Daily Comment (August 25, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with an explanation as to why traders believe that central banks will become more hawkish over the next few months. Next, we review the ramifications of President Biden’s student loan forgiveness program. Lastly, we will give our thoughts as to whether the U.S. should intervene in Ukraine to protect the country’s nuclear power plant and what it could mean for financial markets.

A Hawkish World: Market participants have placed bets that major central banks will raise rates aggressively in their next meetings.

- A day before Federal Reserve Chair Jerome Powell is set to speak at Jackson Hole, investors have dampened expectations that the central bank will alter its policy path. There has been speculation that the Fed will stop tightening late this year or early next year due to the poor economic data and a reduction in inflation. However, recent comments from Fed officials have tapered down those expectations. For example, Kansas City Fed President and voting member Esther George advocated that the Fed should discuss the pace of future rate hikes but continue to raise rates until inflation is firmly under control.

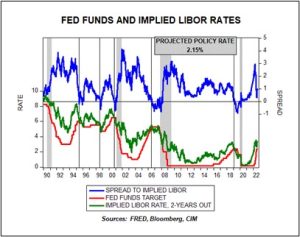

- Investors have already baked in the possibility of a pause in 2023. Thus, Powell’s remarks stating the contrary could lead to a violent reaction from markets. In the chart below, the green line represents the implied three-month LIBOR rate from the two-year deferred Eurodollar futures, and the red line shows the fed funds target rate. The Fed usually begins to cut rates once the two lines cross. Although the model does not signal an imminent rate cut, the finish line is clearly in sight.

- In Europe, elevated inflation has led money market funds to place bets that the European Central Bank will raise rates by 100 bps by its October meeting. That would put the central bank’s key rate at 1.00%, the highest level in over a decade. The bank has faced pressure to become more hawkish after inflation in the Euro area outpaced the U.S. in July for the first time since the pandemic. Additionally, the increase in energy prices due to the Russia-Ukraine war still threatens to worsen European inflation in the winter. If the ECB raises its policy rate, the rise in borrowing costs will likely hurt riskier southern European economies disproportionately. In other words, investors will demand an additional risk premium to lend to those countries due to their high debt burdens and relatively weak economies.

-

- Investors have piled onto bets that Italian bonds will fall. The total value of Italian bonds that traders have wagered against has hit its highest level since the financial crisis. The prospect of higher European interest rates and a return of right-wing populists to power has added to investor concerns that the country may struggle to repay its debts.

- Chinese regulators have pressured banks not to sell the yuan in order to prevent further devaluation of the currency. The slowdown of the Chinese economy coupled with hawkish U.S. monetary policy have pushed the yuan down against the dollar. Currency depreciation, especially for commodity importers, can add to inflationary pressures because most goods are priced in dollars. As a result, if the currency continues to drop against the dollar, the People’s Bank of China could be forced to remove monetary accommodation, which would lead to slower GDP growth for China and could hurt the global economy.

The strong dollar poses a significant threat to international equities, particularly as oil and gas prices remain elevated. Because Fed tightening has contributed to the dollar surge throughout the year, a reversal could provide a tailwind for struggling economies. That said, Fed officials have made it clear over the last few weeks that it would like inflation to drop before it decides to reverse course. As a result, we maintain our position that the current investing environment does not favor international equities.

Student Loan Debt Relief: President Biden announced student loan forgiveness of up to $10,000 for students making under $125,000 a year.

- The debt forgiveness program will likely have minimal impact on financial markets. Only 13.5% of the population has student loan debt, therefore, it does not impact many people. So far, economists have not been able to show any significant economic effects. Bloomberg estimates show that the executive order could add up to 0.2% to annual inflation. However, there is a possibility that consumer confidence could receive a temporary lift. Thus, from an economic standpoint, the order is fairly insignificant.

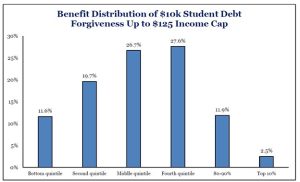

- There is speculation that the student loan forgiveness program could provide some relief for the housing market. Although the recent home-price surge has disproportionately hurt young adults, most of the proposed debt relief will not go to low-income households. As a result, the financial positions of the most vulnerable potential homebuyers will not change significantly because of this executive order.

(Source: Strategas)

- The program could impact President Biden’s reelection ambitions if he decides to run again in 2024 but will likely not change the outcome of mid-term elections in the fall. Millennial and Gen Z voters make up a vital block for Democrats; however, recent polling has shown that these groups’ enthusiasm has dipped significantly since the 2020 election. Although President Biden has seen a recent surge in popularity, the Democrats are still heavily favored to lose the House and are only slightly favored to maintain the Senate.

The recent decision by the President to forgive student loans will have political ramifications. Essentially, Biden has decided to show favoritism to a critical voting bloc. Although this is not unusual for a president, especially when elections are near, it does raise the likelihood of a potential voter backlash during mid-term elections in November. Generally speaking, a deadlocked Congress is favorable to equities because it means that laws will be unlikely to change significantly. Hence, a Republican takeover of either or both houses in Congress should be viewed favorably by markets.

Russia-Ukraine Update: Russia has raised the stakes of its invasion of Ukraine with its seizure of the Zaporizhzhia nuclear plant.

- Russian forces have occupied the Zaporizhzhia nuclear plant for six months. The power plant is the largest in Europe and contains six of Ukraine’s 15 functional reactors. The country has relied on nuclear power for its energy needs to reduce its dependence on Russia. Thus, Russia’s occupation of the area poses a severe risk to Ukraine’s power supply. If the Kremlin decides to take the plant offline, citizens would be forced into a virtual blackout. Although this scenario has yet to bear fruit, there is speculation that Russia could attempt this in the winter.

- President Biden has received calls for the U.S. to aid Ukraine in its effort to remove Russian troops from the power plant. Ukrainian and former U.S. government officials have urged the White House to send military personnel to secure the site and protect the International Atomic Energy Agency inspectors.

A nuclear disaster at the power plant could disrupt the global supply chains, hinder food production, and make energy problems much worse. Although it is unlikely that the U.S. would send military to help secure the area, President Biden will likely be forced to step in if the situation deteriorates into a global crisis. A potential nuclear disaster could have a seismic impact on financial equities. We will continue to monitor this situation closely.