US-Canada trade tensions. The action is also expected to ease economic pressure on many of Canada’s small businesses.

US Monetary Policy: At the Fed’s annual symposium in Jackson Hole, Wyoming, last Friday, Chair Powell cautiously opened the door to a cut in the benchmark fed funds interest rate at the next policy meeting in September. As a result, futures trading suggests investors now see an 83.3% chance that the policymakers will implement a 25-basis-point cut next month and a high likelihood of at least one more cut by the end of the year.

- We think investors’ expectations for at least two rate cuts by the end of the year are reasonable, so long as incoming economic data cooperates.

- Importantly, the increased certainty of rate cuts appears to be broadening the stock market. For example, small-cap stocks saw out-sized price gains on Friday after Powell’s speech, while lagging large-cap sectors also performed well.

US Cryptocurrency Market: Banking lobbies such as the American Bankers Association have reportedly started warning US lawmakers that a loophole in the recent Genius Act could prompt bank customers to pull as much as $6 trillion of deposits from the banking system, tightening credit and raising interest rates. The provision in question allows crypto exchanges to pay interest to customers holding third-party stablecoins. The bankers’ complaint highlights the risk that stablecoins will draw funds from the banking system and potentially destabilize it.