Daily Comment (August 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning from a blistering hot St. Louis! It’s the “dog days” of August, and as we noted above, U.S. equity futures are pointing to a higher open. Unfortunately, we have been experiencing this pattern recently, where we see stronger futures overnight only to see the gains fade as the day wears on. Overall, August has been a tough month for equity investors as global stocks are having the worst month so far in over a year. Meanwhile, the early signs of the political season are upon us—tonight is the first GOP debate. The leading candidate, Donald Trump, is sitting this one out.

In today’s Comment, we open with a recap of the BRICS meetings being held in South Africa. Up next is a quick look at the upcoming Jackson Hole conference. A roundup of economic news follows, including a look at the U.S. housing market. The China update is next as the U.S. Commerce Secretary makes her way to Beijing. We close with the international roundup and a look at the critical Suwałki Gap.

BRICS Meeting: The five official nations of the BRICS—Brazil, Russia, India, China, and South Africa—are considering expanding the group. China’s President Xi, who caused a bit of a stir when he failed to show up at a business meeting, met with South African President Ramaphosa to discuss expanding the group. Xi’s vision for BRICS is to create a counterweight to the G-7. Although China wants to expand the group (with Iran and Indonesia expressing interest in joining), India and Brazil are more cautious, worried that additional members will dilute their influence. We suspect that Xi’s support for expanding the body is designed to enhance China’s clout.

Perhaps the biggest concern comes from rumblings that BRICS will create an alternative to the dollar system. The body has ties to the New Development Bank, which is lending in local currencies to members. Although there has been talk of creating a BRICS currency, the idea it would emerge from these meetings was mostly scotched by President Ramaphosa, who flatly stated that there would be no discussions about a common currency. All members have expressed interest in trading in their own currencies, which makes sense. The problem is that without a reserve asset to hold surpluses, the utility for the exporter to hold the local currency of another country is rather low. A classic example is that Russia, who is selling oil to India, is now holding billions of INR that it can’t do much with, since it doesn’t want imports from India, and India restricts capital inflows. There has also been talk of using gold as the reserve asset. Although this might work (and could be profoundly bullish for gold), a gold standard is inflexible and thus tends to lose its allure for trade.

Our take is that there will be more talking, but we are not likely to see the membership group expand yet. Also, the expectation of a BRICS currency is probably premature.

Jackson Hole: Later this week, the KC FRB annual meetings in Jackson Hole will be held, with Chair Powell’s speech due on Friday. Last year, Powell ditched his prepared remarks and kept it simple—expect higher rates and get used to them. We don’t expect a repeat this year. If anything, he will likely be non-committal on further increases, and will probably signal that a rapid decline in the policy rate is unlikely. The contours of the debate are framed between two poles. On the one side is that the economy is too strong and inflation too hot so the policy rate needs to rise further. In his first interview since leaving the St. Louis FRB, Jim Bullard laid out the case that the state of the economy warrants higher rates. The other side was discussed by the current “Fed whisperer” Nick Timiraos of the WSJ, who begged the question…is the 2% target worth the pain necessary to get there? We suspect this is what Powell will need to address on Friday.

Economic Roundup: Housing woes continue, labor unrest does too, and the Biden administration looks to help student loan borrowers.

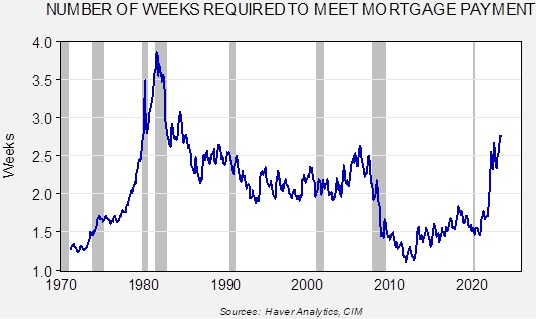

- Later today, we will get new home sales data, with a modest rise expected. Yesterday, existing home sales came in weaker than expected. Compared to last year, sales are down 16.3% for single family homes. However, despite weak sales, prices for existing single family homes rose 1.6% from last year. In our affordability study, which measures how many weeks a worker earning the median wage for non-supervisory workers to service a mortgage at the prevailing wage, median home price, and mortgage rate, the level reached nearly 2.8 weeks, the highest level since 1985.

