Daily Comment (August 20, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment will first address recent doubts about the AI boom, then examine other critical market developments, including the trade calm between the US and China, the eurozone’s pivot toward new trade partners, and a call for the resignation of an FOMC member. We will conclude with an overview of other global and domestic factors shaping the financial landscape.

AI Spook: US equities sold off sharply on Tuesday after an MIT study cast doubt on the commercial viability of generative AI. The research, which drew from a significant dataset of interviews, surveys, and deployment analyses, revealed a staggering 95% of AI pilots did not produce a meaningful boost to revenue or productivity. This finding directly challenges the high valuations of AI-focused companies, prompting the market downturn.

- However, the study suggests that the models’ poor performances stem less from their technical quality and more from flawed corporate integration. The report found that companies partnering with external AI specialists achieved a 67% success rate — double the 33% rate of those that relied solely on in-house development.

- While slow adoption cycles are typical for new technologies, the current pace raises serious questions about the tech sector’s massive capital expenditures and potential overcapacity. For context, Alphabet’s projected 2025 capex of $85 billion exceeds France’s entire military budget for 2027. This aggressive build-out of AI data centers, intended to meet anticipated demand, risks creating a significant capacity glut and fuels concerns about a brewing bubble.

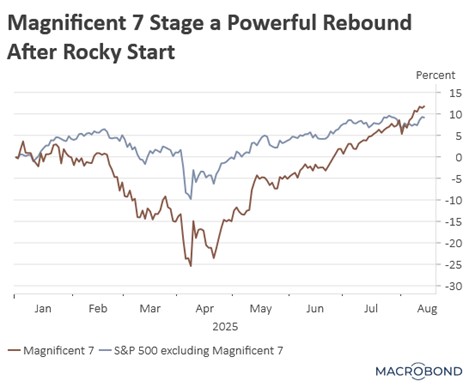

- The market’s gains remain narrowly concentrated in the Magnificent 7, even as concerns over tariffs have subsided. This persistent lack of breadth heightens the market’s vulnerability to a sentiment-driven pullback. Given these concentrated risks and elevated uncertainty, we advise investors to maintain a disciplined and prudent approach to portfolio construction.

US Satisfied: The White House is leaning toward maintaining the status quo with China, its largest rival. Signaling this intent, Treasury Secretary Scott Bessent stated the US is “very happy” with the existing tariff structure. This position was reinforced last week by the administration’s decision to extend the trade deal deadline by 90 days into November, suggesting a deliberate pause to de-escalate tensions.

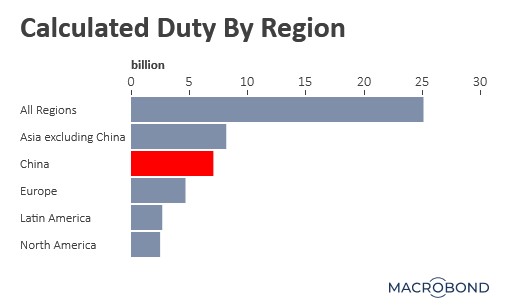

- The significant tariff revenue collected on Chinese imports is a major factor in the White House’s support for the status quo. These duties are the primary contributor to US import tax receipts, and available evidence suggests the financial burden is largely falling on Chinese exporters rather than American consumers.

- The current period of trade calm is a positive for the market, as it mitigates the risk of further supply chain disruption. Given the recent weakness in the Chinese economy, US trade negotiators now possess significant leverage to secure concessions. Consequently, we remain optimistic that the administration can reach an agreement, which would substantially reduce market uncertainty.

State Stablecoin: Wyoming has launched the first state-sponsored stablecoin, the Frontier Stable Token (FRNT), to cement its status as a blockchain hub and attract investment. Backed by a 102% reserve of US dollars and short-term Treasurys, FRNT will leverage blockchain technology to offer faster, cheaper transactions for businesses and consumers. The timing of its unveiling at the state’s Blockchain Symposium, coinciding with the Jackson Hole Economic Symposium, signals the industry’s aspiration to compete against the traditional financial system.

Eurozone Looking Elsewhere: ECB President Christine Lagarde has urged the EU to strengthen its relationships with non-US countries. While she affirmed the importance of the eurozone’s relationship with the US, she also stressed that the region should strive to keep its economy more export oriented. These were her first comments since the EU struck a deal with the US. Referring to the new arrangement, she also stated that she expects growth to slow due to trade uncertainty.

Economic Bellwether: Despite apparent corporate optimism from home improvement retailers about consumer health, earnings results have been mixed. Home Depot missed estimates and warned that tariffs may force price changes. In contrast, competitor Lowe’s beat estimates and raised its outlook, benefiting from its acquisition of Foundation Building Materials. This divergence may partly reflect a slowdown in housing activity, a potential sign of economic uncertainty.

Israel Call Up: The Israeli government has announced that it will call up 60,000 reservists as part of its ongoing military operations in the Gaza Strip. The decision was made two days after Hamas reportedly accepted a ceasefire agreement that closely mirrored a proposal from the previous US administration. Despite the potential for de-escalation, Israel has stated its intent to continue its offensive, citing the goal of eliminating the threat posed by Hamas. While the conflict is expected to persist, analysts believe it is unlikely to expand regionally.

Trump Broadens Attack: President Trump has called for the resignation of Federal Reserve Governor Lisa Cook following allegations that she falsified bank documents to receive favorable mortgages. This move is consistent with the president’s stated objective to reshape the Federal Open Market Committee (FOMC) with members aligned with his economic views. The demand for her resignation comes as the president intensifies his pressure on the central bank to lower interest rates at its next meeting.

Japan Government Bonds: Japan’s super-long-term government bonds have recently attracted strong foreign investment, with aggregate buying reaching a record $63 billion in recent months. This surge in demand is primarily driven by foreign investors looking to capitalize on rising interest rates, which have increased amid concerns over higher government spending. Additionally, a weaker US dollar is playing a role, as investors seek to benefit from a stronger yen, particularly if the Bank of Japan follows through with plans to tighten its monetary policy.