Daily Comment (August 25, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will be split into three main topics: 1) What investors will be looking for in Fed Chair Jerome Powell’s speech at Jackson Hole; 2) How China is using BRICS as a way to challenge the U.S. and its allies; and 3) Why the export ban on semiconductors is making companies uneasy.

Powell’s Moment: Investors will be glued to Fed Chair Jerome Powell’s every word as he delivers his views on the future path of monetary policy at Jackson Hole.

- Federal Reserve Chair Jerome Powell is likely to remain tight-lipped about the future of monetary policy in his upcoming speech. Last month, Powell indicated a shift toward reduced guidance and increased data dependence regarding the Federal Open Market Committee’s next rate decision. Consequently, investors are still speculating about what he might say, given recent economic data that suggests the Fed may need to be more hawkish in its efforts to combat inflation. The latest nowcast from the Atlanta Fed shows that the GDP likely accelerated in the third quarter of the year. Meanwhile, the latest jobless claims data suggests that the labor market remains stubbornly tight.

- In the lead-up to Powell’s speech, Fed officials have expressed a range of views on the appropriate path of interest rates. Boston Fed President Susan Collins and former St. Louis Fed President James Bullard have both expressed support for additional rate hikes. At the same time, Philadelphia Fed President Patrick Harker has suggested that interest rates do not need to be raised further. The divergence in views among Fed officials suggests that there is still uncertainty about the appropriate path of monetary policy. Despite their differences, there is a growing consensus that interest rates are close to peaking.

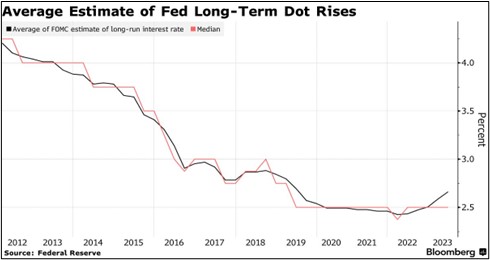

- The prevailing view is that interest rates will remain elevated for an extended period of time. The median long-term federal funds rate is still near 2.5%, but the average rate has begun to outpace it. This has led investors to revise their expectations upwards of future interest rates, as they believe that the central bank may not cut rates as quickly or aggressively as it did in the past. In fact, investors have already purchased protection against any sell-off that could occur if Powell reinforces this hawkish stance.

BRICS United: China is using the BRICS summit to consolidate its influence and build a bloc of emerging economies that can challenge the Western-led order.

- On Thursday, the BRICS countries (Brazil, Russia, India, China, and South Africa) extended invitations to Saudi Arabia, Egypt, United Arab Emirates, Iran, Argentina, and Ethiopia to join their bloc. The possible admission of these countries appears to be an attempt to create an emerging markets bloc to counter the U.S.-led bloc in the G7. That said, it is unclear whether these countries are interested in joining the group, as many of them still have strong military and trade ties with the United States. Prior to the announcement, Indonesia asked not to be named. It is also possible that some BRICS countries may not support the expansion of the bloc, as it could dilute their own influence.

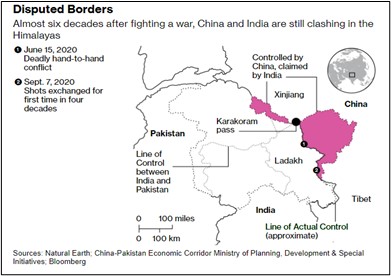

- Despite suspected differences within the bloc, there are indications that China is willing to compromise with the members in exchange for cooperation. During the summit, Chinese President Xi Jinping and Indian Prime Minister Narendra Modi pledged to work towards a peaceful resolution of the border dispute between their two countries. The two sides have been at odds over the territory ever since a 2020 clash between the countries’ militaries. Modi was the one who initiated the discussion on the border dispute, suggesting that India’s decision to welcome new members may have been made for transactional purposes.

- Together, the BRICS countries compose 37% of the global GDP and nearly half of the world’s population, and its potential expansion will undoubtedly increase its influence on the world stage. However, it is still unlikely that China will be able to exercise the same level of influence over the BRICS countries as the United States has over the G7 members. The United States’s ability to maintain open capital markets means it will continue to be an attractive trade and investment destination for other countries, especially emerging markets. Therefore, the rise of the BRICS countries is a potential challenge to U.S. dominance, but it is not yet a real threat.

Chips Everywhere: Semiconductor companies worry that trade restrictions targeting China could hurt their bottom lines.

- Chinese companies imported a record amount of semiconductor equipment in June and July as they scrambled to secure supplies ahead of the implementation of export curbs by the United States and other countries. Trade data from China showed that the country’s import of chip production tools increased by 70% compared to the same period last year. Chinese companies are looking to stock up before export restrictions come into effect on September 1. The surge in semiconductor imports by Chinese companies reflects Beijing’s determination to maintain its technological advancement despite Washington’s attempts to slow it.

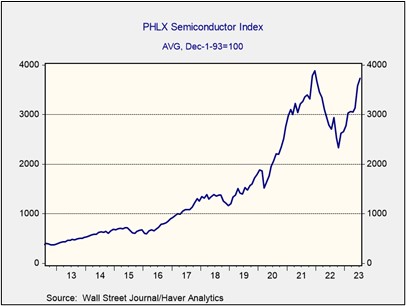

- Semiconductor firms that view China as an essential market are worried about the harsh restrictions on exports. Chipmaker Nvidia (NVDA, $471.63) warned that additional curbs would further hinder their ability to compete in the world’s second-largest economy. The company reported earlier this week that sales of its popular AI chips more than doubled from last year, and it expects demand to continue to grow. The news initially caused a surge in the PHLX Semiconductor Index, but investors later sold off as they remained uncertain about the full impact of the regulations on profits.

- The U.S. government’s policy of asking businesses to “de-risk” their operations in China has been met with confusion and uncertainty. Some businesses have interpreted this policy as a call to completely sever ties with China, while others believe that it is simply a request to take steps to mitigate risk. This lack of clarity has made it difficult for businesses to plan for the future and has created anxiety among investors. Although we suspect that the U.S. and China are heading for a break-up, we believe that lobbying by firms will make it a long and drawn-out process.