- So far, this development hasn’t hurt the economy because most existing home borrowers are simply not selling their homes, reducing supply. We expect to see new home sales rise relative to existing homes when the data comes out later this morning.

- United Parcel Service (UPS, $166.86) workers, represented by the Teamsters Union, announced the two parties had come to an agreement, averting a strike. Terms suggest about a $7 per hour jump in the average hourly pay. Next up is the UAW, which is trying to claw back earlier concessions. Meanwhile, the labor market news is somewhat mixed. Pay for new hires is reportedly stabilizing after rising rapidly in recent years. At the same time, tech layoffs are falling, suggesting an improvement for those workers. Later today, we get benchmark revisions to the payroll data which could result in about a 600k reduction in reported jobs.

- The Biden administration has launched the SAVE Plan which is designed to scale student loan payments to incomes and cap interest costs. The courts struck down earlier efforts to cancel some student loans, so the administration is taking another path, essentially reducing debt service costs. There have been concerns that when households with outstanding student debt begin paying on these loans in the fall, the economy would suffer. This plan will likely blunt some of that negative pressure.

- Margin protection has been an element in keeping inflation elevated. There is evidence we have reached the end of that protection as firms are signaling that they probably won’t be able to pass along further cost increases. However, there is no evidence to suggest a rollback in prices is likely.

- On the battered commercial real estate side, it’s a “good news, bad news” story. The good news is that office tenants are renewing their leases, but the bad news is that they are doing so while taking less space.

- The Bank for International Settlements warns that cryptocurrencies seem to be increasing financial fragility in emerging markets.

China update: Gina Raimondo is off to China where the economy continues to struggle.

- Commerce Secretary Raimondo is on her way to China, part of a parade of administration officials trying to at least stabilize U.S./China relations. As part of the trip, the U.S. has eased come controls, removing 27 Chinese entities from the “unverified list.” We doubt this action will make much of a difference. We note that National Security Director Sullivan warned China to be more “transparent” about its economic data, reacting to news that Beijing won’t publish youth unemployment data anymore.

- Due to concerns about the Chinese financial system, policymakers are moving cautiously on potentially reducing rates, likely worried that aggressive cuts will trigger capital flight and a rout of the CNY. Unfortunately, without stimulus, the Chinese economy will continue to struggle.

- As geopolitical tensions rise between China and the U.S., American financial firms are seeing reduced opportunities in China.

International Roundup: Here are other news items of note.

- There are reports of local fuel shortages in Russia. Between the reconfiguring of supply chains, resources being diverted for the war effort, and sanctions, the domestic economy is bound to have periodic supply issues. What remains uncertain is if these outages will result in a drop in production or civil unrest. So far, there isn’t much evidence of either.

- The State Department has warned Americans in Belarus to “leave immediately.” The government notes that the presence of Russian troops is rising in the country and local law enforcement can be “arbitrary.” The department also notes that European nations bordering Belarus have been closing borders. Last week, Lithuania closed two border crossings, and Poland and Latvia are considering closing crossings as well. Direct flights out of Belarus are limited.

- There is a growing concern that Russia might forcibly take the Suwałki Gap which separates Belarus from Russian-controlled Kaliningrad.

(Source: The Baltic Times)

(Source: The Baltic Times)

-

- If this gap were seized, there would be no land bridge between NATO and the Baltic state, making their defense difficult. The vulnerability of this area isn’t anything new, but the reported build-up of Russian troops in Belarus has raised alarms. The State Department’s warning adds to this concern.

- We also note that Russia has reportedly placed nuclear weapons in Belarus. In the context of the increasing threat to the Suwałki Gap, this is a further Russian provocation.

- Russia may be considering annexing the regions in Georgia it seized in 2008.

- It’s settled—Srettha Thavisin will be the next PM of Thailand. Thailand has been under a caretaker government since March.

- Spain’s king has asked the conservative party leadership to form a government. Given that the coalition isn’t a majority, this effort will likely fail and so new elections later this year are increasingly likely.

- Azerbaijan is essentially blockading the disputed region of Nagorno-Karabakh. The region, which has an Armenian majority, is beginning to see shortages of essential items develop.